Analysis for February 27th, 2014

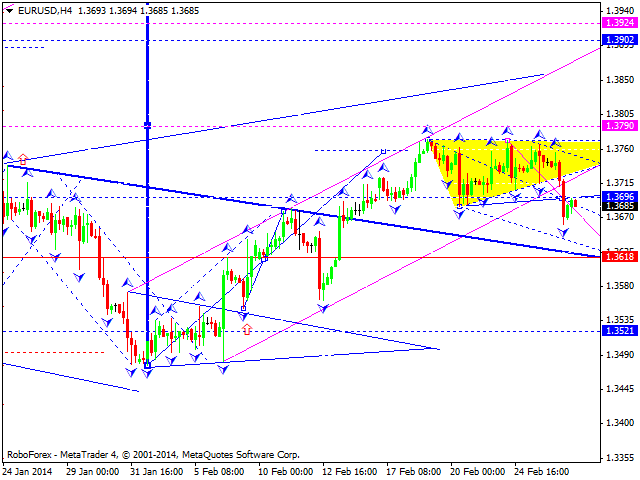

EUR USD, “Euro vs US Dollar”

Euro couldn’t finish its ascending structure; after slight consolidation, market started descending correction towards level of 1.3620. We think, today price may consolidate for a while and then continue moving downwards and form the third wave of this correction with target at level of 1.3630. Later, in our opinion, instrument may continue growing up.

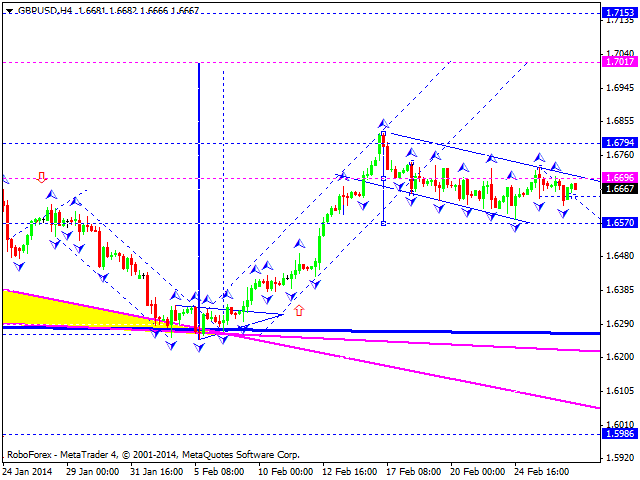

GBP USD, “Great Britain Pound vs US Dollar”

Pound continues forming consolidation channel near level of 1.6700 and right now is moving downwards to reach level of 1.6580; this movement may be considered as correction. Later, in our opinion, instrument may continue growing up towards level of 1.7000.

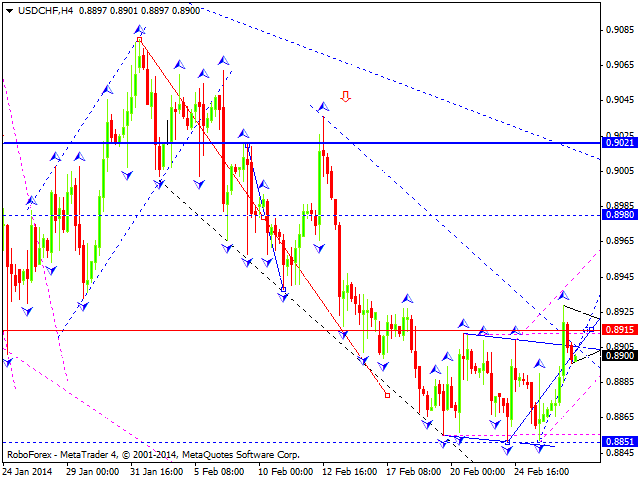

USD CHF, “US Dollar vs Swiss Franc”

Franc broke its consolidation channel upwards and may continue this correction. We think, today price may reach level of 0.8980 and then continue falling down towards level of 0.8730.

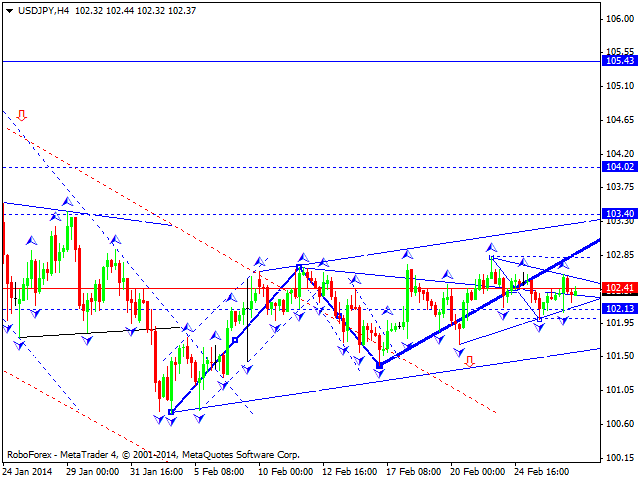

USD JPY, “US Dollar vs Japanese Yen”

Yen is forming the third ascending wave of correctional flag pattern (a bearish one, in this case) with target at 103.40. We think, today price may complete this wave and then start the fourth one with target at 102.10. Later, in our opinion, instrument may form the fifth wave towards level of 104.00 and then fall down to reach level of 100.00.

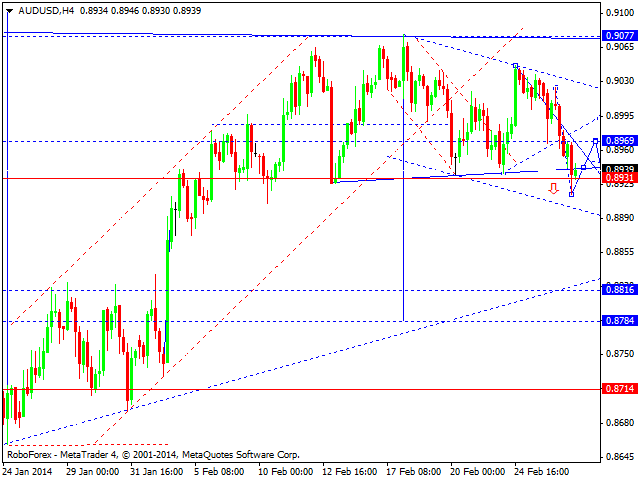

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar completed its three-wave correction; market has broken the minimum of the first descending wave and may continue falling down towards level of 0.8820. Later, in our opinion, instrument may return to level of 0.8930 and then continue moving inside descending trend.

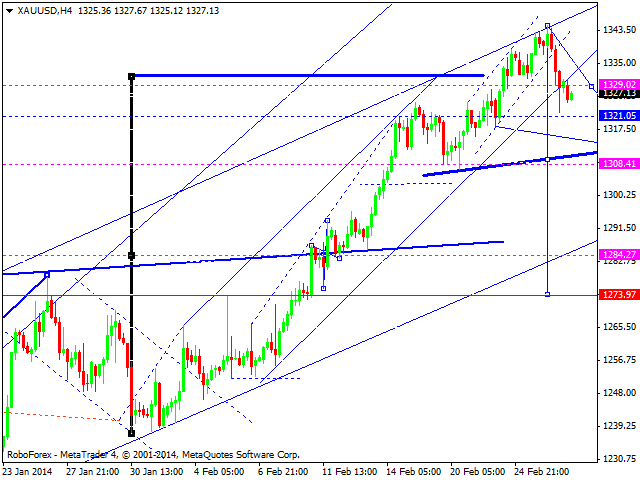

XAU USD, “Gold vs US Dollar”

Gold broke the channel of the third ascending wave and right now is forming descending structure. We think, today price may form the first wave of correction with target at 1312 and then return to level of 1329. Later, in our opinion, instrument may continue this correction towards level of 1285.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD remains in the red below 0.6500 on US-China trade risks

AUD/USD remains under selling pressure below 0.6500 in the Asian session on Tuesday, reversing some losses. Trump's threatened additional 10% tariffs on China, weighinmg heavily on risk sentiment and the China-proxy Australian Dollar while lifting the haven demand for the US Dollar.

USD/JPY drops below 154.00 as US Dollar surge stalls

USD/JPY drops below 154.00 in Tuesday's Asian trading. Fresh tensions surrounding US-China trade war underpin the safe-haven US Dollar while the Japanese Yen catches a fresh bid on PM Ishiba's calls on businesses to hke wages. Fed Minutes are next in focus.

Gold: Trump tariffs threat lifts XAU/USD, focus shifts to Fed Minutes

Gold price has staged a solid comeback so far this Tuesday’s trading after hitting a six-day low at $2,605 in early dealings. Gold buyers look forward to the Minutes of the US Federal Reserve’s (Fed) November meeting for the next push higher.

TRON Foundation becomes the largest investor in Donald Trump's World Liberty Financial

Donald Trump-backed DeFi platform, World Liberty Financial, received new support on Monday after Tron founder Justin Sun announced that the Tron Foundation had invested $30 million into the president-elect's platform, making them its largest financial supporter.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.