Crude

The oil price was only little changed yesterday and the front-month contract on Brent thus again settled above 66 USD/bbl. Regarding news, the market more or less ignores news that Saudi Arabia may call a truce in specific areas in Yemen as well as reports about a possible closure of a port in Libya.

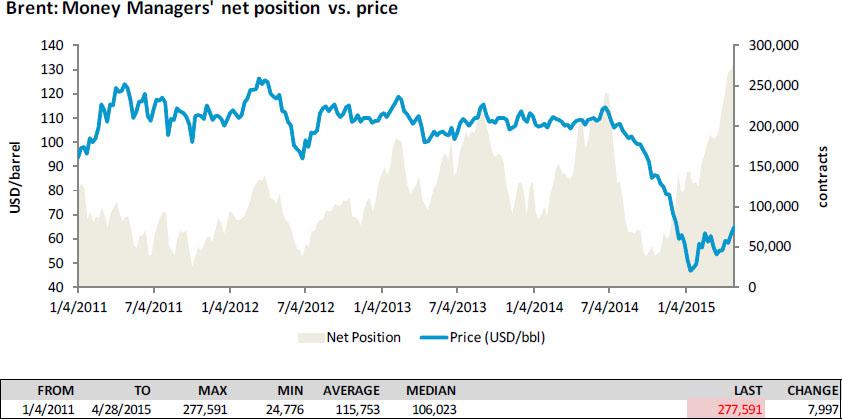

Clearly, market focuses mainly on the situation in the US, namely on the evolution of crude oil inventories. Though the official data is to be released tomorrow, the API will release its own report later today; expectations are set for a relatively modest (in comparison with previous months) increase in crude oil inventories. Figures from the latest ICE Commitment of Traders report suggest that - in spite of a record-high net speculative position in Brent futures (see the chart below) – room may still exist for further increase in the oil price should the inventories growth disappoint as number of traders betting on a decline in prices remain quite high (it, in fact, did not change last week).

Metals

Today in early trading, the copper price falls from a 4-1/2 month high hit on Friday, probably in a response to the weaker than expected data from China. Yesterday, the HSBC China manufacturing PMI was revised lower from a preliminary reading of 49.2 to 48.9, signalling an ongoing loss of momentum in the sector (recall that the LME was closed due to a holiday yesterday so that the reaction is delayed).

On the other hand, news about lower copper production of mining division of Glencore could at least partially offset negative data from China.

Chart of the day:

Net speculative positions in Brent futures hit yet-another all-time high last week.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.