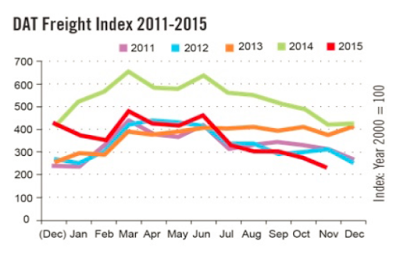

A chart of the DAT freight index posted on CCJ Indicators shows a huge, ongoing collapse in trucking shipments.

"Spot freight falls 15 percent: The amount of freight available on the spot market fell 15 percent in November from October, DAT reported last week. That dip is in line with seasonal trends, the online loadboard said. Year over year, however, freight volume fell 45 percent from November 2014. Van freight fell 2.9 percent from October, flatbed 39 percent and reefer 9.1 percent, DAT says."

Not to worry!

To that I would add that in August, September, October, and November, shipping volumes were down compared to the same month in 2011, 2012, 2013, and 2014 except for the single instance of September 2015 vs. September 2012.

“We expect conditions to improve as we move through the year as the market further prepares for tight truck capacity when the HOS, ELD, and speed governor rules are implemented over the next two years,” says FTR’s Jonathan Starks. “The main risk right now is the weakness in manufacturing and the high inventory levels. The inventory situation needs to be corrected before we are likely to get a sizable burst of manufacturing activity. Look for that to happen early in 2016.”

Sizable Burst of Unwarranted Optimism

Starks foresees a "sizable burst of manufacturing activity." He provided no reasons for expecting for that burst of activity.

I suppose inventories will magically shrink or consumers will go on a record buying spree despite rising interest rates, a slowing global economy, unaffordable home prices, high and rising rent prices, and rapidly rising medical costs, the latter two rising much faster than paychecks.

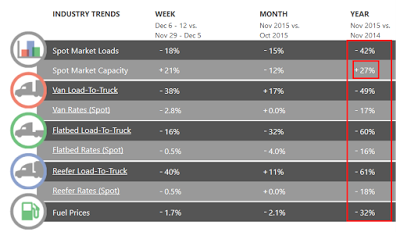

DAT Trendlines

In the above chart, courtesy of DAT Trendlines, the only thing up vs. a year ago is capacity to ship. That spells trouble in my book.

To that we can safely add Industrial Production Declines Most in 3.5 Years, Down Eighth Time in Ten Months.

Finally, inventories are a very serious problem, not something that can be wished away.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.