Market movements overnight were extreme; with the VIX hitting a 3 year high as the market panicked on recent data about the future prospect of rate rises in the US, and the slowdown of global growth in major economic zones such as Europe and Asia.

The volatility has been immense and the markets overnight were impressive, scary, and downright intimidating for traders. Massive moves were a result of the recent downgrade in future prospects and the USDJPY, NZDUSD and all equity indexes moved sharply as money rushed to find returns and safety globally.

Safety and something tangible is what the market seems to hunger for when stuck in an extreme situation. We’ve seen that with gold time and time again, sudden rises in the precious metal as investors rush into it. But gold got stuck as well. In fact, I was surprised how small the movement was given the panic in equity markets.

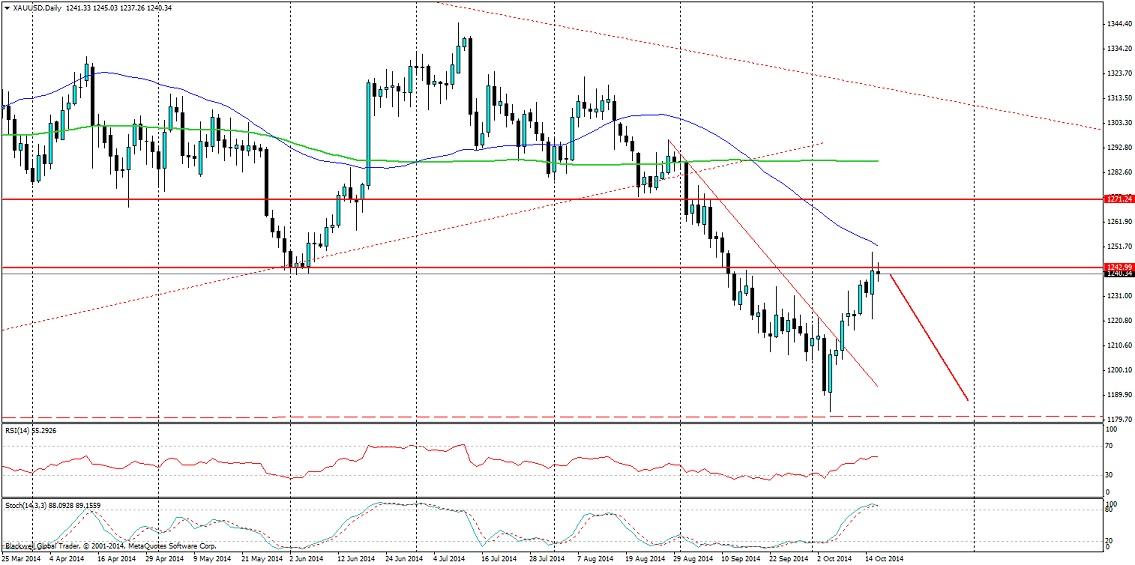

In fact gold went and hit the resistance level at 1241.00. This was a very strong resistance level in the market and it was not surprising, but past movements with gold and less volatility have seen larger movements which have smashed out resistance levels easily. So you can understand my apprehension to start longing gold in the market.

I think it’s even possible that we might see gold pull back from the resistance level in the market at present. In order for this to happen, we may need to see more bearish candles on the chart. Rushing in now would be foolish and I would look to see a solid bearish candle pushing lower and joining in via some momentum trade. Also the time window may very well be in the short term, but I feel that a movement lower, especially with some positive data, could cause a big swing lower.

Gold may well move a bit higher, but after last night’s result it was much less than anyone expected. I feel that markets may be tired of gold overall, and that there could be a swing lower if we see a solid bearish candle. Tonight will certainly give us the picture we are looking for when trading this precious metal.

Recommended Content

Editors’ Picks

EUR/USD consolidates gains below 1.0500 amid weaker US Dollar

EUR/USD holds gains below 1.0500 in European trading on Monday, having recovered from its two-year low of 1.0332. This rebound is due to a sell-off in the US Dollar and the US Treasury bond yields amid a US bond market rally. The focus shifts to German data and ECB-speak.

GBP/USD flirts with 2600 on the road to recovery

GBP/USD is trading close to 1.2600 early Monday, opening with a bullish gap at the start of a new week. A broad US Dollar decline alongside the US Treasury bond yields on appointment of a fiscal hawk Scott Bessent as the Treasury Chief helped the pair stage a solid comeback.

Gold price sticks to heavy intraday losses amid risk-on mood, holds above $2,650 level

Gold price witnessed an intraday turnaround after touching a nearly three-week high, around the $2,721-2,722 area and snapped a five-day winning streak at the start of a new week. Bets for slower Fed rate cuts also drive flows away from the non-yielding yellow metal.

Bitcoin consolidates after a new all-time high of $99,500

Bitcoin remains strong above $97,700 after reaching a record high of $99,588. At the same time, Ethereum edges closer to breaking its weekly resistance, signaling potential gains. Ripple holds steady at a critical support level, hinting at continued upward momentum.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.