There’s an old saying that ‘no good deed goes unpunished’. Most likely, the lifting of the EU milk quota regime, one year plus one month ago was carried out with the best of intentions for the benefit of consumers. Unfortunately, it seems that the total global dairy production was underestimated and total global demand overestimated. The European Commission office of Agricultural and Rural Development had been preparing for ending production caps since 2003: The final date to end quotas was first decided in 2003 in order to provide EU producers with more flexibility to respond to growing demand, especially on the world market...” To be fair, growing demand from many large emerging markets, China and India for example provided convincing data. In fact the A&RD had further noted that “...It was reconfirmed in 2008 with a range of measures aimed at achieving a ‘soft landing’... ... even with quotas, EU dairy exports have increased by 45% in volume and 95% in value in the last 5 years... ...prospects for further growth remain strong – in particular for added-value products, such as cheese, but also for ingredients used in nutritional, sports and dietary products...”

The data missed the mark, the caps were lifted and milk prices plummeted. It’s fair to say that what was to happen with petroleum production was about to happen with milk production. Milk producers would ramp up production at the expense of pricing in order to maintain market share; i.e., a price war. Farmers seem to have anticipated the market better than the EC . Somerset, UK dairy farmer James Hole commented: "...All they are going to end up doing is create huge milk pools coming out of Europe... ...Long term there will probably have to be another form of capping. I can't see how they can just make it a free-for-all...” Belgian dairy farmer Yvan Deknudt noted: “...We're really scared that production is going to explode and we won't be able to pay our costs any more...” and German dairy industry association president Karl-Heinz Engel commented that, “...We're prepared... export-orientated and competitive...”

Further compounding the prospect of ‘milk lakes and butter mountains’ was a sharp reduction of dairy exports to its main dairy importer, Russia, due to increasing hostilities over Ukraine : “...To compensate the loss of sales in Russia, EU countries increased cheese and butter export volumes to the South Asian markets as well as the US, Africa and the Far East. For example, butter exports to Saudi Arabia have increased for more than three times, to the US – have more than doubled and to China – have grown by about 48%. Cheese exports have doubled to South Korea and have grown by 40% to Saudi Arabia and 19% to Algeria...”

That’s bang on New Zealand’s main dairy import partners.

This presented the Reserve Bank of New Zealand with an additional challenge to its slowing economy. Dairy is by far the largest of all New Zealand’s exports at over 33.5%. Asia and South Asia comprises about 75% of New Zealand’s dairy export market. By most measures the EU is the leading global economy in terms of nominal GDP at over USD $18.5 trillion whereas New Zealand ranks 53 with nominal GDP of about USD $189.025 billion. The point is that New Zealand suddenly found itself up against a milk churning giant.

Although the RBNZ decided to maintain its rate policy in March of 2015, concern about dairy prices was noted in the Monetary Policy Statement : “...the aggregate price for dairy products... ...remains 35 percent below the record high of February 2014... ...A risk, however, is that the reduced cash flow results in a sharper slowdown in spending and economic activity...”

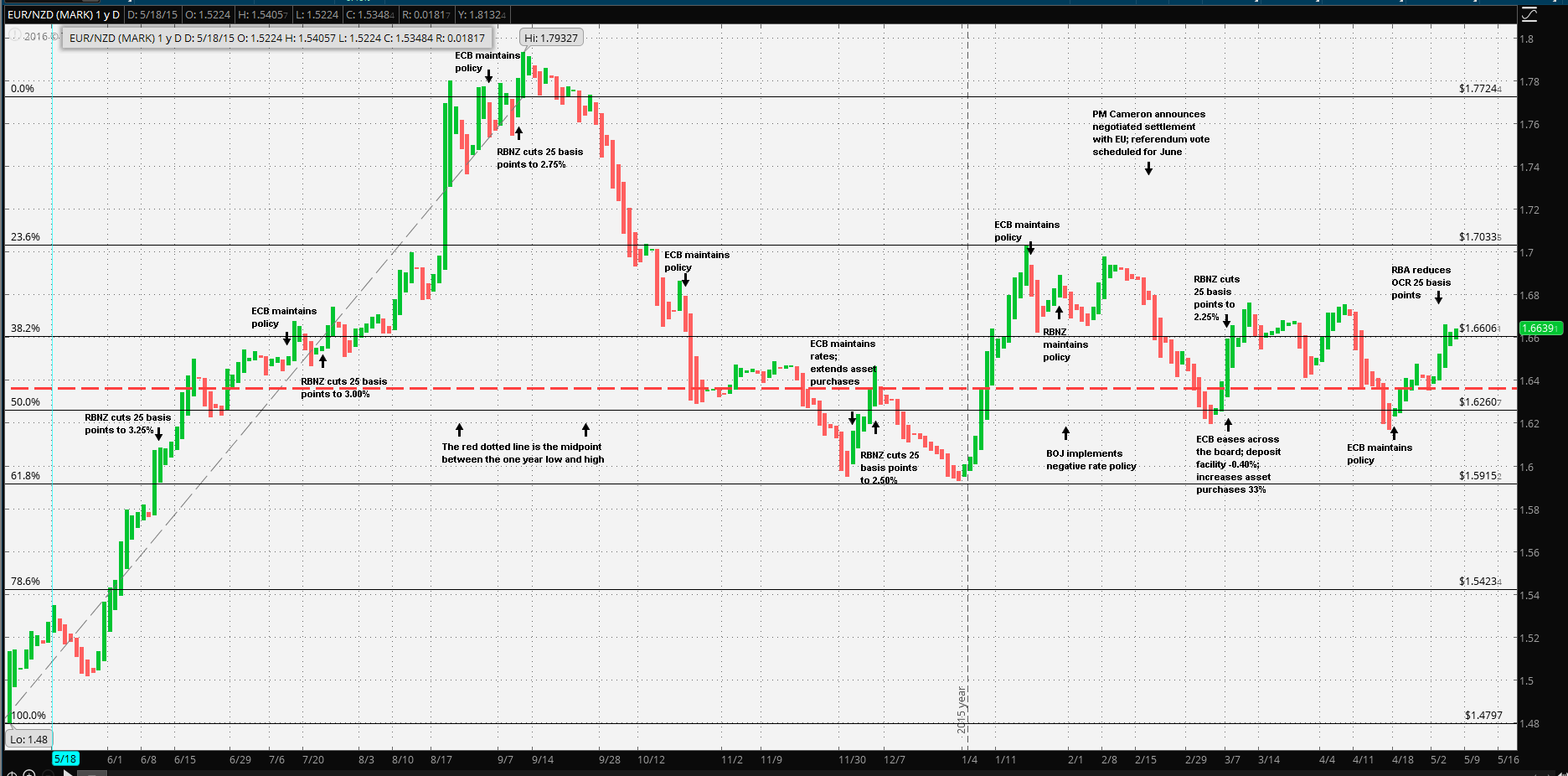

The above chart clearly demonstrates the weakening of the Kiwi vs the Euro as the RBNZ continued to successively step down the OCR in 25 basis point increments, in June, July and September. Once again, commodity prices was one of the main topics in the Monetary Policy Statement of June 2015 : “...Prices for New Zealand’s export commodities have also declined over the past year... ...Dairy production in other major dairy exporters, such as Europe and the United States, remains high, even though growth has slowed over 2015... ...farmers’ incomes in the 2014/15 season are expected to be around $7 billion lower, representing a fall of about 3 percent of nominal GDP...”

However, the September 2015 Kiwi reversal coincided with the increasing expectations that the ECB with expand QE. The reversal leveled off just after the ECB December October meeting and remained within a range of Kiwi support of NZD $1.5915 and resistance NZD $1.6954 until just before the ECB January meeting. The Kiwi remained in that range for a short while after a further RBNZ 25 basis point reduction. After the ECB January meeting, the Kiwi traded in a range of NZD $1.6263 Kiwi support to NZD $1.7033 Kiwi resistance. The RBNZ acted again, 25 basis, just after the 10 March ECB action of further across the board rate reductions and the Kiwi continued within the same range. It was again noted in the March RBNZ Monetary Policy Statement with respect to declining GDP that “...A key channel has been a fall in dairy prices...” The bank specifically noted the favorable effect of a weaker Kiwi: “...Net exports also improved, in a large part reflecting earlier exchange rate depreciation...” It’s important to note that the RBNZ expressed concerns for another major NZ agricultural exports, as well as commodities in general.

The point of the narrative is this: the New Zealand economy is heavily dependent of agricultural exports, particularly that of dairy. In spite of its best intentions, the European Commission mistimed the abolishment of the production cap, contributing to the motivation for the RBNZ to respond. A weaker Kiwi benefits the much smaller economy. However, the ECB motivation is driven disinflation in the Eurozone, far more than to stimulate exports. In fact, a weaker Euro negatively affects its own non-Eurozone, EU members.

Should new normal rates of global growth persist, the RBNZ may have no other choice other than to defend its export market further, particularly if they are forced to compete with dairy production on a far larger scale. Currently, the Kiwi carries a depreciation advantage over the Euro in the Asia-Pacific region. It’s likely that the ECB will wait and measure the results of the 10 March actions, but to be sure, the RBNZ will be keeping an eye on the Euro.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.