Analysis for July 17th, 2014

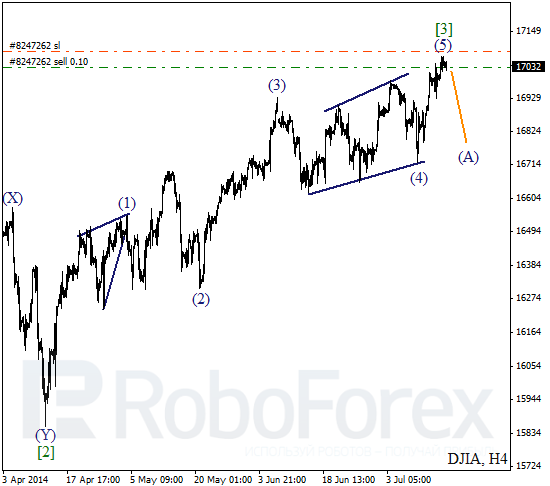

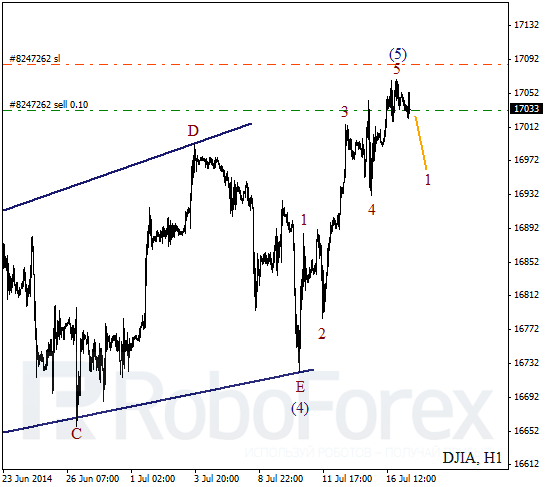

DJIA Index

Probably, Index has completed its bullish impulse inside wave [3]. On minor wave level, after finishing triangle pattern inside wave (4), price has formed impulse inside the fifth wave. Consequently, during this very Thursday price may start new descending correction.

More detailed wave structure is shown at H1 chart. Current impulse inside wave (5) is completely formed. Probably, the first bearish wave is forming. I expect the further descending movement and, therefore, I have opened a short position with stop loss at maximum.

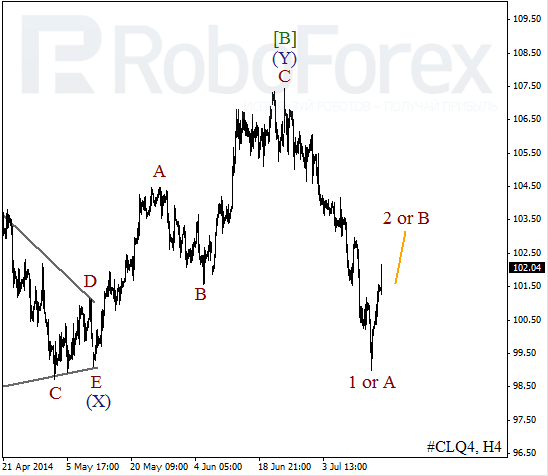

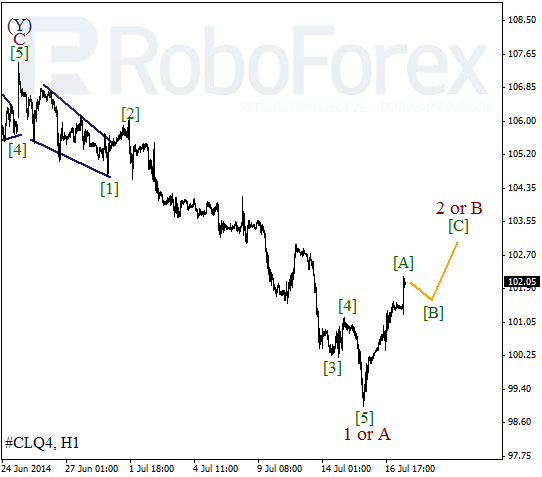

Crude Oil

Oil is still being corrected after the impulse formation inside wave 1 or A. In the near term, quotes are expected to continue rising inside bullish wave 2 or B.

As we can see at H1 chart, price has completed wave [5] and oil finishes its bullish impulse inside wave [A]. After short local correction, I expect the ascending movement inside impulse wave [C] of 2 or B.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD rises back above 0.6500 after hawkish RBA Bullock's comments

AUD/USD edges higher to regain 0.6500 in Asian trading on Friday. The pair capitalizes on upbeat Australian Private Capex data for October and hawkish comments from RBA Governor Bullock. A broadly muted US Dollar also aids the Aussie's uptick amid light trading.

USD/JPY extends sell-off to near 150.00 after hot Tokyo CPI

USD/JPY extends sell-off to test 150.00 in Friday's Asian session following the release of hotter-than-expected November inflation figures from Tokyo, Japan’s capital. The data strengthens the case for another BoJ rate hike in December, sending the Japanese Yen through the roof.

Gold price holds firm below $2,650 amid cautious optimism

Gold price posts small gains below $2,650 in the Asian session on Friday, awaiting a fresh catalyst before the next leg of a directional move amid a cautiously optimistic mood. Bets for a Dec Fed rate cut remain intact, acting as a tailwind for Gold price alongside a subdued US Dollar.

ASI's FET rallies following earn-and-burn mechanism launch

The Artificial Superintelligence Alliance (FET) saw double-digit gains on Thursday after it announced plans to burn up to 100 million tokens as part of its Earn-and-Burn mechanism, set to begin in December.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.