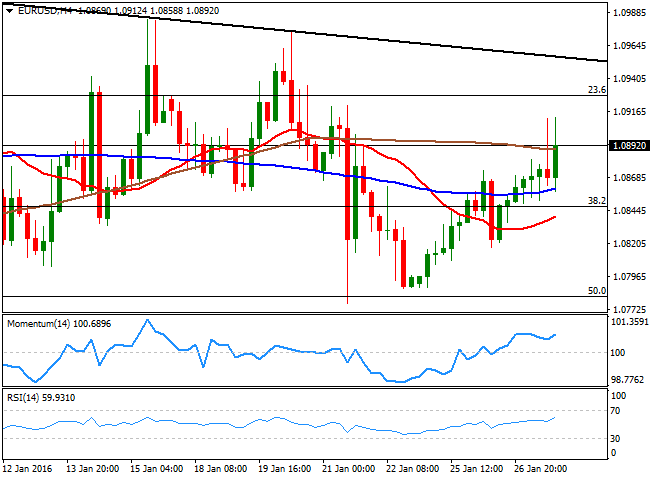

EUR/USD Current Price: 1.0898

View Live Chart for the EUR/USD

As largely expected, the US Federal Reserve kept rates unchanged, but acknowledged rising headwinds, as they say that are closely monitoring global economic and financial developments. They also added that the jobs market improved further even as economy slowed late 2015, while the economy is expected to warrant only gradual rate rises. Overall, dovish, but pretty much what the market was waiting for, resulting in a limited dollar's slide.

Earlier today, German GFK consumer confidence beat expectations for February, printing 9.4 against the 9.3 expected, and matching previous month reading. In the US, new home sales beat estimates with a 10.8% December registering a seasonally adjusted annual rate of 544,000 units, inventories popped 2.6% in December to a six-year high, while the median price fell 2.7% to leave a 4.3% y/y drop.

The EUR/USD pair traded as high as 1.0911 during the European morning, but faded half of its intraday gains as crude oil surged. Following FED's dovish announcement, the commodity retreated, helping the EUR/USD pair extend up to 1.0912, but was steadily rejected from spikes beyond the 1.0900 figure. The short term picture is bullish, given that in the 1 hour chart, the price holds above its moving averages whilst the technical indicators present strong upward slopes in positive territory. In the 4 hours chart, the upside is also favored, with the price above its moving averages and the technical indicators gaining upward strength well above their mid-lines. Selling interest however, has contained rallies between 1.0920 and 1.0960 ever since the year started, meaning that the pair needs to steadily advance beyond it to offer a more constructive outlook.

Support levels: 1.0845 1.0810 1.0770

Resistance levels: 1.0925 1.0960 1.1000

EUR/JPY Current price: 129.43

View Live Chart for the EUR/JPY

The EUR/JPY pair finally broke higher, rallying above the 129.00 level as the EUR strengthened at a faster pace than the Japanese yen following the US FED decision. The pair holds near its daily high of 129.47 by the end of the US session, presenting a strong upward tone in the short term, as the 1 hour chart shows that the price is now well above its 100 and 200 SMAs, with the shortest now above the larger, and that the technical indicators head strongly higher within overbought territory. In the 4 hours chart, the technical bias is also bullish, as the technical indicators head north above their mid-lines, in line with additional gains on a break above 129.60 the immediate resistance.

Support levels: 129.10 128.50 128.00

Resistance levels: 129.60 130.00 130.45

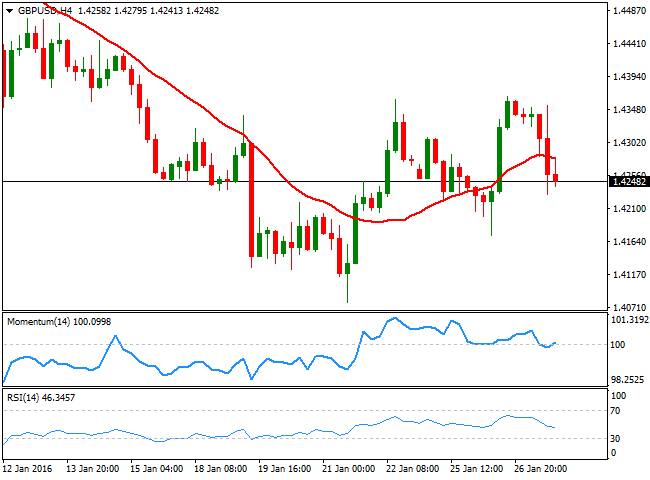

GBP/USD Current price: 1.4248

View Live Chart for the GBP/USD

The British Pound remained immune to the improved market mood during the first half of the day, and also mild dollar's weakness triggered by the FED. In fact, the pair remained under pressure and approached its daily low of 1.4229 right after the announcement, and remains within 20 pips of the mentioned low as the day ends. There are many different reasons for the ongoing Pound weakness, which include soft local data, and the referendum over a Brexit looming. What comes as a surprise these days, is that the currency can't advance, even with oil's prices recovering. Technically, the 1 hour chart presents a strong bearish momentum, as the technical indicators head sharply lower, near oversold territory, while the 20 SMA has turned south well above the current level. In the 4 hours chart, the price is being capped by its 20 SMA, now around 1.4280, while the Momentum indicator hovers in neutral territory and the RSI indicator heads south around 46, maintaining the risk towards the downside.

Support levels: 1.4220 1.4170 1.4130

Resistance levels: 1.4280 1.4315 1.4360

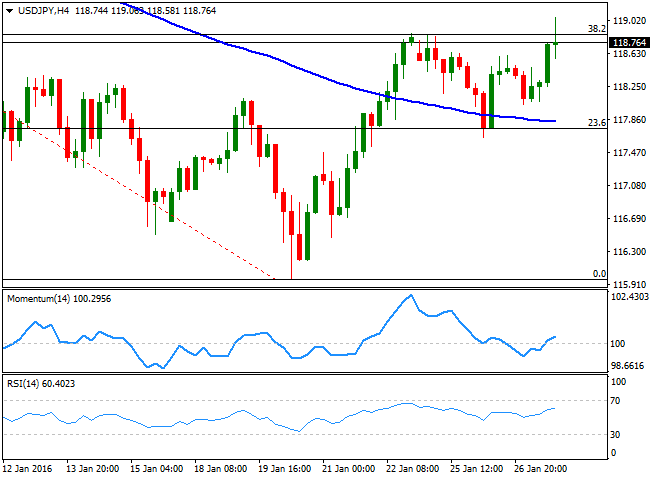

USD/JPY Current price: 118.34

View Live Chart for the USD/JPY

The USD/JPY pair rallied up to 109.06, but failed to sustain gains beyond the key Fibonacci resistance at 118.90 that limited rallies also last week. The pair advanced alongside with stocks and crude, retreating as the FED offered a bearish stance. The pair could remain limited ahead of the upcoming BOJ's meeting next Friday, as the Central Bank is expected to announce some additional stimulus, or at least put them on the table for the forthcoming meetings. Technically, the 1 hour chart shows that the price remains above its moving averages, with the 100 SMA currently around 118.30, but also that the technical indicators have turned sharply lower from overbought readings, suggesting some further short term slides. In the 4 hours chart, the technical indicators have managed to advance above their mid-lines, but lost upward strength, in line with the shorter term outlook.

Support levels: 118.30 117.90 117.40

Resistance levels: 118.90 119.35 119.70

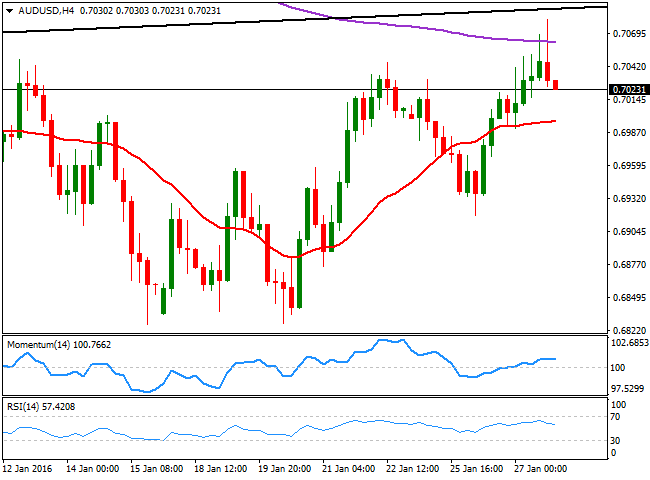

AUD/USD Current price: 0.7021

View Live Chart for the AUD/USD

The Australian dollar reached a fresh 3-week high of 0.7081 against its American rival, underpinned by a pickup in Australian inflation. The consumer price index printed at 1.7%y/y in the fourth quarter, beating estimates of 1.6% and previous reading of 1.5%, while the trimmed mean inflation measure came in line with median forecast and remained stable at 2.1%y/y. Good news ahead of the upcoming RBA economic policy meeting next week, as it gives the Central Bank room to maneuver. The pair approached the 0.7100, ahead of the FOMC decision, helped also by the strong recovery in oil's prices, but lost steam and turned south, particularly after the RBNZ decide to leave rates unchanged at 2.5%, weighing on the Aussie, The 1 hour chart shows that the technical indicators have accelerated their declines below their mid-lines, while the price stands below a bearish 20 SMA. In the 4 hours chart, the price is above a now horizontal 20 SMA around the 0.7000 figure, while the Momentum indicator remains flat above its 100 level, and that the RSI indicator heads slightly lower, but above 50, limiting the downside as long as the price holds above the 07000 level.

Support levels: 0.7000 0.6960 0.6920

Resistance levels: 0.7040 0.7085 0.7110

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD rises back above 0.6500 after hawkish RBA Bullock's comments

AUD/USD edges higher to regain 0.6500 in Asian trading on Friday. The pair capitalizes on upbeat Australian Private Capex data for October and hawkish comments from RBA Governor Bullock. A broadly muted US Dollar also aids the Aussie's uptick amid light trading.

USD/JPY extends sell-off to near 150.00 after hot Tokyo CPI

USD/JPY extends sell-off to test 150.00 in Friday's Asian session following the release of hotter-than-expected November inflation figures from Tokyo, Japan’s capital. The data strengthens the case for another BoJ rate hike in December, sending the Japanese Yen through the roof.

Gold recovery faces healthy resistance; will buyers succeed?

Gold price extends its gradual recovery mode and tests the critical $2,670 resistance early Friday, having hit a weekly low of $2,605 on Tuesday. A broadly subdued US Dollar (USD) performance alongside the US Treasury bond yields lend support to the Gold price upswing.

ASI's FET rallies following earn-and-burn mechanism launch

The Artificial Superintelligence Alliance (FET) saw double-digit gains on Thursday after it announced plans to burn up to 100 million tokens as part of its Earn-and-Burn mechanism, set to begin in December.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.