- BTC has finally broken above the symmetrical triangle pattern.

- The price has managed to cross over the 50-day SMA during this breakout.

The community is buzzing right now after Square’s announcement that they have purchased $50 million in Bitcoin. Well-know trading veteran, Peter Brandt, confirms that BTC is well-positioned to kickstart a new bull run.

It is a major development that a global corporation is now putting $BTC onto its balance sheet. The weekly and daily charts a poised to flash a big buy signal. https://t.co/p6652SfqVc pic.twitter.com/rCoKZCY5LB

— Peter Brandt (@PeterLBrandt) October 8, 2020

This overall positive sentiment has finally lifted the price above the symmetrical triangle pattern. With BTC currently priced at ~$10,900, it looks like the month-long consolidation that the price was going through is finally over following today’s bullish breakout.

BTC daily chart

By measuring the distance between the high and low of the triangle, we can predict a target for the breakout, which, in this case, turns out to be ~$12,500. The first notable barrier for the bulls was the 50-day SMA curve that they have already broken past. The next level, as defined by the IOMAP, is the $11,700 resistance line.

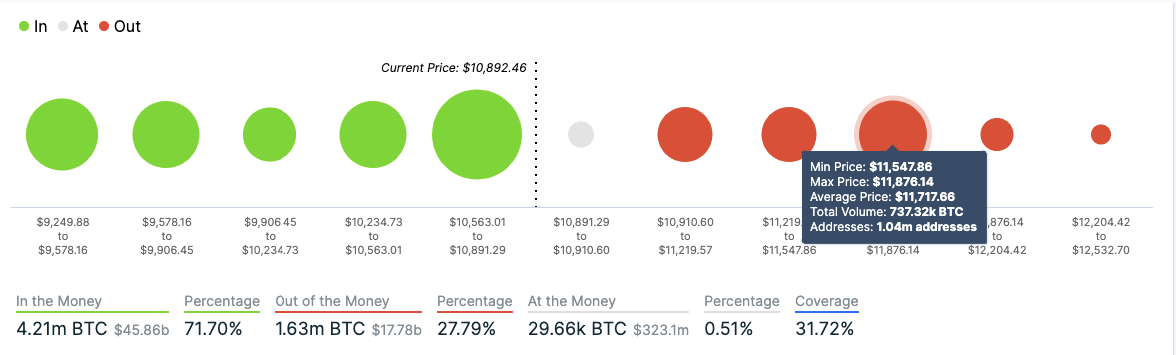

BTC IOMAP

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) is a handy tool that helps us visualize strong resistance and support levels. As per the tool, there is a strong resistance wall at $10,700, wherein 1 million addresses had previously purchased ~740,000 BTC. If the buyers break past this level, they should easily reach our target of $12,500 and beyond.

The MACD in the daily chart shows increasing bullish momentum, which should give the buyers enough firepower to break past this resistance wall.

Santiment’s holder distribution chart further supports our bullish hypothesis.

BTC holder distribution

The holder distribution chart helps us see the number of addresses holding a specific amount of tokens. If the number of whales, aka holders with millions of dollars worth of BTC, is increasing, then that’s a positive sign for the network. As per the chart, the number of addresses with >10,000 BTC has gone up by 6 over the last seven days. This shows that instead of selling off their coins, the whales are accumulating and strengthening their positions.

Now, let’s set a long-term price target for Bitcoin by looking at the weekly chart.

BTC/USD weekly chart

As one can see, BTC is consolidating in a symmetrical triangle pattern in the weekly chart. By applying the same logic as we did in the daily chart, we can put a long-term target for a bullish breakout. In this case, a successful breakout can empower the buyers to take the price up to $21,500, beating the current all-time high for BTC (~$20,000). The 50-week, 100-week, and 200-week SMA curves are hovering comfortably below the price, so there aren’t any significant resistance levels that could thwart our project price action.

The flipside - Can the bears spoil the party here?

So, what can the bears do to ruin our optimistic price projection? If they somehow take control right now, the downside action will be severely limited by the 50-day SMA curve. Even the IOMAP shows that a strong support wall lies around the area where the 50-day SMA is hovering right now (~$10,800) since 2.25 million addresses had previously purchased around 1.6 million BTC at this level.

Even if the bears somehow break below this level, the IOMAP visualizes more healthy support levels below that will likely absorb any residual selling pressure.

Verdict: BTC has broken above the symmetrical triangle to end its >1 month consolidation period. The immediate target for the bulls appears to be $12,500. In the long-term, the price may break past the all-time high level and reach $21,500, provided they can sustain the current positive sentiment. The downside seems to be capped at $10,800 by the SMA 50 curve.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Celebrity meme coins controversy continues amid Pump.fun revenue dominance

Pump.fun outperformed the Ethereum blockchain on Tuesday after raking in $1.99 million. Following this achievement, a meme coin based on actress Sydney Sweeney was the subject of controversy after its developers dumped their bags on investors.

PEPE's on-chain metrics indicate potential rally after weeks of silence

PEPE has struggled to see any significant price move after reaching an all-time high in May. Increased adoption rate and low MVRV ratio indicate a bullish run may be on the horizon. A single PEPE outflow from Binance worth $14.7 million gives credence to signs of bullish expectation.

Ethereum has failed to overcome key resistance despite bullish sentiment surrounding ETH ETF

Ethereum (ETH) is down more than 1.4% on Tuesday following another ETH sale from the Ethereum Foundation. Meanwhile, crypto exchange Gemini's recent report reveals that ETH ETF could see about $5 billion in net inflows within six months of launch.

Crypto community blasts Polkadot following report of treasury spending

Polkadot reports $87 million of treasury spending during H1. Crypto community members expressed harsh feelings toward the DOT team's high spending. DOT is up more than 2% in the past 24 hours but risks correction following the report.

Bitcoin: BTC price correction could end in July, according to seasonal data

Bitcoin (BTC) price appears poised for a decline this week, influenced by slight outflows in US spot ETFs, selling activity among BTC miners, and a combined transfer of 4,690.28 BTC to centralized exchanges by the US and German governments.

-637377959889663783.png)

[04.02.41, 09 Oct, 2020]-637377960613749010.png)

-637377960913905547.png)