The GBP/USD pair fell to a multi-year low of 1.4352 levels on Tuesday and ended around 1.44 levels on Wednesday as the technical recovery ran out of steam at 1.4476 levels. The British Pound has been hammered since mid-December as markets came to terms with the falling prospects of the BOE rate hike in 2016. The losing streak has been so severe since 14th Dec that the cable closed higher on just three trading days.

Eyes BOE rate decision and minutes

The bank is widely expected to keep the interest rates unchanged. It is widely known by now that the economy and inflation in the UK is heading lower. The surprisingly weak UK November industrial and manufacturing production numbers released on Tuesday only added to the evidence of the slowdown in the activity. More importantly, slowdown in the wage growth is a bigger concern and that is likely to see the BOE keep rates unchanged.

A hawkish development would be a 7-2 interest rate vote count and that could trigger a recovery above 1.4460 (support of the trend line drawn from July 2013 low – April 2015 low). On the other hand, a 9-0 dovish surprise could push the pair lower to 1.4227 (May 2010 low).

Technicals - Strong support at 1.4372

Sterling’s failure to sustain above the resistance at 1.4460 (trend line drawn from July 2013 low – April 2015 low) and a bearish break from the symmetrical triangle on the hourly chart indicates the pair could re-test 1.4352 (Tuesday’s low). However, the oversold nature of the RSI on the daily and 4-hour chart could trigger a recovery later in the day. A rebound from 1.4372 (76.4% of Jan 2009 low-July 2014 high) could see the pair close above 1.4460 levels today.

EUR/USD – ECB minutes unlikely to jawbone EUR

The EUR/USD pair bounced off the 50-DMA support at 1.0813 to end with moderate gains at 1.0877 levels on Wednesday. This was the third time in last four days that the currency pair found fresh bids around the 50-DMA support.

Eyes ECB minutes

The ECB accounts/minutes of the December rate decision are scheduled for release today. The minutes are likely to express concerns regarding the low inflation and express readiness to do more. However, both the things are well known to the markets and hence are unlikely to have any impact on the EUR. Moreover, the recent commentary from the ECB members – low rates could trigger bubbles - has been somewhat hawkish.

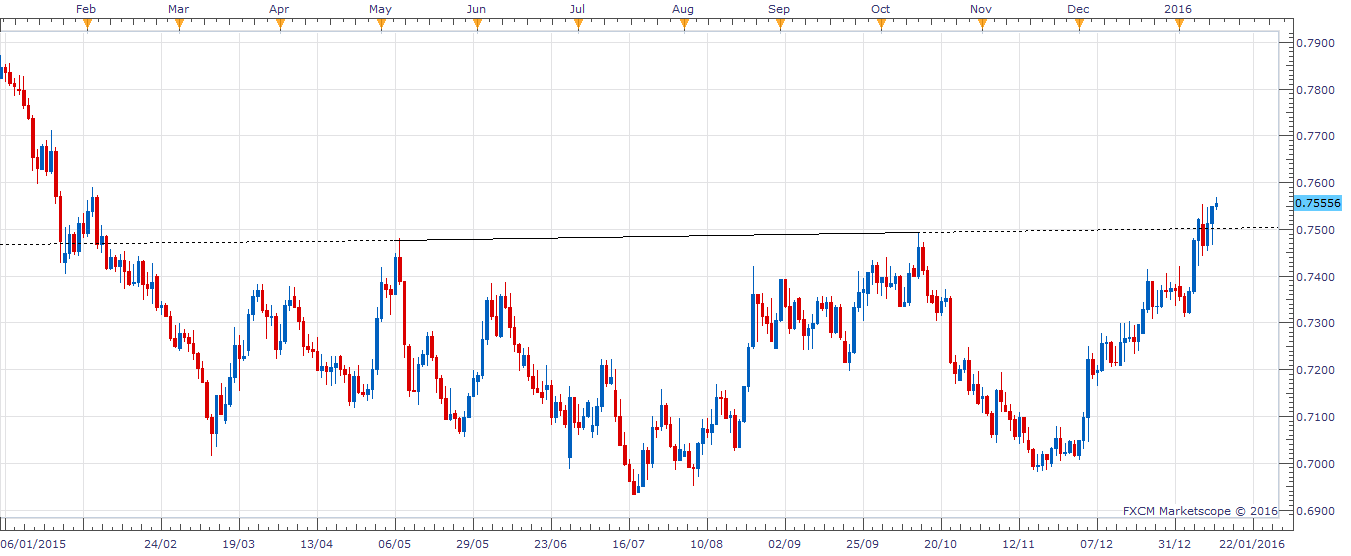

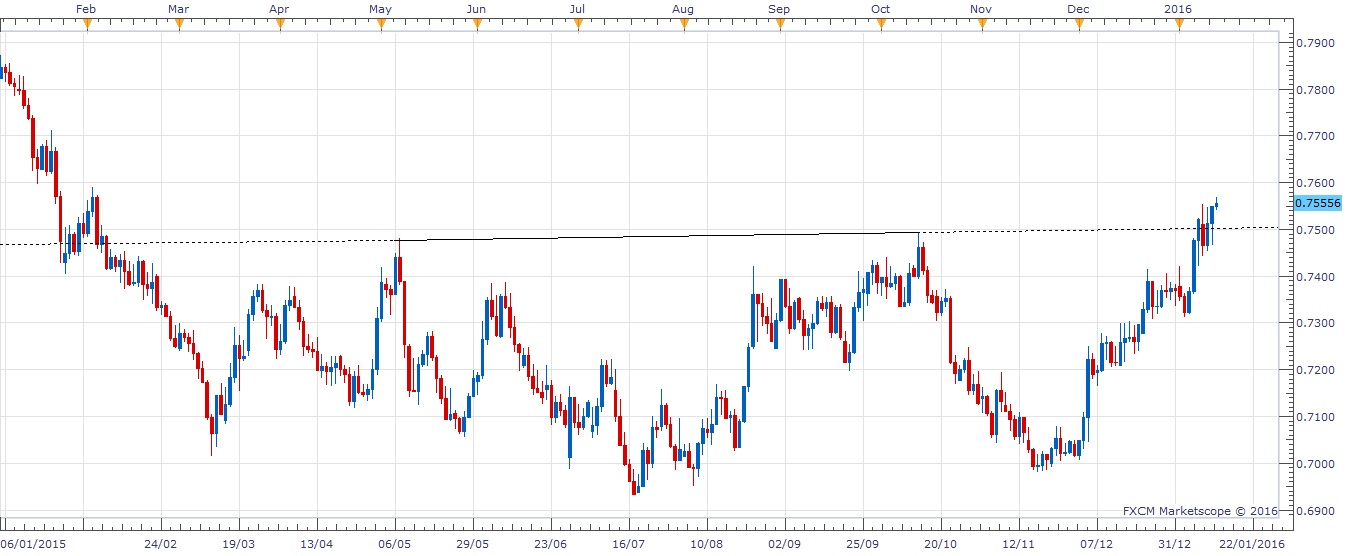

Meanwhile, a bullish break in the EUR/GBP daily chart also indicates increased odds of a bullish move in the EUR/USD pair.The chart shows an inverted head and shoulder breakout has been confirmed and the pair could be heading towards 0.80 levels. The immediate resistance is seen at 0.7592 (Feb 3, 2015 high). The bullish break may be an indication of – further slide in the GBP/USD or a sharp uptick in the EUR/USD pair. Give, the cable is oversold, it is likely that the EUR/USD pair is poised to see a bullish break on charts.

Technicals – moving in a falling channel

Euro’s repeated rebound from the strong support of 50-DMA this week has increased odds of a bullish break from the falling channel seen on the daily chart. The channel resistance is seen at 1.0916. A daily close above the same would mean the uptrend from the December low of 1.0517 has resumed. The pair could target 1.1060-1.1070 (resistance of the rising trend line drawn from March low-April low). On the other hand, a failure to take out 1.0916 could see the pair revisit the 50-DMA support seen at 1.0813. A daily close below 1.0813 would open doors for a drop to the channel support seen at 1.0650.

EUR/GBP – Inverted head and shoulder breakout

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD fluctuates around 1.0900 as markets await US election exit polls

EUR/USD trades sideways near 1.0900 on Tuesday. The US Dollar ignores the upbeat ISM Services PMI data for October and stays under modest selling pressure as investors await exit polls to see who is closer to winning the US presidential election.

GBP/USD clings to modest gains near 1.3000, awaits US election result

GBP/USD trades marginally higher on the day at around 1.3000 after finding support near 1.2950 on a broadly subdued US Dollar. Traders eagerly await the outcome of the US presidential election, refraining from placing fresh bets on the major.

Gold extends consolidative phase as US election result looms

Gold attracts dip-buyers after touching a one-week low on Tuesday but remains below $2,750. The benchmark 10-year US Treasury bond yield stays in positive territory above 4.3% as markets eye US election exit polls, limiting XAU/USD's upside.

Crypto markets brace for volatility in tight race between Trump and Harris

The US presidential election is one of the most significant events in the world. Due to the influence of the country’s political decisions, policies, and economic approaches, it can significantly impact crypto and global markets.

US election day – A traders’ guide

Election day volatility: Brace for potential wild market swings. Election days bring opportunities, but also risks. Unclear results can increase volatility further.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.