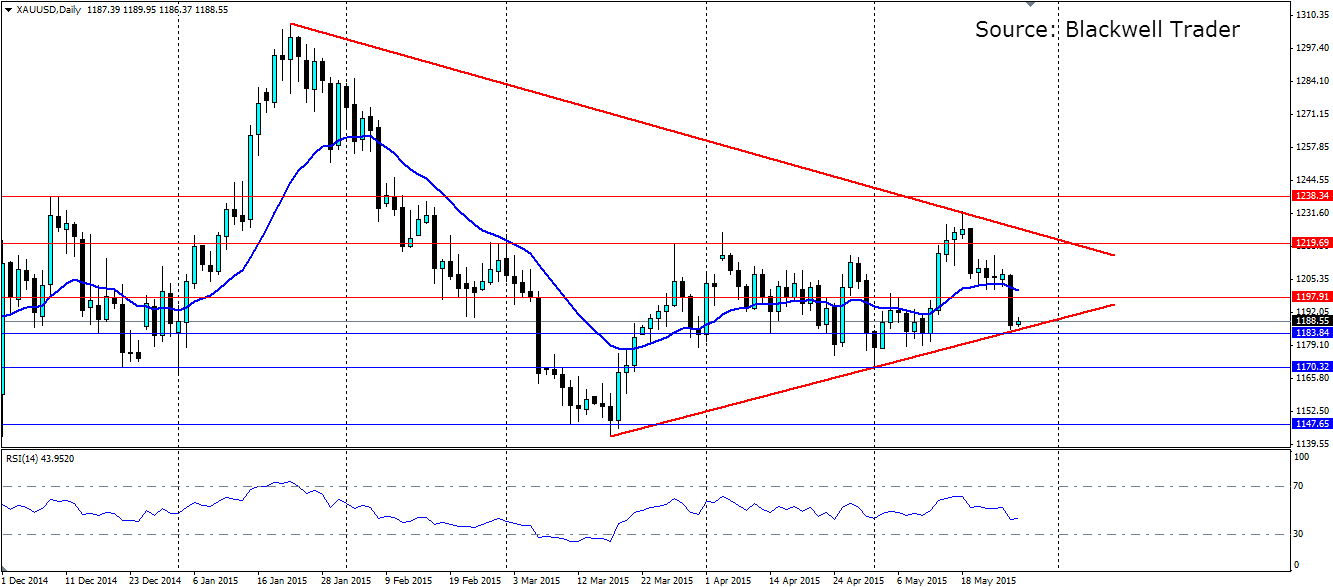

Gold was sold off heavily yesterday, pushing the metal back below the $1200 an ounce mark as India announced a ‘Monetisation Programme’. Gold now sits along the bullish trend line at the bottom of a consolidation shape that will provide dynamic support and could see the metal retrace higher.

India announced a plan to unlock the wealth stored in some 20,000 tons ($767 billion worth) of gold that is currently lying idle in Indian households. The plan is to encourage banks to take deposits of gold in the form of bullion and jewellery that will pay interest to the owner. This gold would then be sold on the open market to try and satisfy local demand. Currently India imports 1,000 tons of gold per year and this is putting a huge drain on foreign reserves.

This plan could go some way to reduce those imports with locally sourced gold. Depositors will not receive back the specific gold they deposit, which will put off a lot of people from depositing jewellery. But for holders of bullion it will be a good way to receive a return on their investment. Whether it is successful and reduces imports remains to be seen.

Gold traders responded by selling off the precious metal from $1,206.72 an ounce, down to $1,188.51. The rampant US dollar certainly would have helped by adding to the bearish pressure. The bullish trend line that has been in play since the lows hit in mid-March has once again been brought back into the picture.

Gold has fallen back into a liquidity zone that has seen plenty of raging and reversing, so it’s likely we will see this act, along with the dynamic support along the trend line, to reverse gold once again and see it push higher towards the recent highs, or at least the bearish trend line that forms the top of the pennant shape that gold is currently consolidating within.

Either way look for a rejection and a bounce off the bullish trend in the short term. Resistance will be found at 1197.91, 1219.69 and 1238.34 with the bearish trend line acting as dynamic resistance. If we see the bullish trend line fail, look for support at 1183.84, 1170.32 and 1147.65.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund and function similarly to a traditional stablecoin.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.