Class 8, “heavy duty” truck orders are down 39% from a year ago.

First, let’s take a look at the reports, then we will take a look at what this may mean for the economy.

Class 8 Truck Orders Plunge 39%

The Wall Street Journal reports Truck Orders Fall in April.

Last month, trucking fleets ordered just 13,500 Class 8 trucks, the big rigs used on long-haul routes, down 16% from March and 39% from a year earlier. It was the fewest net orders in any April since 2009, FTR said.

DAT Solutions, an Oregon-based transportation data firm, reported that loads available for dry vans, the most common type of tractor-trailers used for shipping consumer goods, fell 28% in April while capacity on the market was up 1.7% on a year-over-year basis.

Eaton Corp. , the sales leader in heavy-duty truck transmissions, predicted that organic sales from its vehicles unit will fall 10%-12%, after earlier predicting that sales would drop 7% to 9%. The company lowered its outlook for the business after concluding there are at least 20,000 heavy-duty trucks built last year that are still sitting on dealer lots.

Engine maker Cummins Inc. said on Tuesday it doesn’t expect any improvement in the truck market later in the year. It now expects heavy-duty truck production in North America to be at 210,000 vehicles this year, down 5% from its earlier view and down 28% from 2015’s actual volume. Cummins’ first-quarter sales of diesel engines to the heavy-duty truck market dropped 17% from a year earlier to $631 million.

Worst Yet to Come

CCJ reports Sagging truck orders ‘will probably get worse before it gets better’.

Last month was the worst April for Class 8 truck orders since 2009 according to preliminary data released by FTR Wednesday.

North American Class 8 truck net orders fell for the fourth consecutive month in April to 13,500 units, down 16 percent month-over-month and 39 percent year-over-year.

Don Ake, FTR’s vice president of commercial vehicles, says “surprisingly low” orders across the board were weak as the Class 8 market tries to find the bottom of this cycle.

Kenny Vieth, president and senior analyst for ACT Research, says the blame for low orders was widespread.

” … an ongoing overcapacity narrative, a resulting weak freight rate environment, softness in late-model used truck values, and excessive new vehicle stocks,” he adds.

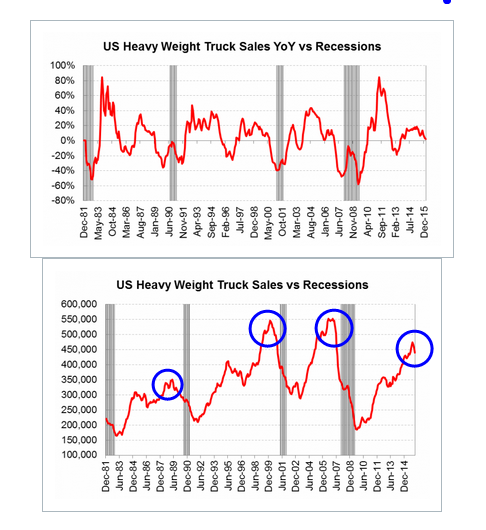

Large Truck Sales vs. Recessions

Variant Perception reports Peak in Heavy Truck Sales Point to Cyclical Pain.

Heavy truck sales are oddly a good leading indicator for the economy. It is odd because a lot of industrial production is coincident with the business cycle. However, if you go back over forty years, you can see that recessions have always been preceded by a decline in heavy truck sales. This is particularly true if the increase in truck sales is very large. Today, truck sales are not far from where they were at previous cyclical peaks in 1999 and 2007.

Heavy Truck Sales

Orders are down, sales will follow, sharply!

Topping off the the automotive sector please don’t miss About Those Record Auto Sales: Let’s Communicate!

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD holds on to intraday gains after upbeat US data

EUR/USD remains in positive ground on Friday, as profit-taking hit the US Dollar ahead of the weekend. Still, Powell's hawkish shift and upbeat United States data keeps the Greenback on the bullish path.

GBP/USD pressured near weekly lows

GBP/USD failed to retain UK data-inspired gains and trades near its weekly low of 1.2629 heading into the weekend. The US Dollar resumes its advance after correcting extreme overbought conditions against major rivals.

Gold stabilizes after bouncing off 100-day moving average

Gold trades little changed on Friday, holding steady in the $2,560s after making a slight recovery from the two-month lows reached on the previous day. A stronger US Dollar continues to put pressure on Gold since it is mainly priced and traded in the US currency.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.