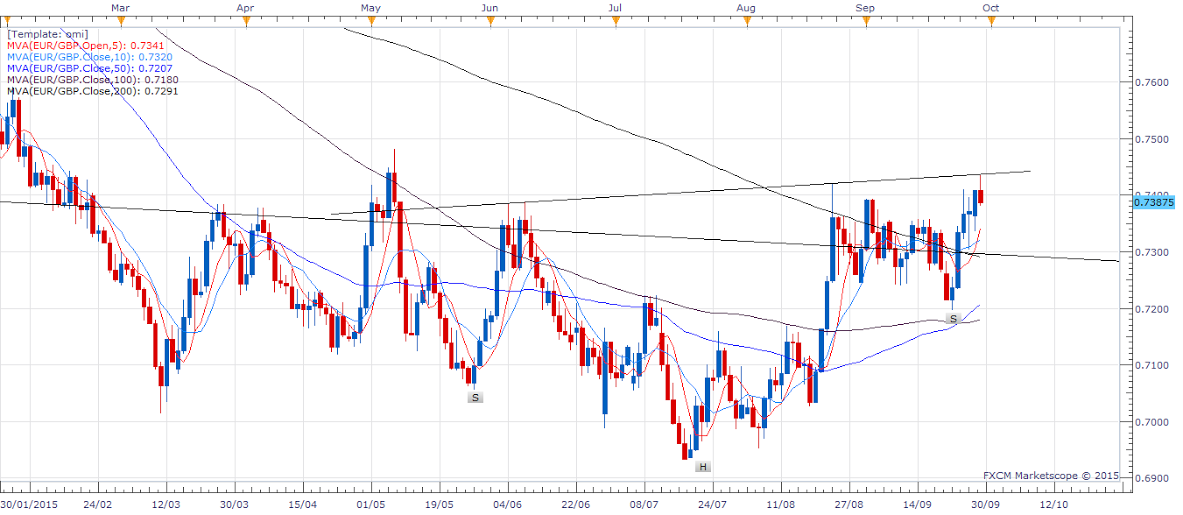

EUR/GBP Daily Chart

The EUR/GBP daily chart shows a classic inverted head and shoulder formation on the daily chart positioned at the bottom of the six and a half year long downtrend. A breakout would open doors for a target of 0.7946. That is a 500 pip move above the neckline resistance; a move which appears likely on in case of a major shift in the monetary policy stance of either the BOE or the ECB.

Six months back, a report titled “Could BOE turn dovish and cut rates†(https://www.fxstreet.com/analysis/macro-scan/2015/03/25), wherein I had made a case for the possible dovish turn by the BOE and a possibility of an interest rate cut. Four main reasons were cited back then – Falling inflation (still a problem), Sterling exchange rate (still a problem), Risk of hung parliament in the UK (threat no longer exists), Delay in Fed rate hike (Fed rate hike now seen happening in December or March 2016).

Falling inflation is still a problem in the UK. Not that deflation is bad, but central banks targeting 2% annualised inflation makes it bad and thus decreases the odds of a rate hike. Moreover, the labor markets (represented by unemployment rate) in the UK have strengthened considerably, despite which CPI is threatening to dip in the negative territory. This leaves very little scope to hike rates, since any rise in the unemployment level post rate hike threatens to push the BOE further away from its 2% CPI target.

Sterling exchange rate too remains a major problem. In fact, in the last six months the negative impact of the GBP strength has become more pronounced. The drop in the exports is a concern, and thus, country risks loosing its share of exports amid aggregate demand deficiency in the global economy if the BOE hikes rates and leads to spike in the GBP.

The problem for the BOE only increased further after the Federal Reserve took a dovish turn in September and the ECB expressed its readiness to do more. The CME Fed watch data shows a 25 basis point hike happening only in March 2016. October is likely to be a non-event, while the probability of the December ate hike is very low. Moreover, Fed’s Yellen and other policymakers are trying hard to talk up rate hike bets, but markets seem to believe the other way round. In my personal opinion, the Fed rate hike is unlikely to happen this year. Consequently, the prospects of the BOE rate hike is very very low.

New factors that could force BOE to cut rates

Turmoil in the Financial markets – The panic with regards to China and heightened concerns regarding the global growth after the Fed’s dovish turn has rattled markets across the globe. Moreover, Fed not only kept rates unchanged, but did not even hint at a possible rate hike in 2015; an opportunity lost in my opinion. No wonder, the markets no longer believe what the Fed is trying to sell with regards to rate hike or inflation. A rate hike or a possible hint at a rate hike in near-term by the Fed would have provided stability to the markets. But, now even if they hike rates now, it would trigger more risk aversion; thereby taking BOE further away from the rate hike and more closer to a rate cut.

Aggregate demand deficiency is more visible now – In the last six months, it has become more evident that there is a need to re-develop demand in the global economy. China’s slowdown and the shift in the PBOC’s FX policy and interest rate cut followed by a retaliatory action by other Asian and EM central banks only highlights the battle for maintaining export share has resumed. The ECB also stressed its readiness to do more, while speculation that the BOJ may expand its stimulus next month is already on the rise. Consequently, it is difficult for the BOE alone to stay hawkish and/or hike rates.

Hence, the view stays intact that BOE is indeed likely to turn dovish and may actually tilt towards rate cut, especially since the bank has a 25 basis point room (interest rate currently at 0.50%) before it hits the zero lower bound.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD trades sideways below 1.0450 amid quiet markets

EUR/USD defends gains below 1.0450 in European trading on Monday. Thin trading heading into the Xmas holiday and a modest US Dollar rebound leaves the pair in a familair range. Meanwhile, ECB President Lagarde's comments fail to impress the Euro.

GBP/USD stays defensive below 1.2600 after UK Q3 GDP revision

GBP/USD trades on the defensive below 1.2600 in the European session on Monday. The pair holds lower ground following the downward revision to the third-quarter UK GDP data, which weighs negatively on the Pound Sterling amid a broad US Dollar uptick.

Gold price holds comfortably above $2,600 mark; lacks bullish conviction

Gold price oscillates in a range at the start of a new week amid mixed fundamental cues. Geopolitical risks continue to underpin the XAU/USD amid subdued US Dollar price action. The Fed’s hawkish stance backs elevated US bond yields and caps the pair’s gains.

The US Dollar ends the year on a strong note

The US Dollar ends the year on a strong note, hitting two-year highs at 108.45. The Fed expects a 50-point rate cut for the full year 2025 versus 4 cuts one quarter earlier, citing higher inflation forecasts and a stubbornly strong labour market.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.