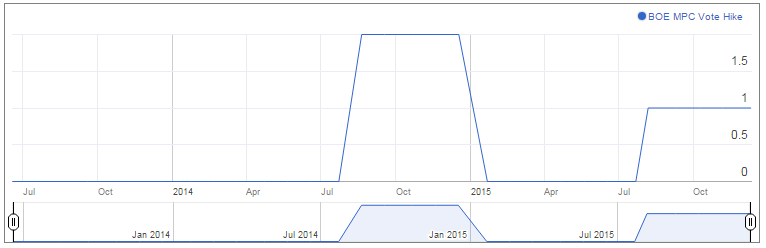

The rate decision meeting in the previous months saw just one of the nine Monetary Policy Committee members vote in favour of a rate hike. The scenario may stay unchanged tomorrow. The vote to hold rates will likely remain 8-1. Ian McCafferty can be expected to remain the lone hawk. Some analysts however feel McCafferty may choose to change his stance at tomorrow’s meeting. Economists Fabrice Montagne and Andrzej Szczepaniak feel there is a possibility of Ian McCafferty withdrawing his vote to raise rates on account of recent fall in oil prices as well as the dominant market volatility. He had chosen to refrain from voting in favour of a rate hike in January 2015 post the sharp in oil price in the December of 2014.

What will likely prompt the BoE to hold rates steady tomorrow?

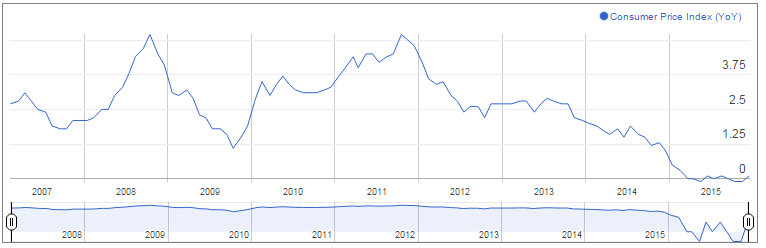

It might be worthwhile to study the factors that are weighing on the central bank’s inclination to hike. Broadly, it is larger global economic outlook as well as the poor growth at home which is postponing the increase of rate further into the future. The central bank has revised downward Britain's growth outlook to 2.7 per cent for 2015. Inflation is a prime concern for policy makers. CPI remained almost flat in November. It came in at 0.1 per cent, in tune with expectations of economists. Core CPI was at 1.2 per cent, a slight increase from 1.1 per cent recorded in October. Chris Williamson, chief economist at data firm Markit remarked "UK inflation remained largely absent in November, and looks set to remain weaker for longer than forecasters have recently been expectingâ€ÂÂ. BoE chief economist, Andy Haldane, warned that the economy and inflation were "skewed materially to the downside."

Prices have large been kept in check by low oil prices and poor wage growth. Latest figures show wage growth slowed to 2.4 per cent in the three months to October from 3 per cent recorded earlier. It grew at a slowest pace since early 2015 in this period. Only higher wages can lift consumer spending and help to stabilize price. The weaker outlook for inflation together with the slowdown in wages will likely compel the central bank to postpone rate hike to the end of 2016 or even beginning of 2017.

The manufacturing sector has also shown sharp decline in growth in the last quarters, weighed down by poor global outlook. Manufacturing production contracted 0.4 per cent month on month in November. Britain’s manufacturers expect 2015 to be their worst year for growth since 2009.

Watch: Trade the Bank of England BoE rate decision with FXStreet - Live Coverage with Valeria Bednarik

Falling oil prices is a worrying factor not just for the BoE but all other major central banks as oil price is restricting inflation growth hurting the major economies’ objective to push inflation up to their set target. Oil price is on a falling spree, hitting multi-year lows and raising concerns that it might even fall below $30 per barrel mark. Low oil price is bad news for UK’s economy which is struggling to combat the impact of an almost absent inflation rate.

The BoE will also have to consider the fears arising over a Brexit possibility before arising on rate decision. Brexit fears are hurting business sentiment in the UK and the central bank’s miscalculated step may chase investors away.

Some economists see the possibility of a hike this year

The minutes of the meeting will explain the rationale behind keeping rates steady. Markets can gauge the future course of action by studying the discussion on significant developments. According to economists Fabrice Montagne and Andrzej Szczepaniak, the minutes’ tone can be expected to stay largely unchanged from the December’s meeting. They feel the minutes will highlight “uncertainty among Committee members and muted underlying inflationary pressuresâ€ÂÂ.Read: BoE Forecast 2016: When will they raise rates?

Some quarters however believe that BoE will raise rates earlier than market expectations. Capital Economics expect the central bank to raise rates in the idle of this year. However, it has added that ‘chances of a later hike are building’. It also predicted that the BoE will tighten monetary policy at a rate slower than its US counterpart.

Samuel Tombs of Pantheon Macroeconomics feels the existent oil price slump “still isn’t large enough to prevent inflation rising over the coming months. He further noted "But with no sign that low inflation is becoming ingrained, the labour market generating cost pressures and the housing market overheating again, we still expect two rate hikes this year. He sees the first rate hike in May this year.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD stays weak below 1.0500 due to risk-off mood

EUR/USD remains depressed below 1.0500 in Tuesday's European morning as US President-elect Trump’s tariff plans dampen the market sentiment and keep the US Dollar broadly bid. The Euro struggles due to growing Euro area economic concerns and increased dovish ECB bets.

GBP/USD consolidates losses near 1.2550 ahead of BoE's Pill, Fed Minutes

GBP/USD struggles near 1.2550 in European trading on Tuesday, following a slump to the 1.2500 area. The US Dollar holds on to modest gains amid Trump's tariffs threat-driven cautious mood, keeping the pair undermined ahead of BoE Pill's speech and Fed Minutes.

Gold price defends $2,600 ahead of FOMC minutes; not out of the woods yet

Gold price retains its negative bias for the second straight day and trades just above a one-week low during the first half of the European session on Tuesday. The growing conviction that Donald Trump's expansionary policies will reignite inflation and limit the scope for the Fed to cut interest rates further triggers a fresh leg up in the US Treasury bond yields.

Trump shakes up markets again with “day one” tariff threats against CA, MX, CN

Pres-elect Trump reprised the ability from his first term to change the course of markets with a single post – this time from his Truth Social network; Threatening 25% tariffs "on Day One" against Mexico and Canada, and an additional 10% against China.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.