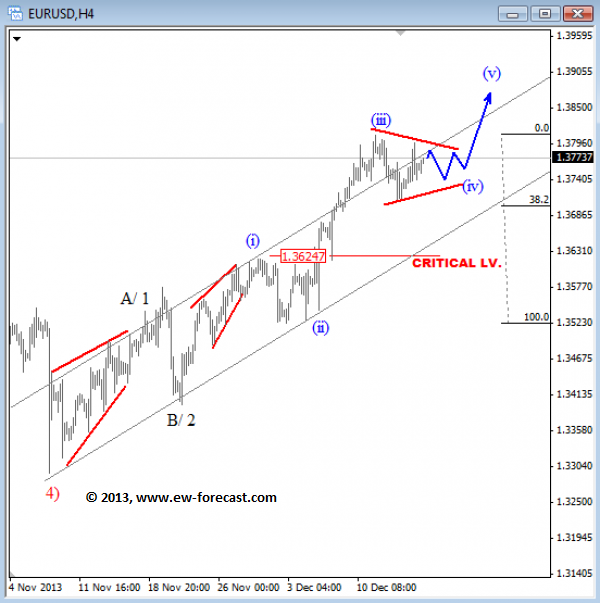

EURUSD 4h Elliott Wave Analysis

On intraday chart EURUSD was higher yesterday but reversal back to 1.3742 suggests that move from Dec 13 low is corrective. Therefore we suspect that wave (iv) is actually still underway since Dec 11. We are now observing idea of a triangle with wave c) moving down to 1.3730 where market may turn up for wave d). Generally speaking, technicals for EURUSD are pointing higher, for a move to a new high but maybe this will not unfold so soon.

EURUSD 30min Elliott Wave Analysis

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended Content

Editors’ Picks

AUD/USD holds above 0.6700, all eyes on Fed rate decision

The AUD/USD pair posts modest gains near 0.6705 during the early Asian session on Monday. The uptick of the pair is supported by the weakness of the US Dollar. However, the concerns about the economic slowdown in China might cap the upside for the China-proxy Australian Dollar.

EUR/USD: Ladies and Gentlemen, here comes the Federal Reserve

The EUR/USD pair reverted early losses and finished just below the 1.1100 mark, little changed for the week. The pair bottomed at 1.1001 mid-week, as the US Dollar benefited from a risk-averse environment. It finally gave up its early gains on Thursday, following the ECB monetary policy announcement and United States inflation figures.

Gold bulls dominate as markets reassess odds of a large Fed rate cut

Gold surged higher in the second half of the week and reached a new record high above $2,580, boosted by growing expectations for a large Federal Reserve rate cut at the upcoming policy meeting.

European crypto fund founder calls Tether $118 billion scam

Founder of Cyber Capital, Europe’s oldest crypto fund, criticized Tether for their reserves and said there has been no audit since 2021. In a tweet thread on X, Justin Bons supports his stance on the stablecoin firm with statistics.

European Central Bank widely expected to cut interest rates in September

The European Central Bank is expected to cut key rates by 25 bps at the September policy meeting. ECB President Christine Lagarde’s presser and updated economic forecasts will be closely scrutinized for fresh policy cues.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.