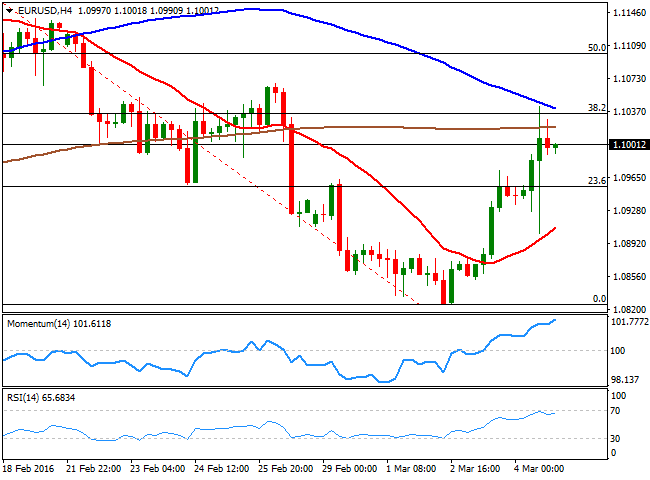

EUR/USD Current Price: 1.1001

View Live Chart for the EUR/USD

Markets were quiet heading into US Payrolls, in which a solid monthly job´s gain was not enough to support a dollar's rally. The headline reading printed 214K far above the 195K consensus, while the January number was revised up to 172K from 151K, but hourly earnings fell by 0.1%, the first decline since December 2014, dragging the year-on-year pace to 2.2% from previous 2.5%. The American currency initially rallied, but quickly turned negative, and the EUR/USD pair closed the week above 1.1000, as poor salaries have been taken by the market as a null chance of a US rate hike next June.

The common currency's rally was limited ahead of the ECB's upcoming economic policy decision his Thursday. With the EU inflation in negative territory, the Central Bank is almost forced to act, as inaction seems not an option. Expectations are of a 10-15bp cut in the deposit rate, but Draghi can be ready to surprise again, with a more dramatic announcement.

Technically, the pair retreated on Friday from a daily high of 1.1042, a couple of pips above the 38.2% retracement of the decline between 1.1375 and 1.0862, also a major static resistance region. Despite the weekly recovery, the price was unable to regain ground above the 200 DMA, around 1.1020, and the most likely scenario is that the pair will remain range bound ahead of the ECB, although the general technical picture favors the upside, as in the daily chart, the price is well above the 100 SMA, whilst the technical indicators have extended their advances further within bearish territory. In the shorter term, the 4 hours chart shows that the price has bounced sharply from a mild bullish 20 SMA, while the technical indicators have resumed their advances near overbought levels. Nevertheless, a strong continuation through the 1.1050 region is required to confirm further gains, up to 1.1120 this Monday.

Support levels: 1.0980 1.0950 1.0920

Resistance levels: 1.1050 1.1090 1.1120

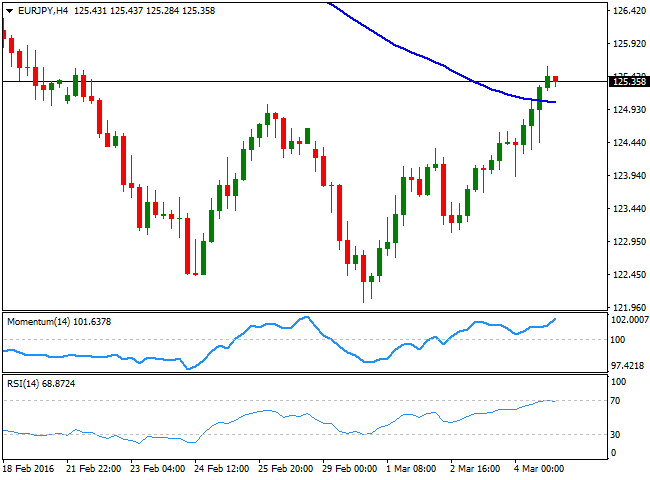

EUR/JPY Current price: 125.35

View Live Chart for the EUR/JPY

The EUR/JPY pair closed the week with gains at 125.35, having erased all of the previous week losses, but still trading with a heavy tone and below the 126.00 level, in where the pair bottomed in 2015. The Japanese yen maintained a neutral stance against the greenback, unable to rally as risk aversion eased somehow on new Chinese easing measures, which means the advance was mostly led by EUR gains and therefore, further gains will depend on whatever the ECB decides this Thursday. From a technical point of view, the daily chart shows that the technical indicators maintain their bullish tone within bearish territory, coming from extreme oversold readings and far below the 100 SMA, currently around 129.70, all of which suggests the recovery has been long-term corrective. In the 4 hours chart, the price stands a few pips above the 100 SMA, and the Momentum indicator heads north above its 100 line, but the RSI indicator is beginning to retreat from overbought levels, which can limit the upside and suggest further slides, particularly if the pair losses the 125.00 level.

Support levels: 124.90 124.40 124.00

Resistance levels: 125.60 126.00 126.55

GBP/USD Current price: 1.4222

View Live Chart for the GBP/USD

The British Pound advanced against the greenback for the past five days, surging up to 1.4247 on Friday, and closing the week a handful of pips below the level. Markets seem to have already digested the possibility of a Brexit, and most experts agree that, despite being unknown territory, it will be negatively in economic terms for the UK. Nevertheless, speculative selling was quite overdone after the GBP/USD fell to the 1.3800 region, its lowest in almost six years. This latest recovery, was supported by a mixture of improvement market sentiment and profit taking, and the pair has reached a major static support at this 1.4250 price zone, in which further advances will likely see bulls keeping into the driver's seat. From a technical point of view, the daily chart shows that the price has recovered above a still bearish 20 SMA, for the first time since mid February, and that the technical indicators have lost upward strength right below their mid-lines, suggesting some consolidation/short term downward correction for this Monday. In the 4 hours chart, the price is still below the 200 EMA, while the technical indicators have lost upward strength near overbought territory, in line with a limited downward corrective move.

Support levels: 1.4185 1.4140 1.4100

Resistance levels: 1.4250 1.4290 1.4330

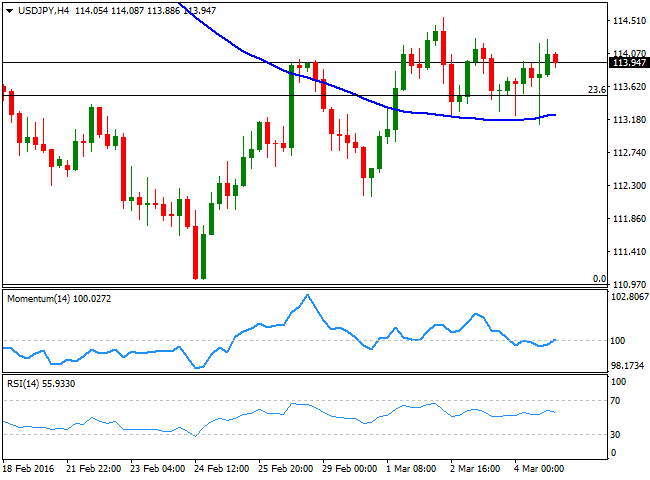

USD/JPY Current price: 113.94

View Live Chart for the USD/JPY

The USD/JPY pair posted some limited gains during the past week, but retains the long term bearish dominant bias. The Japanese Yen held ground as risk aversion sentiment eased after China cut its reverse requirement ratio by 0.5% points at the beginning of the week. But the world's second largest economy could well be the reason risk aversion trading resumes this week, as the country cut its 2016 growth forecast during the weekend, to a range of 6.5% to 7%, down from the previous 7%. BOJ's Governor Kuroda is due to speak at the Yomiuri International Economic Society, in Tokyo at the beginning of the week, and any clue on upcoming measures would affect the currency. From a technical perspective, the daily chart shows that the price has managed to hold above the 23.6% retracement of the latest slump around 113.50, the immediate support, but that the price remains far below its moving averages, while the technical indicators are turning slightly lower below their mid-lines, all of which should keep the upside limited. In the 4 hours chart, the pair presents a neutral stance, as the technical indicators are hovering around their mid-lines, with no certain directional strength. The key resistance is the 115.05 level, the 38.2% retracement of the latest daily decline and the neckline of the double floor established around 111.00. It will take a clear recovery above it to see bears give up and indicate some further mid-term gains.

Support levels: 113.50 113.10 112.70

Resistance levels: 114.25 114.60 115.05

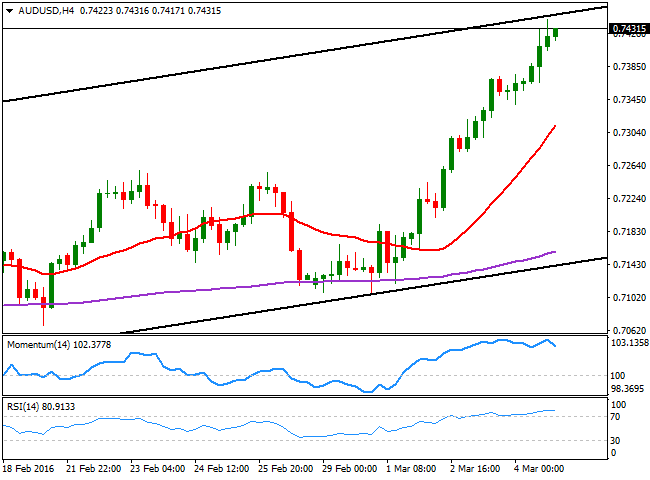

AUD/USD Current price: 0.7431

View Live Chart for the AUD/USD

Strong data coming from Australia helped the AUD/USD pair close the week above the 0.7400 level for the first time since August 2015, with the commodity-related currency also supported by stronger oil and gold and poor US data. Australian inflation and GDP readings beat expectations, indicating a healthy economy in a world concerned over the economic slowdown. On Friday', Australian Retail Sales rose 0.3% in January, slightly below market's expectations, but unable to dent the ongoing strength of the currency. The main risk this week will come from China, as further signs of weakness in the country may affect Aussie. Technically, the pair stands a few pips below the roof of the ascendant channel which has led the way since early January, around 0.7450 for this Monday, and the daily chart shows that the technical indicators have partially lost their upward strength near overbought territory, but are far from suggesting the bullish run is over. In the 4 hours chart, the RSI indicator maintains its bullish slope around 80, the Momentum indicator has turned slightly lower in overbought levels and the price stands far above a sharply bullish 20 SMA, all of which suggests that the pair can extend its rally after a limited downward corrective move.

Support levels: 0.7415 0.7375 0.7330

Resistance levels: 0.7450 0.7490 0.7530

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains near 1.0300 after US PMI data

EUR/USD trades in positive territory at around 1.0300 on Friday. The pair breathes a sigh of relief as the US Dollar rally stalls, even as markets stay cautious amid geopolitical risks and Trump's tariff plans. US ISM PMI improved to 49.3 in December, beating expectations.

GBP/USD holds around 1.2400 as the mood improves

GBP/USD preserves its recovery momentum and trades around 1.2400 in the American session on Friday. A broad pullback in the US Dollar allows the pair to find some respite after losing over 1% on Thursday. A better mood limits US Dollar gains.

Gold retreats below $2,650 in quiet end to the week

Gold shed some ground on Friday after rising more than 1% on Thursday. The benchmark 10-year US Treasury bond yield trimmed pre-opening losses and stands at around 4.57%, undermining demand for the bright metal. Market players await next week's first-tier data.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.