NAR spokesman Lawrence Yun was singing the praises of of a rebound in housing today. But comparisons are easy.

Mortgage News Daily reports Existing Home Sales Resume Gains, Realtors Say More to Come.

Existing-home sales got back on track in October, partially recovering from a 2.2 percent slip in September that ended a two-month winning streak. The National Association of Realtors® (NAR) said previously owned single-family houses, townhouses, condos, and cooperative apartments sold at a seasonally adjusted annual rate of 5.46 million during the month, a 1.9 percent increase from September. This put sales 3.6 percent higher than the 5.22 million rate of sales in October 2018.

Lawrence Yun, NAR's chief economist, said this sales increase is encouraging and he expects added growth in the coming months. "Historically-low interest rates, continuing job expansion, higher weekly earnings and low mortgage rates are undoubtedly contributing to these higher numbers," said Yun. "We will likely continue to see sales climb as long as potential buyers are presented with an adequate supply of inventory."

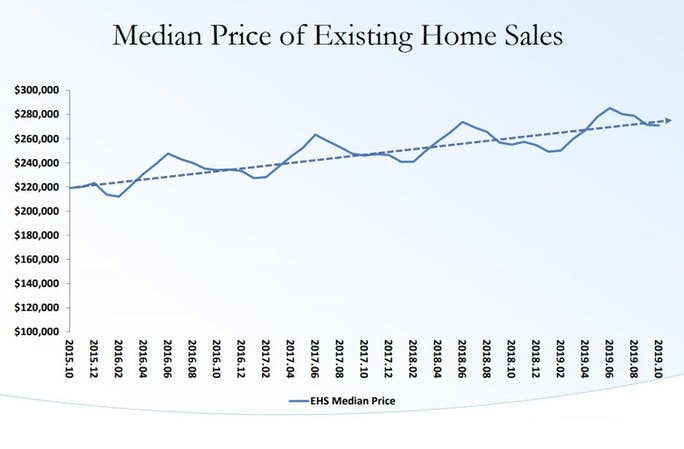

The median existing-home price for all housing types in October was $270,900, up 6.2% from last October's median of $255,100. Prices rose in all regions. It was the 92nd straight month of annual price gains. The median existing single-family home price was up 6.2 percent to $273,600 and condo prices grew 5.6 percent to a median of $248,500.

Inventories softened again, declining 2.7 percent from September's 4.1-month supply to 1.77 million units or a 3.9-month supply at the current rate of sales. In October 2018 there was a 4.3-month supply at 1.85 million units.

Expect Crowing in January

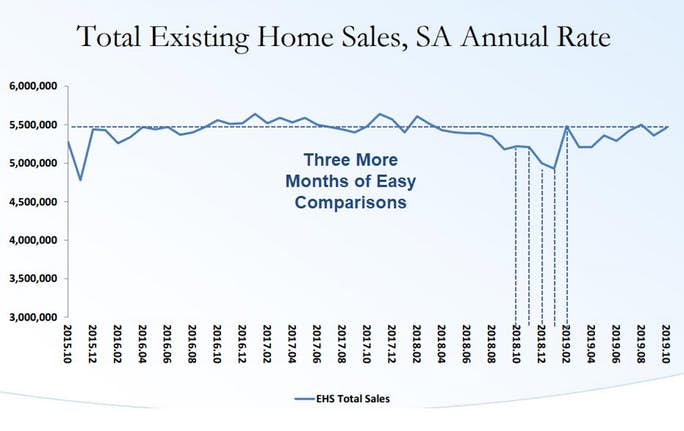

A quick glance at a chart from the October Existing Home Sales report by the National Association of Realtors shows sales are up year-over-year due to easy comparisons.

There are three more months of easy comparisons coming up.

January will provide the best opportunity for crowing even if sales falter.

Meanwhile, prices keep ticking up.

Existing Home Sales Median Price Year Over Year

Any alleged "affordability" on homes due to falling interest rates is chewed up with price increases.

This is why sales flatlined for years.

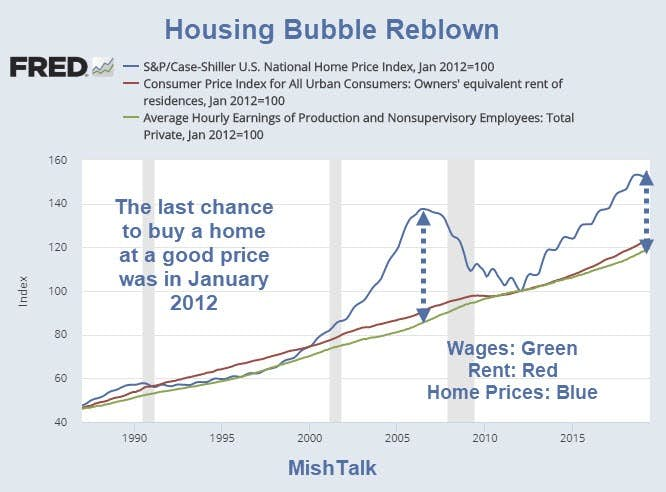

Housing Bubble Reblown

The Fed managed to re-blow the housing bubble.

The Last Chance for a Good Price Was 7 Years Ago.

Don't expect a huge housing boom any time soon. And contrary to widespread NAR propaganda, this is not a good time to buy a home.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.