- Bitcoin resumed the decline amid the downside correction on the market.

- The critical support zone is created by SMA200 daily.

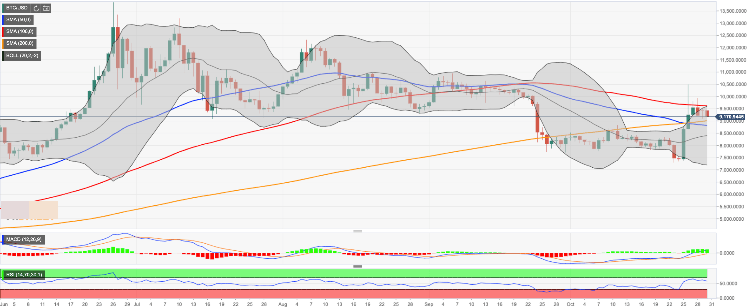

Bitcoin retreated from Tuesday's high of $9,512 to trade at $9,170 by press time. BTC/USD has lost 2% both on a day-to-day basis and since the beginning of the day moving within the short-term bearish trend amid expanding volatility.

BTC/USD, the technical picture

Looking technically, a failure to engineer a sustainable breakthrough above SMA100 (Simple Moving Average) daily slowed down Bitcoin bulls and triggered the downside correction from an overbought territory. At the time of writing, SMA100 daily is registered at $9,616. We will need to see a sustainable move above this handle for the upside to gain traction with the next focus on this week's high at $9,938 followed by a psychological $10,000.

On the downside, the vital support awaits us on approach to psychological $9,000. Strengthened by SMA200 daily, this area is likely to slow down the sell-off and push the price back inside the recent range. However, once it is out of the way, the downside is likely to increase with the next bearish aim at $8,800 (SMA50 daily). A move below this area will open up the way to the previous consolidation zone of $8,700-$8,600 and negate an immediate bullish scenario.

BTC/USD, daily chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto Today: XRP, ADA, XLMsurge as Ripple donates $25M to pro-crypto Fairshake

The altcoin market rally was propelled by news of Ripple Labs donating another $25 million to Fairshake, a Political Action Committee (PAC) that promotes political candidates committed to securing crypto-friendly policy in the United States in the 2026 midterm elections.

Former commissioner Paul Atkins tipped as the frontrunner for SEC chair

Paul Atkins, a former Securities and Exchange Commission (SEC) commissioner, is the leading candidate to chair the agency in President Donald Trump’s administration, according to Fox Business reporter Eleanor Terrett.

Trump plans AI and crypto czars to lead tech policy

President-elect Donald Trump is reportedly planning to appoint an “AI czar” to centralize U.S. policy on artificial intelligence (AI) and strengthen the country’s leadership in this transformative technology.

Bitcoin Price Forecast: BTC drops below $94,000, temporary dip or the start of a sell-off

Bitcoin (BTC) recovers slightly and is trading above $93,000 on Wednesday after declining 6% since Monday. The recent retracement in Bitcoin’s price aligns with a second straight day of outflows from spot BTC Exchange Traded Funds (ETFs)totaling $123 million on Tuesday, suggesting a dip in institutional demand.

Bitcoin: Rally expected to continue as BTC nears $100K

Bitcoin (BTC) reached a new all-time high of $99,419, just inches away from the $100K milestone and has rallied over 9% so far this week. This bullish momentum was supported by the rising Bitcoin spot Exchange Traded Funds (ETF), which accounted for over $2.8 billion inflow until Thursday. BlackRock and Grayscale’s recent launch of the Bitcoin ETF options also fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.