This weeks blog post will be a little shorter as we are writing the subscriber report this weekend.

From last weeks blog post which was very close.

"Most important market dates this week are April 25 and April 28th. Looking for the start of a move down Monday with a possible low April 28, 29."

Gold

I'm now looking at March 28th as the start of a new nominal 18 week cycle 1 trough.

This puts us entering either the 6th week of a new Primary cycle. Since I'm looking at this as entering the 6th week we should be prepared for a pullback Bear in mind we are still in a time period with confusing Astros.

This nominal 18 week cycle even had the pullback I've mentioned in a new Primary cycle you often get a pullback 2- 3 weeks from the beginning. They are marked with TT and TB.

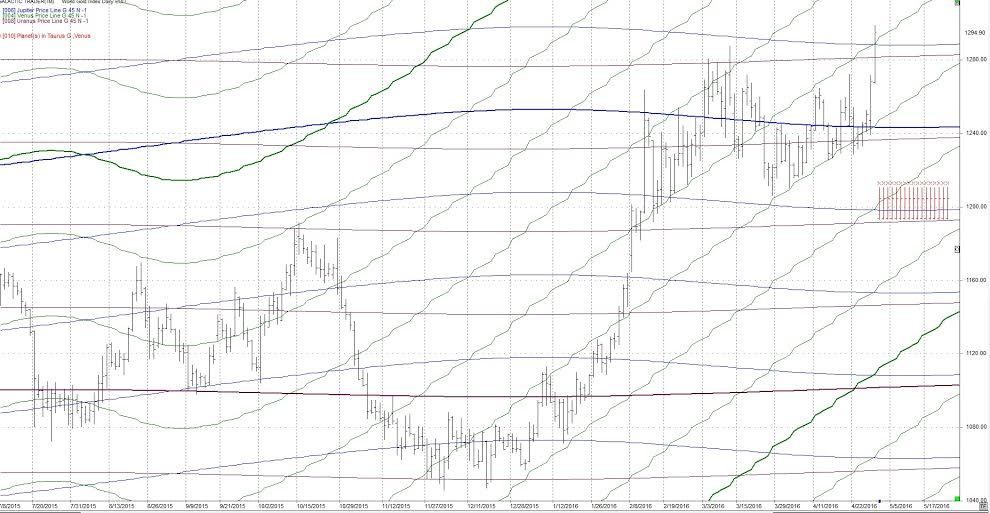

Following is a daily chart for Gold. The orange vertical lines are a 14 cd (calendar day) cycle which has been at highs and lows and hit again on April 21.

Price has moved below the 15 and 45 day sma and the 15 sma is above the 45 sma. This all looks very bullish. Just remember we are entering the 6 week timeframe where we often get pullbacks. The other option is we get a 1/2 Primary cycle which means we'd have a few more weeks of an up move for Gold.

On the following daily Gold charts there are the Venus (green), Jupiter (blue) and Uranus (purple) price lines. These are the longitude of the planet converted to price. Note the Gold price has been following the Venus price line up and as happens so many times, when the Venus and Jupiter lines cross you get a big move (up or down).

This blog will cover the stock market from a timing perspective. As such there will be no coverage of fundamental analysis. The approach will be to look for market cycles which are timed with Astrological cycles. When found technical analysis will be used to fine tune entries and exits. Most articles will include examples. For those who are dubious because it "just should not work", read a few posts. You may be very surprised. I am a certified accountant, computer programmer and astrologer. NORMAL STUFF The projections and information provided does not constitute trading advice, nor an invitation to buy or sell securities. The material represents the personal views of the author. Anyone reading this blog should understand and accept they are acting at their own risk. Each person should seek professional advice in view of their own personal finances.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.