![]()

Crude oil surged on Monday as the International Energy Agency (IEA) projected US shale oil production to decrease substantially within the next two years. Specifically, the IEA expects to see shale production in the US decrease by 600,000 barrels per day in 2016 and by 200,000 additional barrels per day in 2017.

This projection, an optimistic positive for the currently oversupplied oil markets, helped to reinforce Friday’s US rig count data, which showed the numbers of oil rigs in the US having fallen to their lowest level in more than six years.

Further supporting oil prices at the beginning of this new trading week has been continuing speculation from the past few weeks over a proposed OPEC/non-OPEC output freeze that could potentially help limit production around January’s already-elevated output levels.

This series of oil-positive developments provided a glimmer of hope that crude could possibly overcome its currently rampant oversupply problem, weather the specter of potentially waning global demand, and rise further from its multi-year lows. These hopes significantly boosted both the West Texas Intermediate (WTI) US benchmark as well as the Brent Crude international benchmark for crude oil on Monday.

While an extended rebound based upon these optimistic developments could very well be in store for crude oil, however, a major recovery is considerably less likely. This is due to the perspective that the sheer magnitude of global oil oversupply conditions poses an exceptionally large obstacle to a price recovery, and any moderate restraint or reduction of output may simply be inadequate. With that being said, any future agreement that potentially develops into actual coordinated production cuts among major oil-producing nations should very likely lead to substantially higher prices.

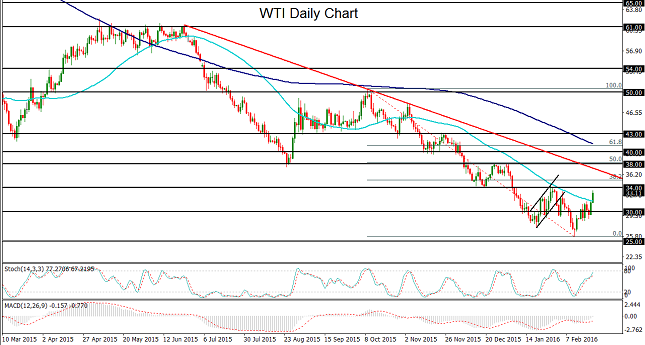

Besides the fact that the recent rise of crude oil prices has primarily been based simply upon projections and speculative conjecture, the WTI benchmark has approached major upside resistance around the $34.00 level. This approach occurs after price action broke out above its 50-day moving average for the first time since November. Previously, prices reached that $34.00 level in early January before retreating back down to hit new multi-year lows. If WTI turns back down once again at or near that resistance, a revisit of the $30.00 level should be likely. From there, any further breakdown could once again target the key $25.00 support area, last approached less than two weeks ago. In the opposite event that further positive developments boost WTI above the $34.00 resistance level, major upside resistance resides at the $38.00 level.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.