- Economists expect the UK to report stagnation in the fourth quarter of 2019.

- After several days under pressure, sterling may recover, especially if the economy ticks up.

- Outright recession risk may push the pound lower.

Standing in the same place usually means eventually falling behind – but that may not be the case for the pound in response to zero growth. There are two reasons why sterling may shine while Gross Domestic Product stagnate, as economists expect for last year's final quarter.

Things have changed since Q4 2019

The autumn of 2019 was a time of turbulence and high uncertainty. In early October, fear of a no-deal Brexit was real as the EU and the UK were apart on critical topics such as the Irish backstop. After Prime Minister Boris Johnson struck an agreement with Brussels, he still had a hard time in parliament, and the country went to the polls.

A clearer path on Brexit emerged only towards the end of the quarter – after the elections in mid-December. This uncertainty took its toll on the economy as businesses deferred decisions. Post-elections Purchasing Managers' Indexes from January already showed a return to confidence. Investors may, therefore, see the GDP figures as stale – even though they represent actual figures rather than the only sentiment.

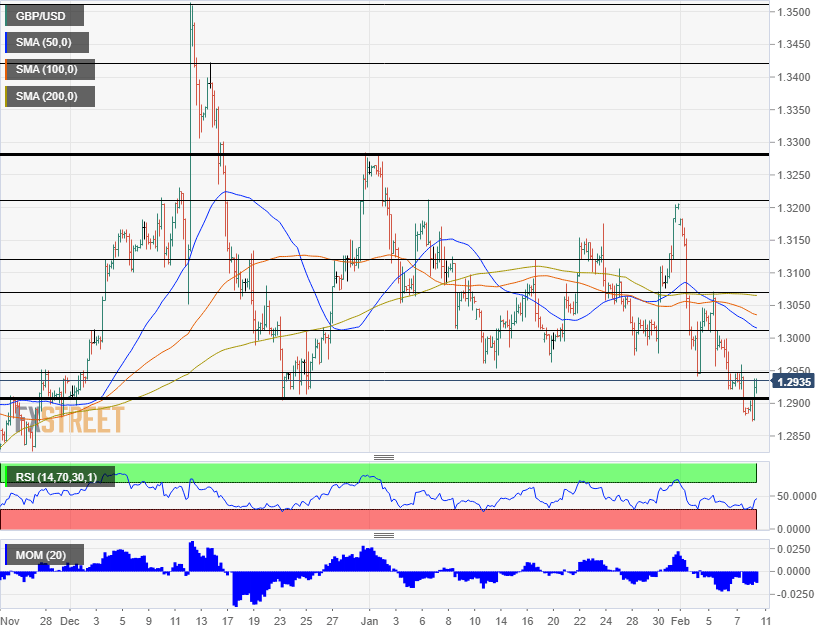

GBP/USD has already fallen

Brexit is far from over – while the UK officially left on January 31, it retains most rights and obligations during the transition period, which expires at year-end. Talks about future relations with the EU begin only in March, but the battle lines have been drawn, and they mark stark differences in the approach of both sides.

If the UK leaves without a deal, it will default to World Trade Organization rules, which means barriers to commerce. Moreover, reports from Brussels suggest that the EU may try to curb London's financial services sector – and hurting the crown jewel of the economy is also worrying.

The pound has already responded to these fears – GBP/USD has dropped to the lowest since November. A figure that does not scream "recession" may be sufficient to trigger a recovery in sterling.

All in all, the wind may blow in favor of cable bulls.

Here are three scenarios

1) Stagnation – GBP/USD advances

As explained earlier, the mix of a figure from the turbulent past – even if it is from the recent past – and somewhat oversold conditions may trigger a recovery. While gains could be limited, the outlook is positive.

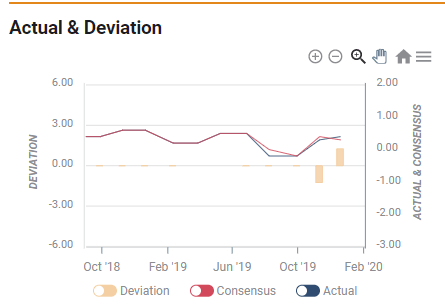

This scenario has a high probability. Since the UK began publishing monthly GDP figures, economists' expectations have become more precise.

Surprises are uncommon and limited:

2) Contraction – GBP/USD edges lower

The economy squeezed by 0.3% in November, and retail sales figures for December were depressing. If these add up to an economic squeeze, the pound may suffer. It takes two consecutive quarters of contraction to define a recession, and fears of an outright downturn may weigh on sterling.

However, it is essential to note that a decline of 0.1% would not be devastating. It would probably take a drop of 0.2% or more in output to send the pound plummeting.

The probability is medium due to the weak data from November.

3) Growth – GBP/USD shoots higher

With expectations standing at 0%, a minimal beat would be sufficient to extend the UK economy's growth and diminish fears of a recession.

The probability is low, and such an outcome – even a meager 0.1% expansion – would trigger a jump in the pound.

Conclusion

UK quarterly GDP provides an in-depth look at a time when things looked much worse. The higher level of uncertainty and recent pound pressure may result in a bounce if low expectations for zero growth are met. A drop in the economy's output could weigh on the pound while surprising growth could trigger a rally.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.