There are no central bank meetings next week but there is an avalanche of economic data from America, Europe, and Japan to keep traders entertained. Politics will also be in the spotlight with a G7 meeting over the weekend. Global leaders are expected to outline steps to stabilize energy markets, which could have tremendous implications for central banks.

Politicians scramble

The spike in energy prices and their impact on consumers has turned into the most important political issue across the world, sending global leaders scrambling to come up with solutions or suffer the wrath of angry voters. With midterm elections coming up in the United States, the White House is in the eye of the storm.

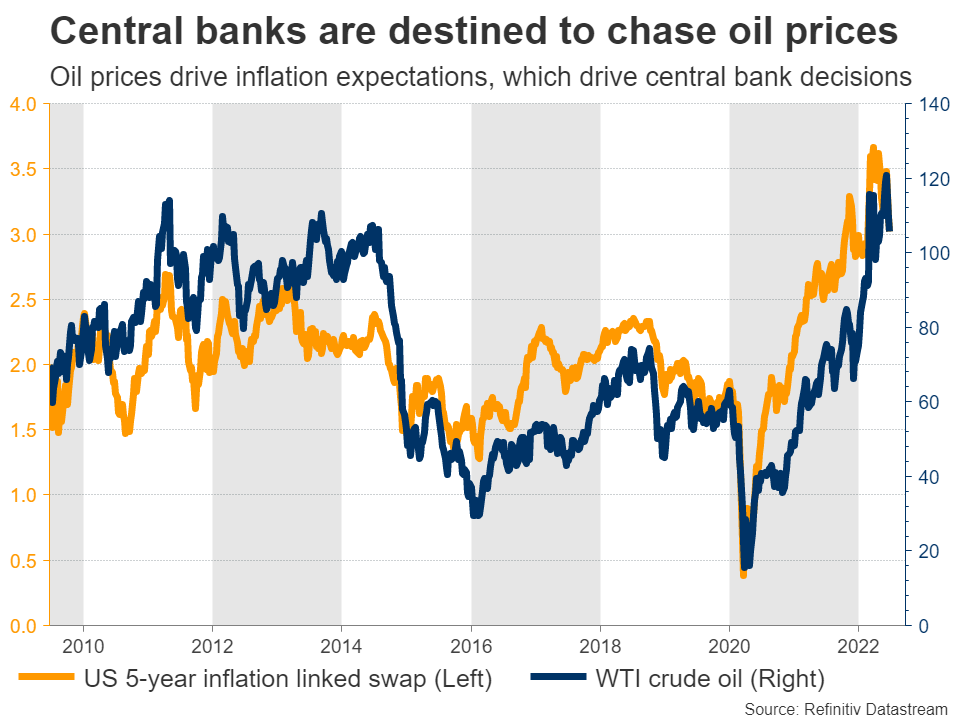

It’s not only politicians feeling the burn. Energy prices are one of the main drivers of inflation expectations in markets, which in turn drive central bank decisions. The Fed won’t need to be as aggressive with rate increases if oil prices finally cool down.

With this in mind, the meeting of G7 leaders in Germany this weekend could be crucial. Stabilizing energy prices is high on the agenda, amid whispers that even drastic measures like price controls are under consideration. These summits rarely produce any real action, but then again, markets only need to sense something is on the horizon to move.

If oil prices extend their latest retreat, that could have repercussions in the FX arena too. The devastated Japanese yen and to a lesser extent the euro would likely get some valuable breathing room and might even stage a relief rally, as both economies are major importers of energy.

Beyond that, there is also a forum on central banking organized by the ECB. This event is usually academic in nature but market participants will still tune in for any signals from the ‘big 3’ on Wednesday - Fed Chairman Powell, ECB President Lagarde, and BoE Governor Bailey.

Eurozone inflation - still hot

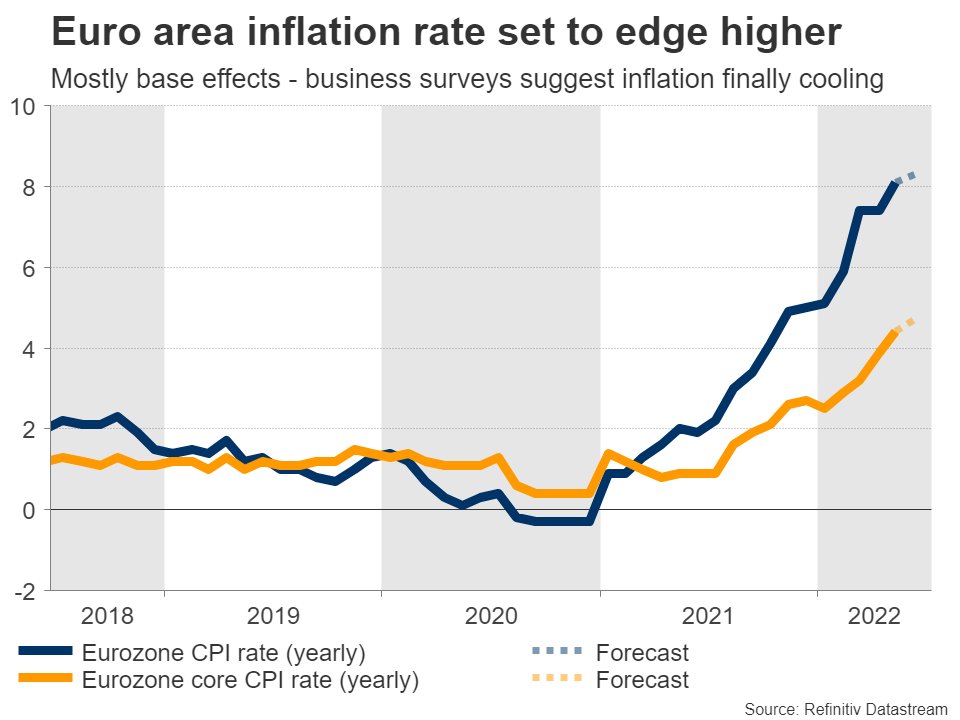

In Europe, there’s both good and bad news. The good news is that inflationary pressures finally seem to be losing steam according to the latest business surveys. The bad news is that this is happening because consumers have started to cut back on spending.

Business confidence has fallen sharply and new orders have stalled, which suggests the economy is slowing rapidly and the time window for the ECB to raise interest rates is closing. Market pricing suggests interest rates will end the year at 1% from -0.5% currently, which seems unrealistic considering the weakening data pulse.

The next clue in this puzzle will come on Friday, with the Eurozone’s latest inflation report. Even though there are some early signs inflation has started to cool, the yearly CPI rate is still likely to edge higher as some very soft monthly prints from last year now drop out of the 12-month calculation.

As for the euro, it’s difficult to envision any trend reversal while energy prices are so high and recession indicators are flashing red. Historically, the euro’s advantage had always been the Eurozone’s trade surplus. This has now flipped into a trade deficit because of soaring oil prices. Hence, any relief rallies are likely to remain shallow until energy prices calm down.

Japan - data matter again?

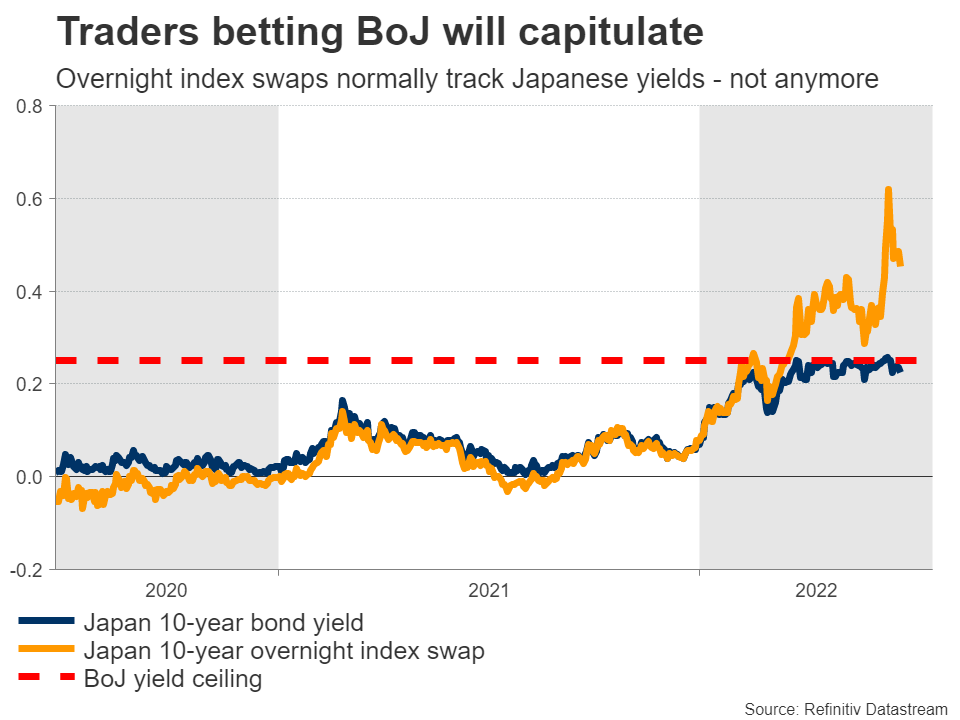

Over in Japan, economic data have not moved the yen for half a decade now, but that might be about to change. The yen did not care about data releases because there was no prospect that the Bank of Japan would change its policy settings. Now there is.

Traders can smell blood in the water, betting that the BoJ will capitulate soon and raise the ceiling it has imposed on Japanese yields - the strategy that has killed the yen. The yen’s collapse has turned into a political mess, with the government facing public outrage about the rising cost of living.

This suggests that FX intervention - even if only to flush out speculators - is on the table if the depreciation continues. Some strategists point to the 145 region in dollar/yen as the line in the sand. It boils down to this - either inflation will fire up enough and the BoJ will pivot by itself or the currency crisis will become unbearable politically and force intervention.

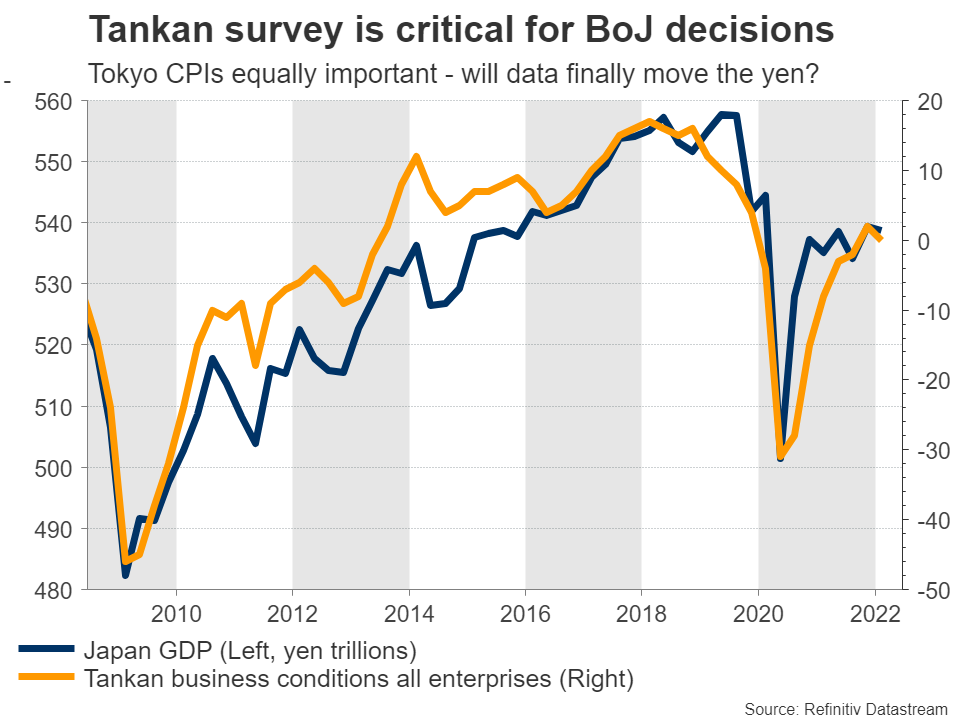

Either way, there is some light at the end of the tunnel. Investors will pay close attention to the summary of opinions from the BoJ’s latest meeting early on Monday, for any hints that policymakers are starting to get cold feet. But the main event will be on Friday, when the BoJ’s Tankan business survey is released alongside the forward-looking inflation stats for Tokyo.

Any signs that inflation is finally gaining some steam might add fuel to speculation about the BoJ changing course in July or September, helping to stop the yen’s bleeding.

King dollar still reigns

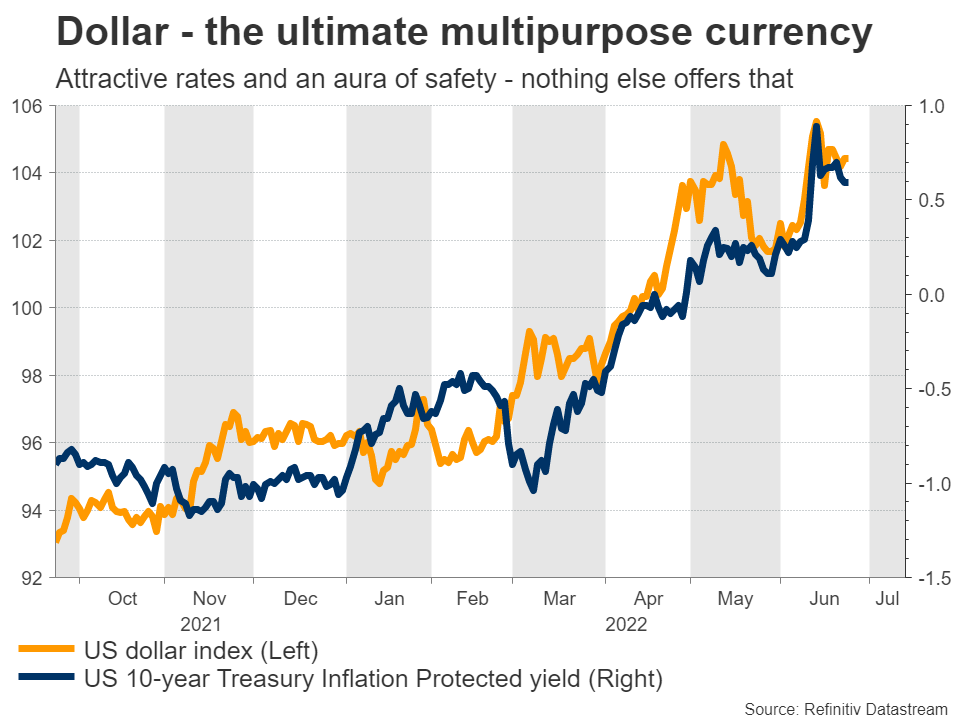

Crossing into America, the dollar continues to party. It has turned into the ultimate ‘all weather’ currency, offering a combination of attractive yields as the Fed beats other central banks to the punch and an aura of safety thanks to its reserve currency status.

There are several signs that the US economy is also losing momentum, but the dollar is unlikely to lose its crown while every other major currency grapples with its own demons - euro with energy, yen with the BoJ, and sterling with unstable risk sentiment.

In terms of data releases, the coming week will feature durable goods orders on Monday, ahead of the core PCE price index on Thursday and the latest ISM manufacturing PMI on Friday.

In neighboring Canada, GDP numbers for April are out on Thursday but are likely to be seen as outdated by traders.

Finally in China, investors will get the first glimpse into how the economy performed in June when the official PMIs are released on Thursday.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.