As Crude Oil continues to feel the wrath of diminished demand and buoyant production, an increasing number of market pundits are now suggesting that $30.00 a barrel could be the new reality.

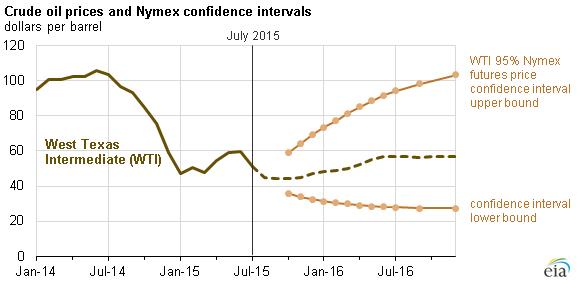

The latest release of the Energy Information Administration’s (EIA) short-term energy outlook has lowered the forward forecasting of WTI crude. Diminishing demand and concerns over a general slow-down in China have meant that global crude oil prices have been in relative free fall since April.

Current modelling seems to indicate a mid-range price for WTI Crude at around the $54.00 a barrel level throughout 2016. However, the confidence interval, that the estimate resides within, is impossibly wide, and provides a lower bound just under the $30.00 level. Considering the current global turmoil, as well as the seasonal slowdown under way, it would appear that the downside is realistically the probable target.

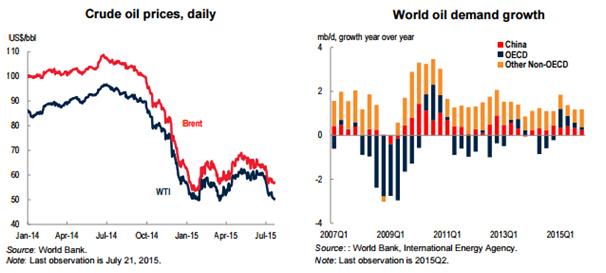

Given the current economic turmoil in China, and the fact that much of their petroleum reserve purchasing has ceased for the year, demand for crude oil is likely to remain relatively static for the remainder of the year. To complicate matters, the market is moving to price in the impact of millions of barrels of oil starting to flow from Iran. This additional supply potentially adds to the already sizeable commodity glut on the global markets.

Although cheaper oil prices are likely to provide some short term respite to motorists, its implications for both the industry and the global economy are stark. WTI prices are now close to levels not seen since the global financial crisis in 2009. Although there is a definite supply glut impacting prices, demand has also diminished in line with a slowdown throughout Asia. In fact, OECD demand has reduced significantly throughout 2015 and mirrors the current absence of persistent inflation within the west.

The reality is that the powerhouse economies of Europe and the U.S.A are slowing and entering a period of diminishing growth. As the majority of economic indicators are backward looking, it is extremely difficult to pick a downturn until you are actually in one. In comparison, crude oil is a rough indicator of economic activity and demand in real time.

A review of global oil prices therefore tells us that something murky is afoot within the global economy. When you consider the risk of a slowing China, modelling seems to show oil prices moving down, not up. Subsequently, we see the medium term price range for WTI falling into the low $30.00’s.

So prepare yourself for the new reality of crude oil…prices in the $30.00’s and a whole barrel of trouble.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD stays under pressure near 1.0550 on renewed USD strength

EUR/USD holds lower ground near 1.0550 on Wednesday. The US Dollar benefits from rising US Treasury bond yields and the cautious market mood, forcing the pair to stay on the back foot. Several Federal Reserve policymakers will be delivering speeches later in the day.

GBP/USD declines toward 1.2650, erases UK CPI-led gains

GBP/USD loses its traction and retreats toward 1.2650 on Wednesday. Although the stronger-than-expected inflation data from the UK helped Pound Sterling gather strength, the risk-averse market atmosphere caused the pair to reverse its direction.

Gold stays below $2,640 as US yields rebound

Gold struggles to hod its ground and trades below $2,640 on Wednesday. Following Tuesday's slide, the benchmark 10-year US Treasury bond yield stays in positive territory, making it difficult for XAU/USD to building on its weekly gains.

Why is Bitcoin performing better than Ethereum? ETH lags as BTC smashes new all-time high records

Bitcoin has outperformed Ethereum in the past two years, setting new highs while the top altcoin struggles to catch up with speed. Several experts exclusively revealed to FXStreet that Ethereum needs global recognition, a stronger narrative and increased on-chain activity for the tide to shift in its favor.

Sticky UK services inflation to keep BoE cutting gradually

Services inflation is set to bounce around 5% into the winter, while headline CPI could get close to 3% in January. That reduces the chance of a rate cut in December, but in the spring, we think there is still a good chance the Bank of England will accelerate its easing cycle.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.