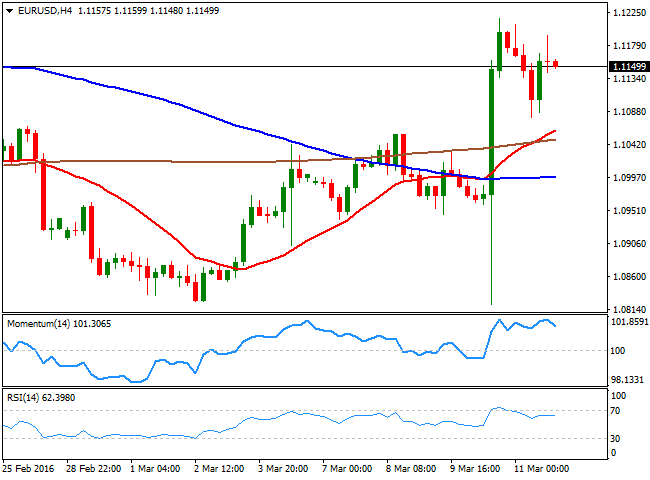

EUR/USD Current Price: 1.1149

View Live Chart for the EUR/USD

The American dollar closed the week broadly lower, as the ECB failed to weaken the common currency, and fueled the greenback's previous decline. The EUR rallied by the end of the week, after the market digested the announcement of a comprehensive package of easing measures by the European Central Bank, aimed to boost the local economy and inflation. The news however, backfired Draghi, as investors can't see how more of the same can change the economic future of the region. Now, attention shifts to the FED, as the US Central Bank will have its economic policy meeting this week, and overall, markets are expecting an on-hold stance, given the persistently low inflation and the economic deceleration that began by the end of 2015.

During the weekend, Chinese data showed that growth in the second world's largest economy slowed further at the beginning of 2016, as value-added industrial output in China rose 5.4% in the January-February period from a year earlier, slowing from previous 5.9%, which means the week may start with some risk aversion across the boards.

In the meantime, the technical picture for the EUR/USD pair shows that it has held on to gains, with a limited pullback on Friday, as buyers surged on dips. Nevertheless, and according to the daily chart, further rallies are not yet confirmed, as despite the price has recovered above its moving averages, the technical indicators have lost upward potential after crossing their mid-lines. The picture is quite similar in the 4 hours chart, in where the technical indicators are in retreat mode from overbought readings. At this point the pair needs to advance beyond 1.1240 to confirm a steadier upward movement, pointing tops to a test of 1.1460 should the FED hit the greenback.

Support levels: 1.1120 1.1080 1.1050

Resistance levels: 1.1160 1.1200 11240

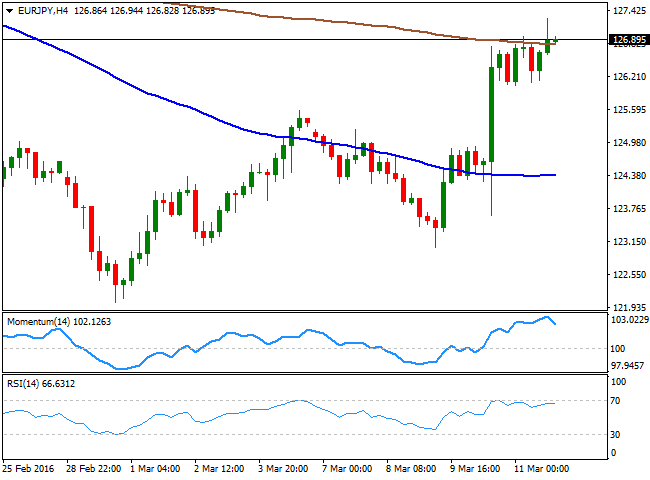

EUR/JPY Current price: 126.89

View Live Chart for the EUR/JPY

The EUR/JPY pair extended its rally further last Friday, and posted 127.28 its highest in nearly a month. The Japanese yen has lacked life of its own last week, depending mostly on market's sentiment and stocks to post limited moves against its majors rivals. The EUR/JPY has been persistently under pressure, and despite the latest bounce a long term trend change is still unconfirmed. Investors may resume JPY buying ahead of the end of the fiscal year in Japan, and on the back of increasing fears of a global slowdown. From a technical point of view, the daily chart shows that the latest advance has stalled well below a bearish 100 SMA, currently around 129.20, while the technical indicators have partially lost upward strength near overbought levels, all of which limits chances of a stronger advance. In the shorter term, and according to the 4 hours chart, the risk remains towards the upside, as despite the technical indicators are beginning to retreat from overbought levels, the price remains near its highs and pressuring the 200 SMA.

Support levels: 126.50 126.05 125.50

Resistance levels: 127.20 127.70 128.10

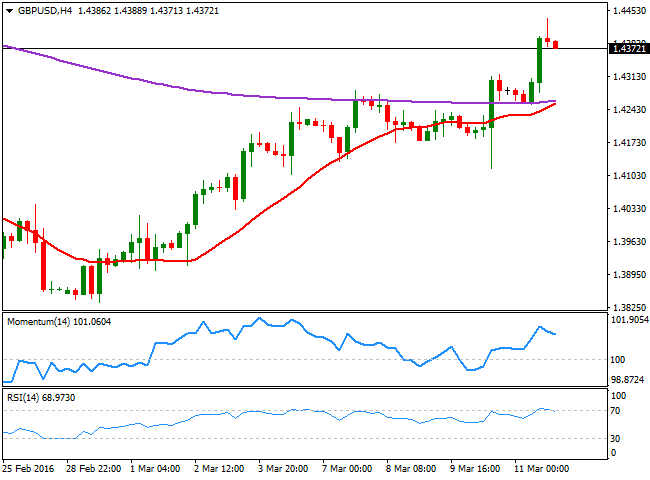

GBP/USD Current price: 1.4372

View Live Chart for the GBP/USD

The Pound extended its latest recovery against the greenback up to 1.4435, closing with solid gains for second week in-a-row at 1.4372. There was an absence of macro market-drivers for the Sterling during these last few days, with the rally mostly supported by dollar's broad weakness. On Friday however, data showed that the visible trade balance resulted roughly as expected, but significant downward revisions to December’s data meant that January showed an improvement in the deficit, against expectations of a deterioration. Also, the BOE released its quarterly inflation survey, showing that expectations have decreased in the year-ahead inflation, to 1.8% from previous 2.0%, the lowest level in 15 years. During this upcoming week, the UK will release its February employment figures, which may determinate if the ongoing recovery is sustainable, particularly on a build-up in employment and wages. In the meantime, the daily chart shows that the strong upward momentum prevails, as the technical indicators continue heading north near overbought territory, while a decline towards the 20 SMA resulted in a sharp bounce. In the 4 hours chart, the price has extended its advance beyond the 200 EMA, currently around 1.4260, while the technical indicators eased partially from overbought readings. Pullbacks towards the level can be seen as buying opportunities, with only a break below the mentioned 1.4260 level signaling a possible return of the bearish trend.

Support levels: 1.4335 1.4295 1.4260

Resistance levels: 1.4410 1.4445 1.4490

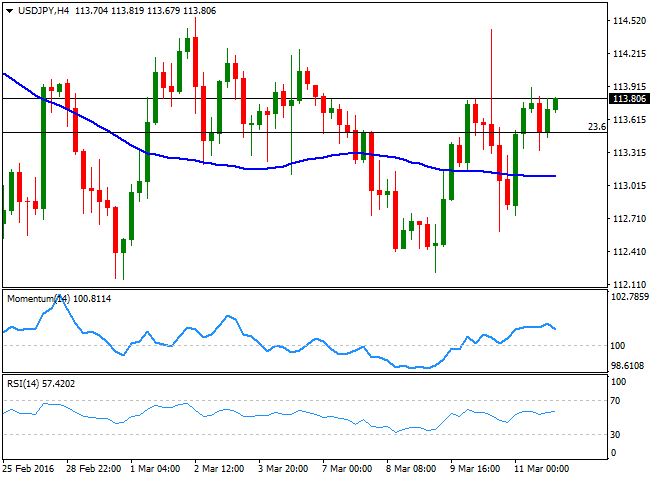

USD/JPY Current price: 113.80

View Live Chart for the USD/JPY

The USD/JPY pair closed the week with a doji, having traded for second week in-a-row within a well-limited range between 112.10 and 114.60. The pair was unable to move in spite of stock's volatility, with investors side-lined ahead of the upcoming BOJ's meeting this week. The Japanese Central Bank is largely expected to remain on-hold, on wait-and-see mode to asses further the effects of negative rates. Nevertheless, the market has had enough surprises from central bankers to remain wary. The bearish trend that ruled the pair for most of this past February has turned into a consolidative stage, and the technical stance is now neutral, until one of the mentioned extremes gives up. Technically, the daily chart shows that the pair continued hovering around the 113.50 region, presenting now a limited upward potential as the Momentum indicator heads north above its 100 level, but with the price developing well below its moving averages, and the 38.2% retracement of its latest decline at 115.05, a breakout point. Shorter term, technical readings in the 4 hours chart are neutral, with the price midway between the 100 and 200 SMAs, and the technical indicators lacking directional strength, within positive territory.

Support levels: 113.50 113.10 112.70

Resistance levels: 114.00 114.60 115.05

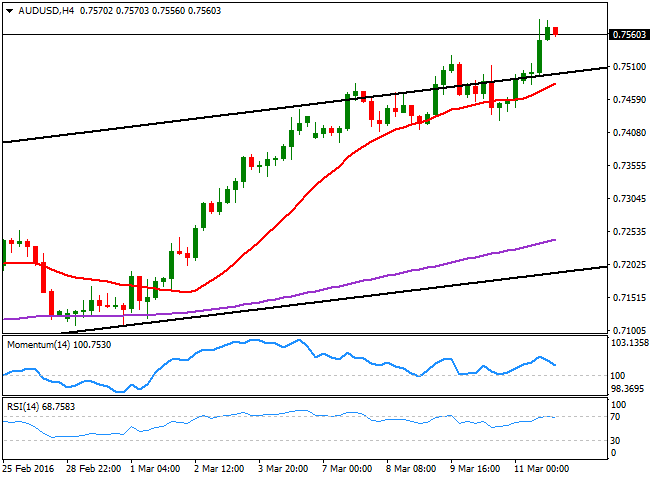

AUD/USD Current price: 0.7514

View Live Chart for the AUD/USD

The AUD/USD pair ended the week at 0.7560, its highest since June 2015. The dollar-bloc currencies were underpinned by rising commodities and stocks last week, with the Aussie being the overall winner given its own strength. The economic situation has continued to improve in Australia during the first months of the year, resulting in an over 700 pips rally in the pair. And the technical picture suggests that further gains are still on the table, as in the daily chart, the technical indicators have resumed their advances within overbought level, as the 20 SMA advances through the 200 EMA well below the current level. In the 4 hours chart, the price remains well above a bullish 20 SMA and near the intraday high set at 0.7582, neutralizing the bearish slopes present in technical indicators, which retreated from overbought levels, but remain above their mid-lines. The pair can see a limited downward movement at the beginning of the week, dragged lower by poor Chinese macroeconomic data released over the weekend, but buyers will likely surge on dips towards the 0.7500 figure.

Support levels: 0.7545 0.7500 0.7465

Resistance levels: 0.7580 0.7630 0.7665

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD remains pressured below 1.0800 on renewed USD strength

EUR/USD stays under pressure and declines toward 1.0750 following Thursday's recovery. A renewed US Dollar uptick and a cautious mood weigh on the pair, as traders digest the Trump win and the Federal Reserve's monetary policy announcements.

GBP/USD holds lower ground near 1.2950 amid tepid risk sentiment

GBP/USD trades in negative territory at around 1.2950 in the second half of the day on Friday. The emergence of dip-buying in the US Dollar and a tepid risk tone undermine the pair. The BoE’s cautious rate cut could check the pair's downside as traders comments from central bankers.

Gold fluctuates below $2,700 amid stronger USD, positive risk tone

Gold trades below $2,700 in the early American session on Friday and is pressured by a combination of factors. Hopes that Trump's policies would spur economic growth and inflation, to a larger extent, overshadow the Fed's dovish outlook, which, in turn, helps revive the USD demand.

Week ahead – US CPI to shift market focus back to data after Trump shock

After Trump comeback, normality to return to markets with US CPI. GDP data from UK and Japan to also be important. But volatility to likely persist as markets assess impact of Trump.

October’s US CPI rates to be the next big test for the greenback

With the US elections being over, Trump getting elected and the Fed having released its interest rate decision, we take a look at what next week has in store for the markets. On the monetary front a number of policymakers from various central banks are scheduled to speak at some point or the other.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.