The European Central Bank electrified financial markets a year ago by launching a landmark quantitative easing program to support the Eurozone economy. And here we are one year later; the bank is still working hard to support the Eurozone economy, prop up inflation and weaken Euro (not a policy target as per ECB!).

What markets expect?/options available with the ECB

Deposit rate cut by at least 10 basis points

Expand asset purchase program – by EUR 10 billion to EUR 30 billion

Speculation about introduction of tiered interest rates (as in Japan) also exists

LTRO

ECB may also extend the maturity of its QE program beyond March 2017.

If it increases the size of the QE program, it may also have to add up more assets into its shopping list.

It may also consider scrapping the ban on buying bonds with yields below deposit rate.

The bank is also likely to revise its inflation forecasts lower and blame slowdown in China and other EMs for weak growth.

What’s priced-in?

A 10 basis points cut in the deposit rate cut is already priced-in –

Deposit rate stands at -0.30%, while the German 2-yr yield stands at 0.55%.

This means even if we assume deposit rate is cut by 10 bps tomorrow, the 2-yr yield is still 15 basis point below the new rate i.e. 0.40%

ECB has scope to surprise through other instruments

Central banks do take a note of policy tools implemented by across the globe and how markets responded to the same. The BOJ experiment with negative rates on January 29 was not well received by the markets –

Yen fell on Jan 29 only to recovery and gain further ground in the following week. The move also failed to prop up stock markets

It also led to rally in gold, which indicates markets are worried about central banks diving deep into the uncharted territory and how they would manage the road back to normalcy

Consequently, ECB could do little on deposit rate front and the aggressive easing stance has to be put forward via other tools, preferably QE.

Markets do expect ECB to expand its QE program, but that may not have been priced-in, which is why EUR/USD refused to drop in the last few days and in fact attempted to break above its 200-DMA.

Stage set for ECB over delivery

Markets expectations regarding ECB action are quite limited this time. Hence, even a slightest of aggressive action could result in a sharp fall in EUR.

Oil is on the rise. The last week’s positioning data revealed bullish oil bets are at record highs. Thus, timing is perfect for the ECB to press the easing button as falling EUR amid rising oil could help bank achieved inflation target earlier than anticipated. (Higher oil and weaker EUR translates to a much faster rise in imported inflation).

Fed is widely expected to come out dovish next week, hence there is a risk of a sharp rally in EUR if the ECB under delivers.

Impact on EUR/GBP

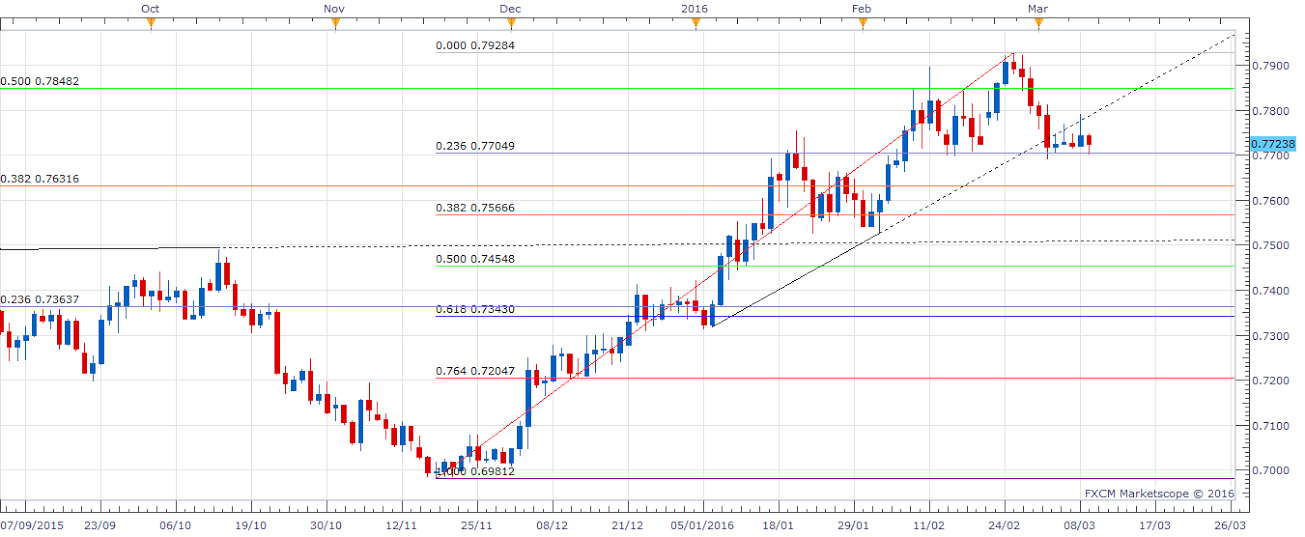

Daily Chart

The cross is finding support around 0.7705 (23.6% fibo of 0.6981-0.7928) after having come-off its multi –month high and in process having breached the rising trend line seen on the daily chart.

An ultra dovish ECB risks sending the EUR/GBP cross all the way down to 0.7547 (38.2% fibo of 0.6981-0.7928) in the next few days.

On the other hand, ECB under delivery may see the cross jump above 0.7848 (50% Fibo of 0.8766-0.6931) in the next few days and move towards latest cyclical high of 0.7928.

Going by the chart alone

A rebound from 0.7705 (23.6% fibo of 0.6981-0.7928) followed by a break above rising trend line resistance seen around 0.7790 would shift risk in favor of a rise to 0.7848

On the other hand, a break below 0.7681 (weekly 10-MA) could see the pair drift lower to 0.7630, which if breached on the daily closing basis would mean increased odds of a drop to 0.7565 (weekly 100-MA) – 0.7547 (38.2% fibo of 0.6981-0.7928).

EUR/GBP bears need to be cautious as the cross risks sharp recovery (from post ECB easing lows), if Brexit fears make a comeback.

UK side of the story is not impressive. Brexit fears can make a comeback anytime, while the forward looking (PMI) domestic demand has been disappointing. Consequently, if the ECB under delivers, the resulting gains in the EUR/GBP cross could be massive.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays weak below 1.0500 due to risk-off mood

EUR/USD remains depressed below 1.0500 in Tuesday's European morning as US President-elect Trump’s tariff plans dampen the market sentiment and keep the US Dollar broadly bid. The Euro struggles due to growing Euro area economic concerns and increased dovish ECB bets.

GBP/USD consolidates losses near 1.2550 ahead of BoE's Pill, Fed Minutes

GBP/USD struggles near 1.2550 in European trading on Tuesday, following a slump to the 1.2500 area. The US Dollar holds on to modest gains amid Trump's tariffs threat-driven cautious mood, keeping the pair undermined ahead of BoE Pill's speech and Fed Minutes.

Gold price seems vulnerable amid bullish USD; $2,600 mark holds the key

Gold price struggles to capitalize on its modest intraday bounce from the $2,600 neighborhood, or over a one-week low and retains a negative bias for the second straight day on Tuesday. Trump's tariff threat drove some haven flows and offered some support to the safe-haven precious metal.

Trump shakes up markets again with “day one” tariff threats against CA, MX, CN

Pres-elect Trump reprised the ability from his first term to change the course of markets with a single post – this time from his Truth Social network; Threatening 25% tariffs "on Day One" against Mexico and Canada, and an additional 10% against China.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.