The GBP/USD pair rallied to a high of 1.5467 on Friday on the back of a broad based weakness in the USD. The weaker-than-expected US personal spending and income data led to profit taking on the USD longs ahead of the weekend and month-end closing.

Focus on UK PMI and US ISM manufacturing

The UK October final manufacturing PMI could become a reason for further rally in the GBP/USD pair in case the headline figure stays around or manages to print higher than the previous figure of 51.5. The details of the report could throw a light on how the new export orders have reacted to fresh drop in the EUR/GBP pair following ECB’s hint at more easing in December. Sterling strength is hurting export activity and is also responsible for the disinflationary effect. An upbeat headline figure, but a sharp drop in the new export orders index could cap gains in Sterling.

Later in the day, the US ISM manufacturing figure would be watched out by the markets. More than the headline figure, the traders are likely to take cues from the employment sub index. Sustained growth in manufacturing sector employment could push up 2-yr treasury yield and lead to USD strength.

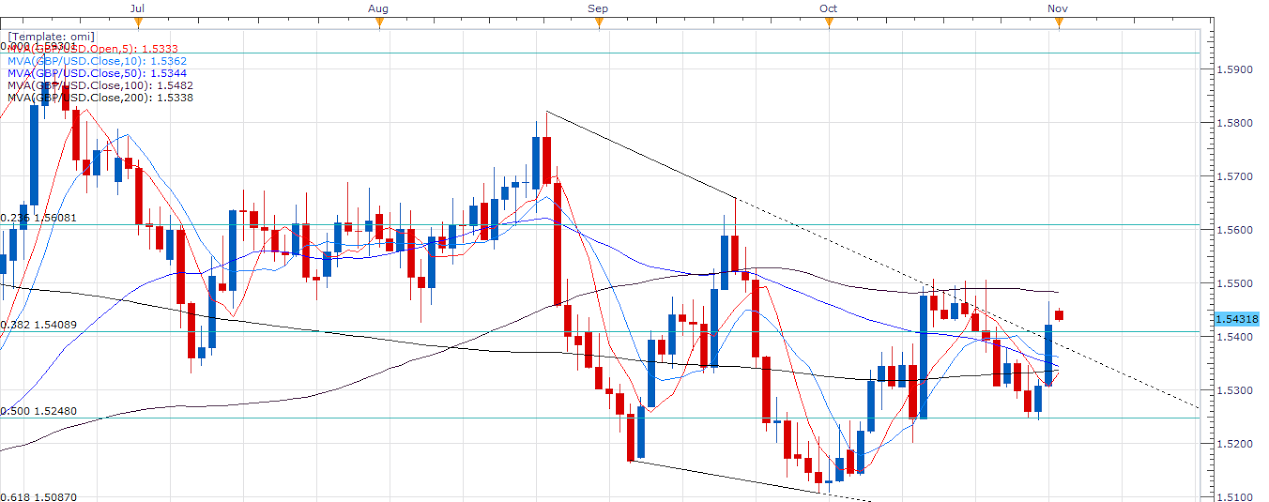

Technicals – Falling channel breached on the upside

Sterling’s close at 1.5421 on Friday confirmed the upside breakout from the falling channel seen on the daily chart. It also marked a daily close above 1.5409 (38.2% of Apr-Jun rally). However, 100-DMA has acted as a stiff resistance since Oct 14 to Oct 22, thus, bulls are likely to wait for a daily close above the same. Nevertheless, the pair could test 1.5477 (100-DMA) – 1.55 today, in case it manages to hold above 1.5409 in early European session. On the other hand, an hourly close below 1.5409 could increase the risk in favour of sell-off to 1.5383 (trend line support).

EUR/USD Analysis: Re-test of 50% Fib amid weak stock markets

The EUR/USD pair spiked to an intraday high of 1.1072 on Friday as the release of downbeat US economic reports triggered a profit taking on the Fed-driven USD longs ahead of the month-end closing. However, the gains above 1.10 were quickly erased and the pair ended last week and the last month at 1.10 levels.

Focus on EZ PMIs and stock markets

An improvement in the Eurozone final manufacturing PMI for October can be expected after the ECB President Draghi hinted at more easing in December. Markets would be more interested to see if the German activity held up well amid increasing signs of a slowdown in China.

The action in the equity markets could have more influence on the EUR/USD pair than the domestic data. The Asian equities turned risk averse today after the Caixin China manufacturing, purchasing managers index, marked the eighth-straight month of contraction. An official gauge of Chinese factory activity contracted unexpectedly in October. The weak data is likely to keep Germany’s DAX weak. The mining heavy UK’s FTSE is also expected to suffer losses. Consequently, the EUR/USD pair could make another attempt at 1.1088 (50% of Mar-Aug rally).

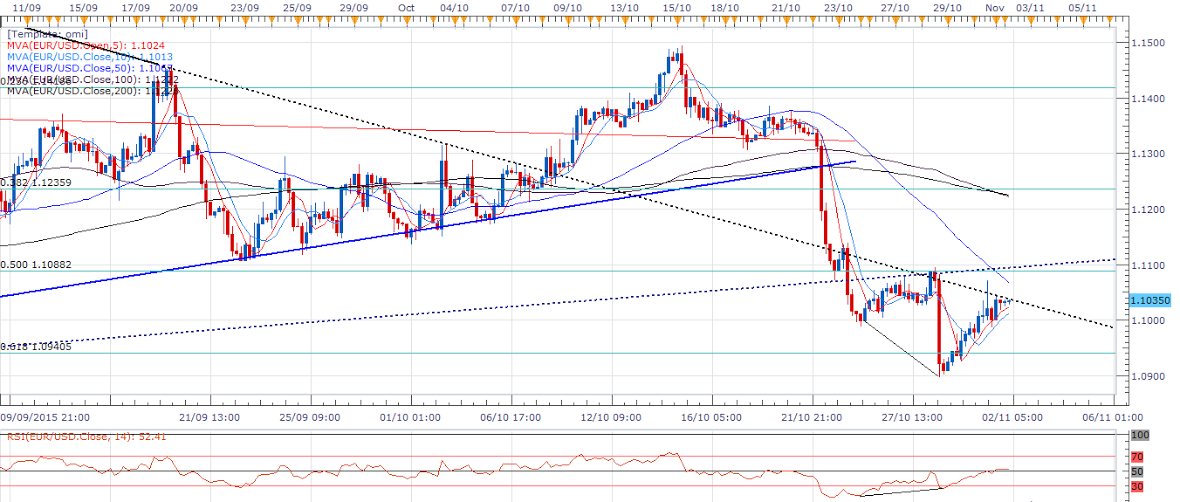

Technicals – Recovery on bullish RSI divergence continues

The technical correction triggered by bullish RSI divergence on the 4-hr chart is likely to continue today. Euro could make another attempt at 1.1088 (50% of Mar-Aug rally) once the immediate resistance at 1.1040 is taken out. A break above 1.1088 would expose 1.11 (rising trend line resistance). Only a daily close above the same would mean short-term bullishness. On the other hand, a failure to sustain above 1.10 may lead to a sell-off to sub 1.09 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD appreciates as US Dollar remains subdued after a softer inflation report

The Australian Dollar steadies following two days of gains on Monday as the US Dollar remains subdued following the Personal Consumption Expenditures Price Index data from the United States released on Friday.

USD/JPY consolidates around 156.50 area; bullish bias remains

USD/JPY holds steady around the mid-156.00s at the start of a new week and for now, seems to have stalled a modest pullback from the 158.00 neighborhood, or over a five-month top touched on Friday. Doubts over when the BoJ could hike rates again and a positive risk tone undermine the safe-haven JPY.

Gold downside bias remains intact while below $2,645

Gold price is looking to extend its recovery from monthly lows into a third day on Monday as buyers hold their grip above the $2,600 mark. However, the further upside appears elusive amid a broad US Dollar bounce and a pause in the decline of US Treasury bond yields.

Week ahead: No festive cheer for the markets after hawkish Fed

US and Japanese data in focus as markets wind down for Christmas. Gold and stocks bruised by Fed, but can the US dollar extend its gains? Risk of volatility amid thin trading and Treasury auctions.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.