The fallout from weekend drone strikes on Saudi Arabian oil refineries is the key story to watch today, leading to big moves in everything from the price of oil itself to the Norwegian krone to the FTSE 100.

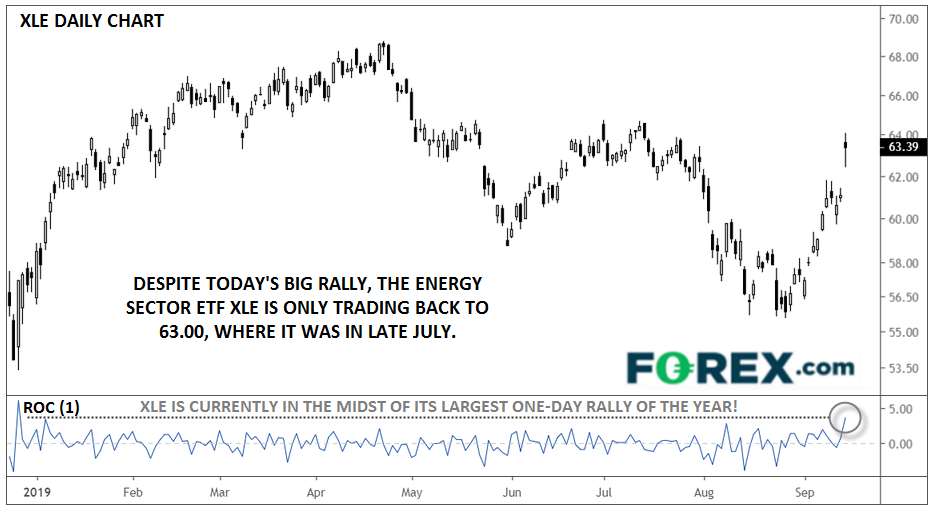

Not surprisingly, US energy stocks are also rallying, with the widely-followed Energy Sector SPDR ETF (XLE) is trading higher by 3.6% as of writing. If the current gains hold through the close of today’s trade, it would mark the biggest one-day rally of the year for the sector:

While today’s move is impressive, it notably trails the nearly 15% rally in oil prices and has only been enough to take the ETF back to the levels where it was trading back in late July (by contrast, the price of oil itself is at its highest level since May).

Drilling down a bit further, the table below shows the percentage of assets and the daily gain/loss (as of 1:30pm ET) in each of XLE’s top 10 holdings:

|

Name |

Symbol |

XLE Weight |

Daily Change |

|

Exxon Mobil |

XOM |

23.1% |

2.3% |

|

Chevron |

CVX |

22.0% |

2.8% |

|

ConocoPhillips |

COP |

5.8% |

8.5% |

|

Schlumberger |

SLB |

4.4% |

6.1% |

|

EOG Resources |

EOG |

4.2% |

6.8% |

|

Phillips 66 |

PSX |

4.0% |

1.6% |

|

Kinder Morgan Inc. |

KMI |

3.9% |

1.6% |

|

Occidental Petroleum |

OXY |

3.8% |

7.1% |

|

Marathon Petroleum |

MRO |

3.2% |

12.2% |

|

Valero Energy |

VLO |

3.1% |

-3.7% |

Looking at the above table, it’s clear that the relative underperformance of the two megacap conglomerates that account for over 45% of the overall sector, Exxon Mobil and Chevron, masks the strength in some of the industry’s smaller players. Given their lower levels of operating leverage and vertically-integrated structures, XOM and CVX may continue to lag the broader sector, making some of the other names in the table above better targets for traders who are bullish on the rest of the sector.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0400 in quiet trading

EUR/USD trades in positive territory above 1.0400 in the American session on Friday. The absence of fundamental drivers and thin trading conditions on the holiday-shortened week make it difficult for the pair to gather directional momentum.

GBP/USD recovers above 1.2550 following earlier decline

GBP/USD regains its traction and trades above 1.2550 after declining toward 1.2500 earlier in the day. Nevertheless, the cautious market mood limits the pair's upside as trading volumes remain low following the Christmas break.

Gold declines below $2,620, erases weekly gains

Gold edges lower in the second half of the day and trades below $2,620, looking to end the week marginally lower. Although the cautious market mood helps XAU/USD hold its ground, growing expectations for a less-dovish Fed policy outlook caps the pair's upside.

Bitcoin misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.