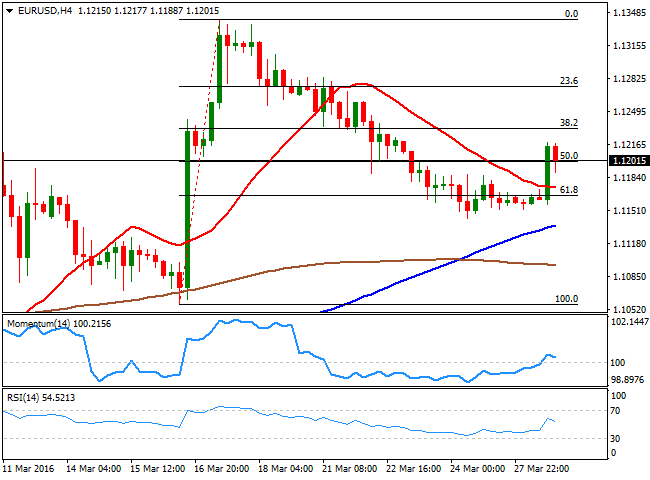

EUR/USD Current Price: 1.1201

View Live Chart for the EUR/USD

As markets returned to normal, the greenback got smashed by mixed personal income and spending figures released in the US, as data beat expectations for February, but January's numbers were revised negatively. The all-important PCE inflation number was a huge disappointment, with the headline reading monthly basis down by 0.1%, while the core number came in at 0.1% against previous 0.3%. Also, the Goods Trade Balance posted a larger-than-expected deficit, of $63.0B. Pending home sales on the other hand, rose 3.5% in February, against January's 3% loss.

This Tuesday, FED's Yellen is due to deliver a speech titled "Economic Outlook and Monetary Policy" at the Economic Club of New York luncheon, the first time she will speak after the latest FOMC meeting. Investors will be looking closely for any comment regarding rates and whether if she will maintain the dovish tone of the statement, of align with latest FED's speakers and offer a more hawkish wording.

In the meantime, the American dollar suffered a strong set back early in the US session, down against all of its major rivals. The EUR/USD pair reached a daily high of 1.1219 before retracing towards the 1.1200 level, easing as Wall Street trimmed most of its early losses ahead of the close. The recovery has been pretty significant considering that the price was unable to fall beyond the 61.8% retracement of its latest daily bullish run, but not enough to confirm a continued advance, given that in the 4 hours chart, the price is currently struggling around the 50% retracement of the same rally, whilst the technical indicators have lost their bullish potential after regaining positive territory. The upside however, is now favored as long as the 1.1160 support holds, with an upward acceleration expected on a break above 1.1245.

Support levels: 1.1160 1.1120 1.1085

Resistance levels: 1.1245 1.1290 1.1330

EUR/JPY Current price: 126.97

View Live Chart for the EUR/JPY

A weaker Japanese yen pushed the EUR/JPY pair higher at the beginning of the day, while poor US data helped it reach a daily high of 127.04. Investors sell the safe-haven currency on speculation that PM Abe will announce a fiscal stimulus plan and delay the increase of the sales tax, given latest inflation figures, well below the Central Bank´s 2.0% target. The short term picture for the EUR/JPY pair is positive, given that the price rallied above its 100 and 200 SMAs in the 1 hour chart, with the shortest having advanced above the largest at the beginning of the day, and currently around 126.05. However, the price remains below this March high at 127.28, the level to beat to present a more constructive outlook. In the 4 hours chart, the technical indicators have lost their upward strength, but hold within positive territory, while the 100 SMA has crossed above the 200 SMA below the current level for the first time since early February, indicating a limited downward potential at the time being.

Support levels: 126.65 126.05 125.40

Resistance levels: 127.30 128.80 129.40

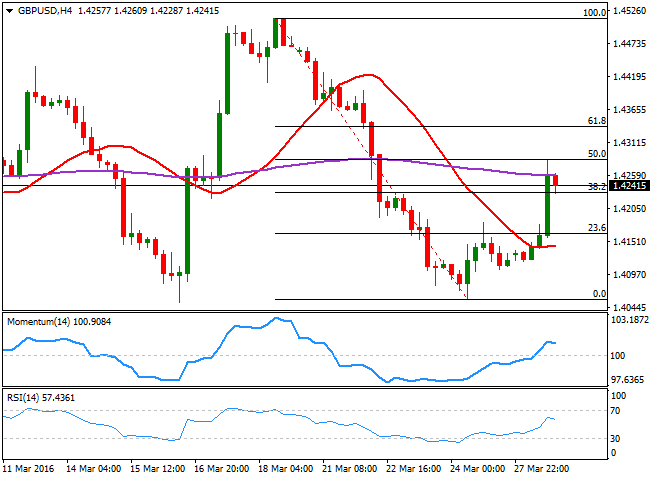

GBP/USD Current price: 1.4241

View Live Chart for the GBP/USD

The GBP/USD pair advanced up to 1.4282, the highest since last Tuesday, fueled by poor US data. The Sterling saw some limited demand at the beginning of the day, as most European and Asian markets were closed on holiday, but downbeat US PCE inflation boosted the advance up to the mentioned high. There were no macroeconomic releases in the UK, and the calendar will remain empty until the release of GDP figures on Thursday, which means that the pair will be largely driven by dollar's self strength/weakness. The upward potential is still quite limited, given that in the 4 hours chart, the pair met selling interest around its 200 EMA, whilst the technical indicators have lost their bullish strength after recovering above their mid-lines. Furthermore, the recovery stalled around the 50% retracement of its latest bearish run, and the price is currently resting above the 38.2% retracement of the same rally, at 1.4230, the immediate support. A break below this last, should the see pair returning to the lower band of the 1.4100 level, which will also increase the risk towards the downside, eyeing levels below the 1.4000 figure for later on this week.

Support levels: 1.4230 1.4190 1.4145

Resistance levels: 1.4285 1.4330 1.4370

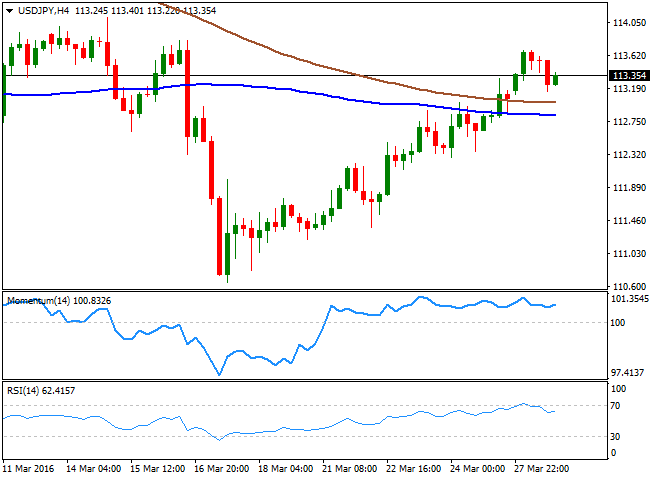

USD/JPY Current price: 113.35

View Live Chart for the USD/JPY

The USD/JPY pair advanced to 113.59, the highest in ten days, but with no actual follow through as tepid US macroeconomic releases stalled the early advance. The Japanese yen weakened as speculative interest is expecting PM Abe to announce some sort of fiscal stimulus and a delay in the planned tax hike, as soon as this Tuesday. Roughly 30 pips away from its Friday's close, the pair has been rising for seven days in-a-row, but it´s still worrisome the fact that the pair remains below 2015 lows, in spite of the negative deposit rate established by the BOJ late February. Technically, the 1 hour chart shows that the Momentum indicator has entered negative territory at the beginning of the US session, with the RSI is heading south around 51. In the same chart, the 100 and 200 SMAs remain below the current level, with the 100 SMA being the line in the sand at 112.30, as a decline below it should open doors for a steeper decline. In the 4 hours chart, however, the technical indicators lack directional conviction, but remain within positive territory. The pair has multiple intraday highs in the 113.70 region, which means only an acceleration beyond the level will favor additional gains up to the 114.45 price zone.

Support levels: 112.75 112.30 111.90

Resistance levels: 113.70 114.10 114.45

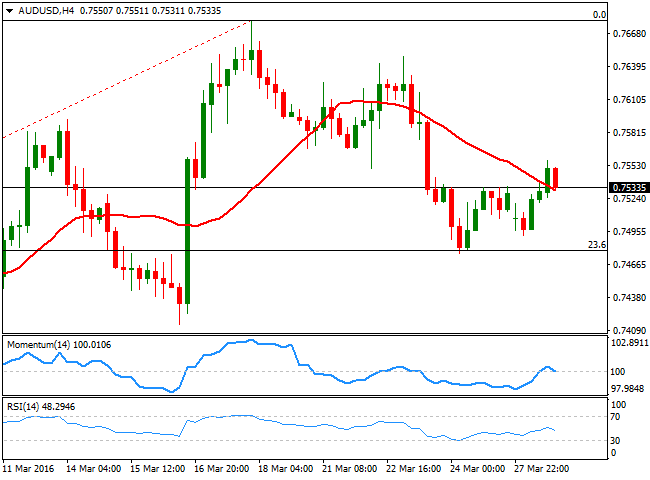

AUD/USD Current price: 0.7533

View Live Chart for the AUD/USD

The Australian dollar swung at the pace of commodities, ending the day higher against the greenback around 0.7535. The pair traded as high as 0.7557 early in the US session, but was unable to rally as improved US housing data put a halt to dollar's decline. The AUD/USD pair has tested the 23.6% retracement of the 0.6827/0.7679 run at 0.7475 hast Friday, as bulls are still defending the bullish trend. However, the pair is still far from recovering its bullish momentum, as in the daily chart, the price is struggling to recover above its 20 SMA, whilst the Momentum indicator keeps heading, now breaking below its 100 level. Shorter term, the 1 hour chart presents a neutral-to-bullish stance, as the price stands a few pips above a mild bullish 20 SMA, while the technical indicators head nowhere, right above their mid-lines. In the 4 hours chart, the technical indicators are hovering around their mid-lines, while the price is around a bearish 20 SMA, unable to rally beyond it, all of which indicates that buying interest is limited at current levels.

Support levels: 0.7510 0.7475 0.7440

Resistance levels: 0.7560 0.7605 0.7640

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains near 1.0300 after US PMI data

EUR/USD trades in positive territory at around 1.0300 on Friday. The pair breathes a sigh of relief as the US Dollar rally stalls, even as markets stay cautious amid geopolitical risks and Trump's tariff plans. US ISM PMI improved to 49.3 in December, beating expectations.

GBP/USD holds around 1.2400 as the mood improves

GBP/USD preserves its recovery momentum and trades around 1.2400 in the American session on Friday. A broad pullback in the US Dollar allows the pair to find some respite after losing over 1% on Thursday. A better mood limits US Dollar gains.

Gold retreats below $2,650 in quiet end to the week

Gold shed some ground on Friday after rising more than 1% on Thursday. The benchmark 10-year US Treasury bond yield trimmed pre-opening losses and stands at around 4.57%, undermining demand for the bright metal. Market players await next week's first-tier data.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.