![]()

It’s been a bad first half of the day for European indices, with a sea of red across all European markets. The FTSE 100 has managed to fare the best, it is currently down 0.8%, which compares with a 1.75% fall for the FTSE MIB in Italy and a 1.14% decline for the Eurostoxx index.

Interestingly, the drop has been across the board, with traditionally defensive sectors, which should do well during times of market panic, such as the healthcare and consumer staples sectors, also coming under pressure. The energy sector is also lower today; however it is the second best performing sector after utilities as some investors try to pick up bargains after sharp falls for the oil majors.

Why the oil price decline is not having a positive effect

The airline sector has also come under pressure today with IAG and Easyjet both falling more than 2%. But falling fuel costs should surely be good news for airlines, right? Well yes, and no. In the current environment of very weak inflation in the UK, corporations’ pricing power could be eroded, which may hit profits down the line. So, even though falling oil prices can save on the costs front, it doesn’t necessarily mean that profits will surge.

Tuesday’s inflation report from the UK suggested that it’s not only oil price declines that are weighing on the CPI rate. Price declines for November, when the CPI fell to its lowest level for 12 years, were also noted across the transport sector, including air transport, and in the prices of recreational and cultural goods. Food and energy prices were the largest downward contributors to the CPI rate; however, lower prices are becoming more broad-based, which is starting to spook investors.

Surely the consumer can save the FTSE 100?

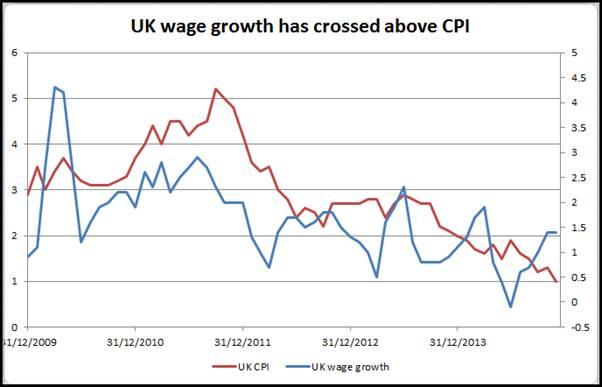

Falling prices and rising wages are surely a boon to a consumer-focused economy like the UK? Well, yes and no. Rising wages, for November wages rose to 1.4%, the second straight month when wage growth was above inflation (see fig 1), could actually cause the BOE to hike interest rates sooner than the market expects. With a potential rate hike looming on the horizon we could see shoppers embark on some belt-tightening for the first few months of 2015.

In conclusion, the oil price decline may not be such a good thing for stocks in the long-term if it starts to erode companies’ pricing powers. This could weigh on the FTSE 100 as we move into 2015. In the short term, however, the FTSE 100 is likely to be driven by external factors like the outcome of today’s FOMC decision, and whether panic in emerging markets starts to spook developed market investors as we move towards the Christmas holidays.

Takeaway:

UK stocks are under pressure on Wednesday.

The sell-off has been broad-based, and even traditionally defensive sectors like healthcare and consumer staples are coming under pressure.

This could be down to the fall in UK inflation.

CPI for November saw broad-based declines, suggesting that the decline in UK CPI is not only down to the oil price.

This could erode corporate pricing power going forward, which could hit profits.

If inflation stays low for the long-term then we could see stocks remain under pressure.

In the short term, the FOMC decision and overall market sentiment could drive the FTSE 100.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD rebounds from session lows, stays below 1.0600

EUR/USD recovers from the session low it set in the European session but remains below 1.0600 on Tuesday. Although the US Dollar struggles to gather strength following disappointing housing data, the risk-averse market atmosphere caps the pair's rebound.

GBP/USD remains under pressure below 1.2650 after BoE Governor Bailey testimony

GBP/USD trades in the red below 1.2650 on Tuesday, pressured by safe-haven flows. BoE Governor Bailey said a gradual approach to removing policy restraint will help them observe risks to the inflation outlook but this comment failed to boost Pound Sterling.

Gold extends recovery toward $2,640 as geopolitical risks intensify

Gold price builds on Monday's gains and rises toward $2,640 as risk-aversion grips markets amid intensifying geopolitical tensions between Russia and Ukraine. Meanwhile, the 10-year US Treasury bond yield is down more than 1% on the day, further supporting XAU/USD.

Bitcoin Price Forecast: Will BTC reach $100K this week?

Bitcoin (BTC) edges higher and trades at around $91,600 at the time of writing on Tuesday while consolidating between $87,000 and $93,000 after reaching a new all-time high (ATH) of $93,265 last week.

How could Trump’s Treasury Secretary selection influence Bitcoin?

Bitcoin remained upbeat above $91,000 on Tuesday, with Trump’s cabinet appointments in focus and after MicroStrategy purchases being more tokens.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.