Technical Analysis

EUR/USD violates 1.2660

“The violence of this euro move has been fairly dramatic. We’re in this period of broad U.S. dollar strength. It’s fairly hard for almost any currency to strengthen in that kind of environment.”

- Bank of Nova Scotia (based on Bloomberg)

Pair’s Outlook

The support at 1.2660 did not withstand the selling pressure yesterday, thus exposing the 2012 low at 1.2040, namely the main long-term target. However, in the short run we may expect some bullish activity at the weekly pivots—at 1.26 and 1.2510 respectively, but the overall outlook should stay bearish. Additional demand area is around 1.24, where the weekly S3 coincides with the monthly S2 level.

Traders’ Sentiment

Although the price of the Euro is becoming more attractive, we observe a decline in the percentage of long positions open in the market. Since the previous report 24 hours ago, their share has fallen from 60 to 57%.

GBP/USD to preserve negative bias until 1.6050

“The dollar appreciation is broad-based. Our recommendation is to be long dollar.”

- Nomura (based on Bloomberg)

Pair’s Outlook

GBP/USD keeps moving away from the three-month down-trend, which is expected to lead the pair to this year’s minimum. The immediate support is at 1.6162, represented by the weekly S1, but it is highly unlikely to influence the major bearish trend. The demand at 1.6050 on the other hand poses a real threat to the bears—potentially it can send the price to 1.63 and in case of success there—to a neck-line of a double bottom pattern at 1.65.

Traders’ Sentiment

The difference between the amounts of bullish and bearish market participants is almost the same as yesterday—18 percentage points in favour of the former. Meanwhile, the portion of sell orders plummeted from 66 to 50%.

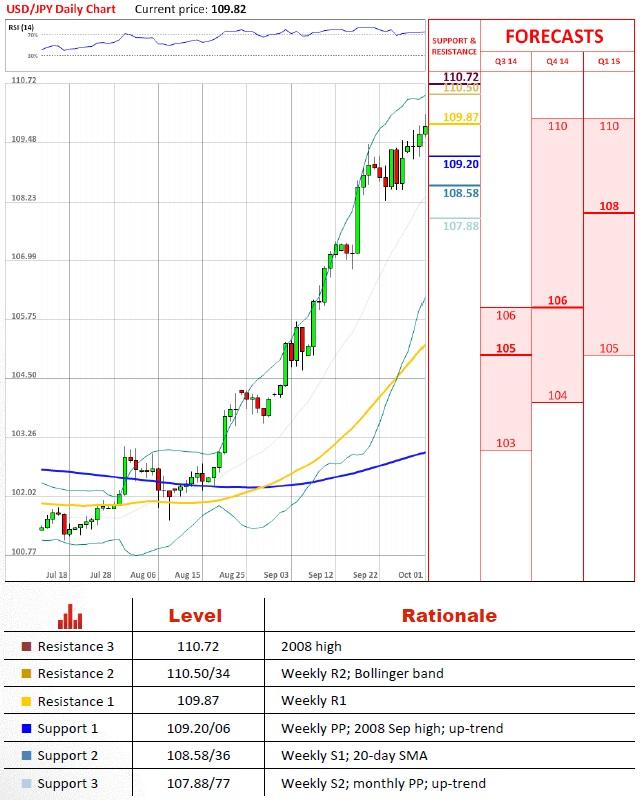

USD/JPY approaches 110.70

“While ¥110 seems close, the path there is still distant.”

- Mizuho Securities (based on MarketWatch)

Pair’s Outlook

After finding firm support at 109 USD/JPY was able to extend the gains to the weekly R1. The next milestone is the weekly R2 level at 110.34—the last hurdle before we see a test of the 2008 high at 110.72. In case of a strong sell-off from here, the pair may return to 108, where it will be expected to stabilise and resume the rally, since this area is created by the monthly PP, weekly S2 and a rising trend-line.

Traders’ Sentiment

Just as yesterday, the sentiment with respect to USD/JPY remains distinctly bearish—as many as 70% of open positions are short. But the share of orders to purchase the U.S. Dollar at the same time increased from 64 to 69%.

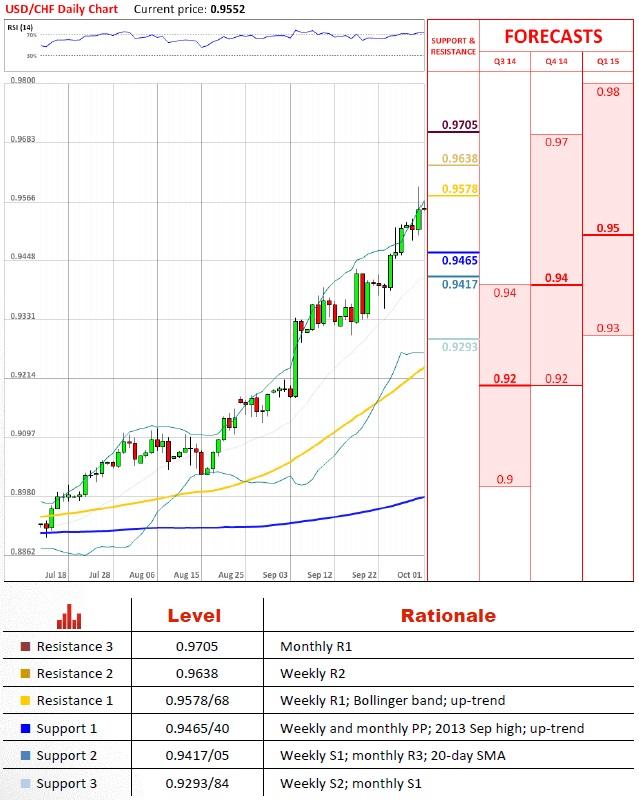

USD/CHF probes resistance at 0.96

“Friday's non-farm payrolls will be key, as it could raise rate hike expectations another notch.”

- Barclays (based on CNBC)

Pair’s Outlook

USD/CHF, after unimpressive performance on Monday, posted new highs yesterday, proving to retain bullish momentum. However, if the pair now retreats from 0.96 back to 0.9450, this will mean that the trading range is gradually narrowing and there is a significant probability of a break-out to the downside. This risk is also highlighted by the monthly technical indicators—five out of eight are pointing downwards.

Traders’ Sentiment

The traders seems to have been encouraged by USD/CHF’s latest rally, being that the percentage of long positions went up from 58 to 62%. As for the orders 100 pips from the spot price, the number of buy ones plunged from 76 to 59%.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.