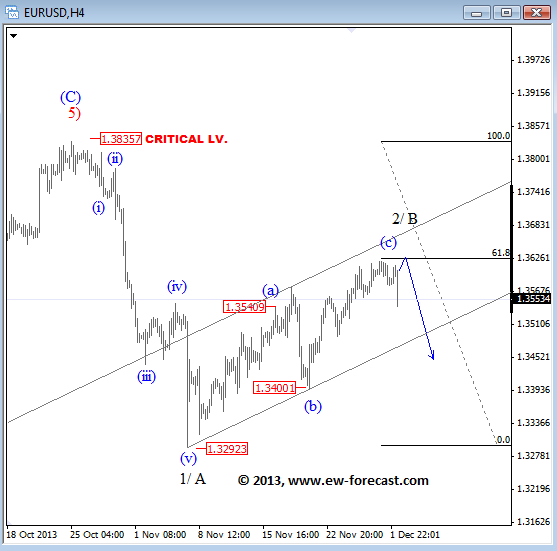

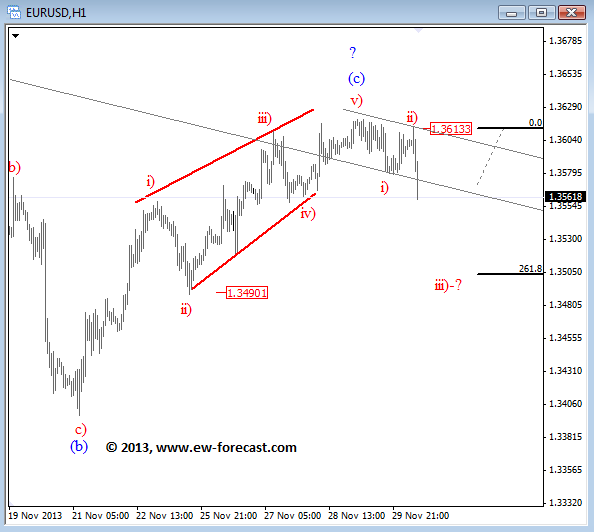

Technically speaking, you will know that we expect a bearish reversal on the EURUSD for a while now, which we also highlighted on Friday with an ending diagonal pattern in wave (c). Current decline from the high is sharp but still not enough data to confirm a top at 1.3620. But further weakness to 1.3500 will suggest that pair is in wave iii) as a part of an impulse bearish moves.

From trading perspective I will have EURUSD on radar for shorts if we get more evidences with the data and structure that would say that top is in place.

EURUSD 4h Elliott Wave

EURUSD 1h Elliott Wave

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended Content

Editors’ Picks

EUR/USD turns lower below 1.0350 after German data

EUR/USD comes under mild selling pressure and eases below 1.0350 in the European session on Wednesday. The pair bears the brunt of an unexpected slowdown in the German manufacturing sector, as the nation's Retail Sales data fail to inspire the Euro. Focus shifts to US ADP data and Fed Minutes.

GBP/USD stays defensive below 1.2500 ahead of key US data, Fed Minutes

GBP/USD stays defensive below 1.2500 in the European trading hours on Wednesday, undermined by a risk-off market sentiment and elevated US Treasury bond yields on increased hawkish Fed bets. Traders look to US data, Fedspeak and FOMC Minutes for fresh trading impulse.

Gold eyes US ADP report and Fed Minutes for next push higher

Gold price is consolidating the previous rebound near $2,650 early Wednesday, awaiting the US ADP jobs report and the Minutes of the US Federal Reserve December meeting for the next leg higher.

DOGE and SHIB traders book profits at the top

Dogecoin and Shiba Inu prices broke below their key support levels on Wednesday after declining more than 9% the previous day. On-chain data provider Santiments Network Realized Profit/Loss indicator shows massive spikes in these dog-theme memecoins, indicating traders realize profits.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important NFP stand out, but a look at the Federal Reserve and the Chinese economy is also of interest.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.