- Bitcoin price rallied back into the $17,000 price zone after several failed attempts.

- On-chain metrics show a 44% increase in BTC deposits on all exchanges in November.

- A 20% decline has resulted from similar deposit influxes and would project Bitcoin to the $13,000 price zone.

Bitcoin price a countertrend move just before November's auction finalized. Still, on-chain metrics suggest the downtrend is not yet over.

Bitcoin price deposits rise 44% during November

Bitcoin price is undergoing a profit-taking consolidation after the bulls prompted a last-minute countertrend rally into the $17,000 price zone. After a weak bearish denial near the aforementioned price zone, the bullish gesture is certainly optimistic. Still, Bitcoin will need to display much more strength as the potential for another move south remains prevalent.

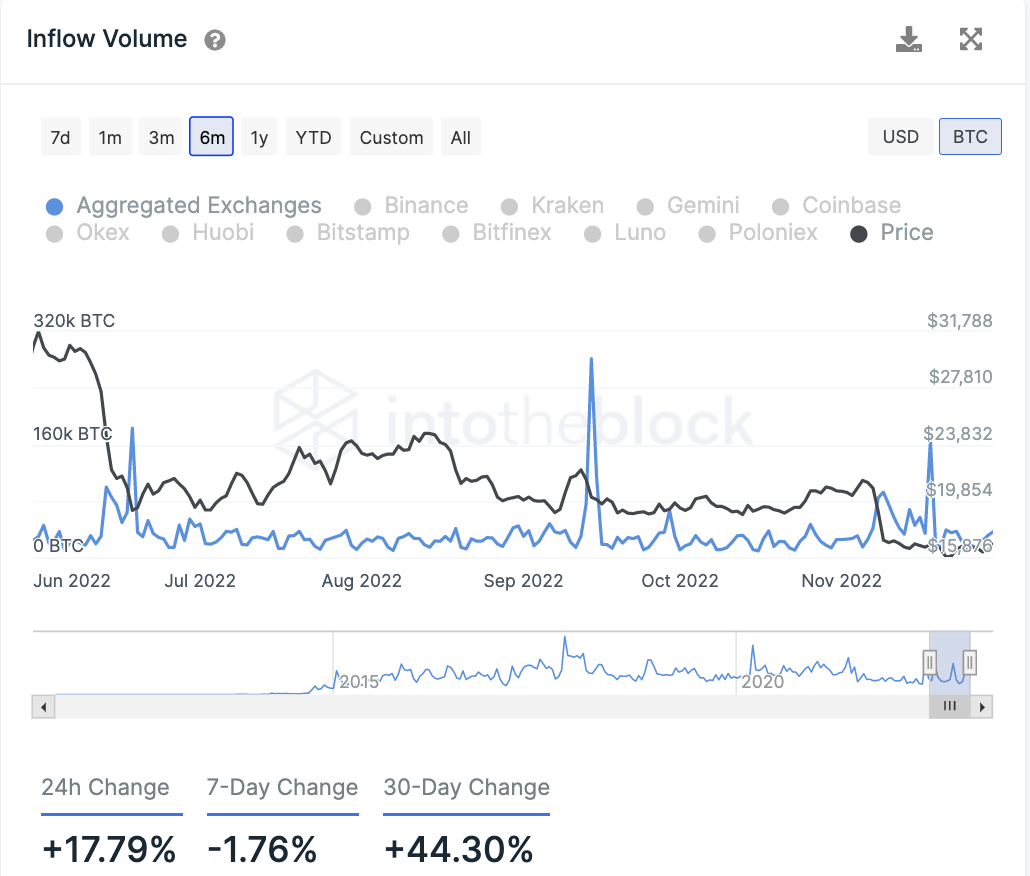

Bitcoin price currently auctions at $16,945. IntoTheBlock's on-chain metrics provide some cues as to what Bitcoin's long-term intentions may be. Specifically, the Inflow Volume Indicator, which accounts for all deposits made on exchanges, has increased by 44% on the month. On November 18, the indicator saw an influx of 165,290 Bitcoin delivered to exchanges. The last time the indicator had a similar influx was on September 14. Back then, 281,230 Bitcoin were deposited to active wallets and exchanges when BTC traded at $20,000.

In theory, the Inflow Volume indicator is meant to gauge market sentiment and justify liquidity upticks. There is a general bias amongst the crypto community, however, that more deposits of an asset onto exchanges eventually lead to a sell-off. In Bitcoin's case, the last two upticks did result in a 20% decline, although the move south took several weeks to play out.

Considering the on-chain metrics, history could repeat itself and a 20% decline would not be a far fetch scenario for the peer-to-peer digital currency. Such a move would land BTC price near the upper bounds of the $13,000 zone, a price level untraded since 2020.

As mentioned in the Bitcoin's macro thesis established earlier in the year, a breach of the $13,880 price level would invalidate Bitcoin's bull run potential.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TRON gains 10% in 2024, supply of stablecoins reaches over $50 billion in Q1

TRON, a blockchain-based digital platform, has seen positive growth in the first quarter of 2024, as seen in a Messari report. TRON noted gains across several metrics like market capitalization, revenue and total value locked.

XRP hovers near $0.50 as Ripple CTO addresses concerns related to stablecoin launch

XRP is hovering near $0.53 on Friday, spending nearly all week below $0.55. Ripple CTO David Schwartz addressed concerns on stablecoin and XRP utility on Thursday.

Terraform Labs set to restrict access for users in the US after recent ruling in SEC lawsuit

Blockchain company Terraform Labs said Thursday that it will restrict access to some of its products and services for US-based users as it expects to receive a court order soon in light of its legal battle against the US Securities and Exchange Commission (SEC).

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.