What's the role of tight labor markets on core inflation and overall inflation?

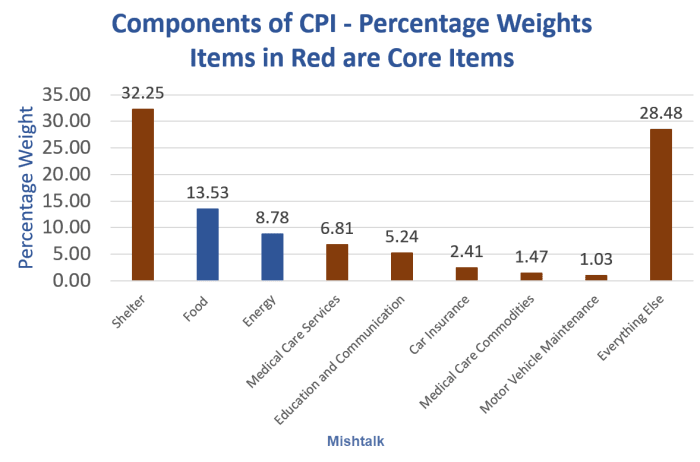

CPI components as of August 2022. Chart by Mish.

Core CPI is defined as everything but food and energy. Here's the set of claims I am investigating.

The claims

- Tight labor markets are keeping the core sticky.

- Well, the only lever the Fed can really pull to decrease core inflation is to try and reduce vacancies to ease wage cost pressure on core inflation.

- We only get back to 4% core inflation by 2024 under very optimistic assumptions where relationship between vacancies and unemployment reverts back to normal and expectations of future inflation don't drift higher.

- What this all means is that it will be hard for the Federal reserve to reduce sticky core inflation without causing a lot of unemployment pain.

Four questions

- Is point one accurate?

- Over what time frame?

- Is this even the right approach?

- What about inflation expectations?

I will start with question 4 because much flows from that.

And to understand the role of expectations, we need to distinguish between inelastic and elastic demand.

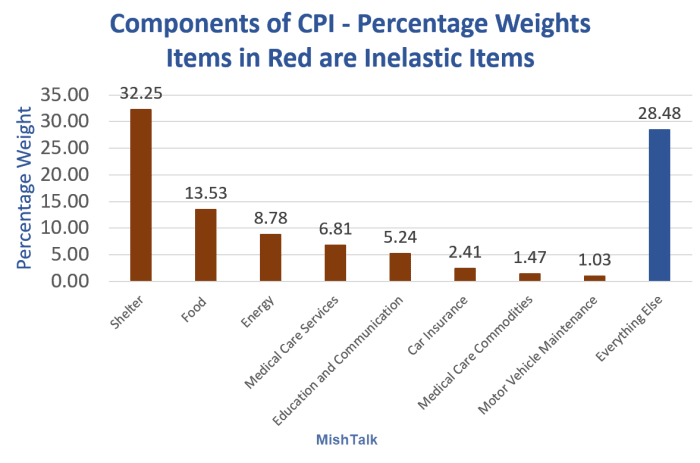

Components of CPI percentage weights inelastic

Inflation expectations silliness

Shelter, food, energy, medical care services, education expenses (think tuition and books), car insurance, medical care commodities, and motor vehicle maintenance are all extremely inelastic items.

One does not rent two houses if they think prices will soon rise, nor does one delay rent if they think the price of rent will drop.

The same applies to medical care, car insurance, motor vehicle maintenance and insurance.

People will not delay eating if they think the price of food will drop. Now will they eat double meals if they think prices will rise. The most they can do is buy a freezer and store limited quantities of things.

They will stop eating out, but they will not stop eating. They will buy inelastic items regardless of price, but they will not rush to have a heart surgery or rent a second apartment just because they expect prices will rise.

Partially inelastic items

Things in the "Everything Else" category are not entirely elastic. Car leases, legal services, funerals are examples. If you have kids and they outgrow their clothes, guess what? You buy clothes. And what happens if your refrigerator breaks?

Add it all up and at most 20 to 25 percent of spending is discretionary and perhaps as little as 10 to 15 percent.

100 percent discretional items include vacation travel, eating out, sporting goods, games, and optional clothing. The Fed will not reduce inflation by attacking those things.

This implies that the entire inflation expectations, one of the most widely believed economic theories, is economic nonsense.

Two Fed studies conclude the same thing (link and more discussion below).

CPI flaws

Not everyone has tuition expenses and some people do not drive.

Those on Medicare do not have medical care CPI issues. Those buying their own insurance will laugh at those ridiculously low percentage weights.

The BLS groups all of this together and comes up with a number as if it means something.

The percentage expenses of someone in college, someone retired on Medicare, and someone buying their own insurance are vastly different.

Given that housing is not in the CPI at all and the Fed does not count asset bubbles as inflation, it's no wonder the Fed has screwed up very badly.

Inflation matters, not just consumer inflation. This answers question 3. The approach by the Fed and economists is horribly misguided as is the 2 percent inflation target itself.

A BIS study concluded "Deflation may actually boost output. Lower prices increase real incomes and wealth. And they may also make export goods more competitive."

The exception was the Great Depression and that was an asset bubble.

Historical perspective on CPI deflations: How damaging are they?

For discussion and a link to the BIS study, please see Historical Perspective on CPI Deflations: How Damaging are They?

The, Fed hell bent on creating inflation, finally succeeded. They are not happy with the result.

Sticky core? Why?

Given that 75 percent or higher of the CPI is inelastic and given shelter is a whopping 32.25 percent in and of itself, the notion that tight labor markets are primarily keeping the core sticky is quite a stretch even if there is correlation in some time frames by happenstance.

Note that shelter's weighted percentage of the core CPI is (32.5 / (100 - 13.58 - 8.78) ) * 100 = 41.9 percent.

A tight labor market is not the driver of rent, medical items, insurance, food, or energy. The rise and fall of energy alone also factors into what's happening.

What about wage inflation?

I agree with Jacob Belk that the Fed can attack wage inflation by killing jobs.

But killing jobs is not a one-to-one relationship with a rise in unemployment.

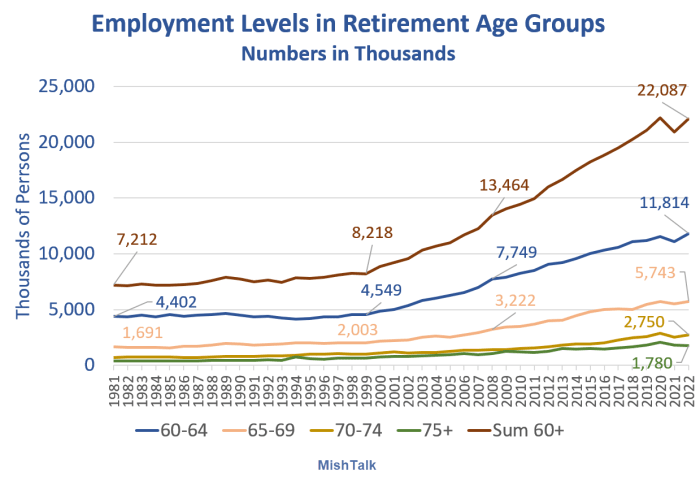

There are an unprecedented 22+ million boomers age 60 or over, many of which will retire.

"What this all means is that it will be hard for the Federal reserve to reduce sticky core inflation without causing a lot of unemployment pain," says Belk.

I am not at all convinced of that, but it's possible. Much depends on the definition of "a lot of unemployment pain."

My belief is this will be a very mild recession in terms of a rise in unemployment.

It's important to note the distinction between a drop in employment and a rise in unemployment.

What about Biden?

The Biden administration certainly isn't helping overall inflation matters by free money giveaways in the form of student loan forgiveness, and its inflationary clean energy policies.

Biden has also kept in place Trump's tariffs on China, is heavily promoting unions, and is accelerating de-globalization, all of which are inflationary.

With that, we can properly revise claim number 4 as follows: What this all means is that it will be hard for the Federal reserve to reduce inflation without a lot of demand destruction from killing the stock market (or some luck in Ukraine or a housing price collapse).

What about shelter?

Shelter at 32.5 percent will be particularly difficult, especially if Fed rate hikes slow construction of new rental units.

Since it's highly likely rising interest rates will result in delays or cancellations of housing units, some of the Fed's inflation-fighting measures are actually counterproductive.

If there are not enough rental units already in the pipeline, the Fed needs a housing price crash (not just the housing transaction crash now underway) to offset mortgage rates, now approaching 7 percent.

Inflation expectations are crashing. So what? It doesn't matter

Returning to an important construct, please consider Inflation Expectations are Crashing. So What? It Doesn't Matter.

I discuss two Fed studies that debunk the idea that inflation expectations matter. One of them presents these excellent quotes.

"It is far, far better and much safer to have a firm anchor in nonsense than to put out on the troubled seas of thought." John Kenneth Galbraith (1958).

"Few things are harder to put up with than the annoyance of a good example." Mark Twain, The Tragedy of Pudd’nhead Wilson (1894).

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.