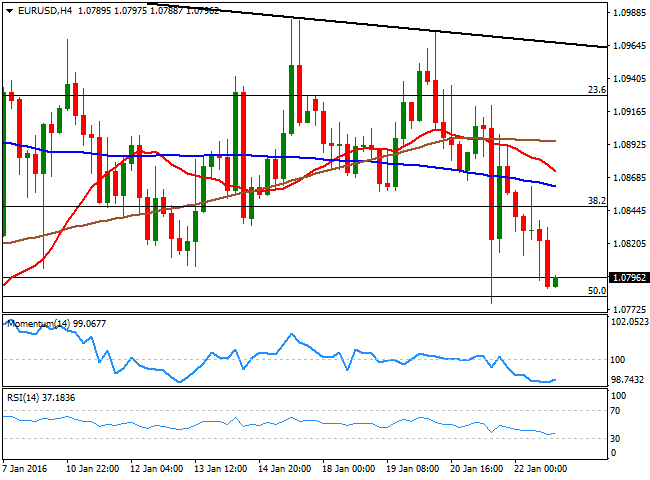

EUR/USD Current Price: 1.0796

View Live Chart for the EUR/USD

Market's reversed course on Friday, as crude oil prices recovered sharply from sub $30.00 a barrel, the lowest in 12 years, to close the week above $32.00 after flirting with $26.00 a barrel earlier in the week. The movement came one day after the ECB's announced is willing to add more stimulus in the Euro area, and that they will review their economic policy as soon as next March. The American dollar surged against most of its rivals, helped also by a better-than-expected January prelim manufacturing PMI, up to 52.7 from a previous 51.2. In Europe, on the other hand, Markit prelim manufacturing and services PMI missed expectations.

The EUR/USD pair ended the week right below the 1.0800 level, presenting a bearish tone at the beginning of a new week, as in the daily chart, the price has broken below its 20 SMA by the end of the week, and extended below it, while the technical indicators have turned south, but still within neutral territory, while so far, the pair has hold above the weekly low and 50% retracement of the latest bullish run at 1.0780, the level to break to confirm further declines. In the 4 hours chart, the technical indicators have lost bearish potential near oversold territory, whilst the moving averages remain all together, but above the current price. Should the decline accelerate this Monday, the decline may later extend down to the 1.0710 region, the 61.8% retracement of the same rally and the lowest in over a month.

Support levels: 1.0780 1.0745 1.0710

Resistance levels: 1.0845 1.0890 1.0925

EUR/JPY Current price: 128.29

View Live Chart for the EUR/JPY

The EUR/JPY pair surged on Friday, as market's renewed optimism weakened the Japanese currency. The promise made by Mario Draghi on additional easing, and the recovery in oil's prices amid hopes over surging demand in the US given the hard winter, has pushed to the background risk aversion, leading to a rally in stocks and pressuring safe havens. The EUR/JPY pair, however, closed a second week in-a-row barely changed, a handful of pips above the weekly opening. Technically, the daily chart shows that the price is nearing the top of its recent range around 128.50, the immediate resistance, whilst the price continued developing well below its moving averages. In the same chart, the Momentum indicator has lost its upward strength right after crossing above its 100 level, while the RSI hovers around 41, all of which limits chances of further gains. In the 4 hours chart, the price is struggling around a sharply bearish 100 SMA, the Momentum indicator aims higher well above its mid-line, while the RSI indicator also advances, currently around 57, supporting some further short term gains on an upward acceleration above the mentioned resistance.

Support levels: 128.00 127.60 127.25

Resistance levels: 128.50 128.90 129.40

GBP/USD Current price: 1.4277

View Live Chart for the GBP/USD

The British Pound advanced towards a weekly high of 1.4361 during the last trading day of the week, underpinned by an improved market's mood, and in spite of poor Retail Sales figure in the UK, as December figures showed that, monthly basis, sales decreased by 1.0%. Compared to a year before, retail sales increased by 2.6%, well below the 4.3% expected. Nevertheless, and as usual ever since the year started, majors were led by sentiment. The advance took place during the first half of the day, with the rally fading over 100 pips in the American afternoon, as selling interest reappeared on the spike. Technically, the daily chart shows that the technical indicators have turned north, but remain within oversold territory, while the 20 SMA heads sharply lower well above the current level, around 1.4480, suggesting the ongoing advance is corrective and without confirming the pair has already bottomed. In the shorter term and according to the 4 hours chart, the price is now above a horizontal 20 SMA, around 1.4200, while the technical indicators have turned south from near overbought territory, heading now south above their mid-lines. If the price breaks below 1.4250, the risk will likely turn back south, with further declines below 1.4200 anticipating another test of the 1.4000 region.

Support levels: 1.4250 1.4200 1.4160

Resistance levels: 1.4315 1.4360 1.4400

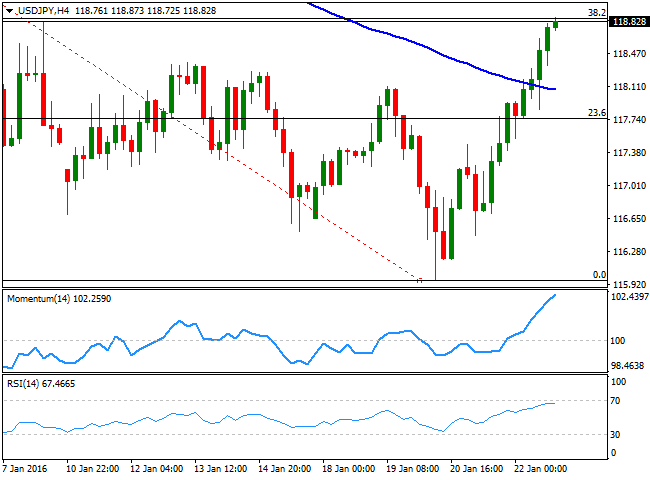

USD/JPY Current price: 118.82

View Live Chart for the USD/JPY

The American dollar advanced against its Japanese rival, reaching a fresh 2-week high of 118.87, and closing the week around this last. The USD/JPY pair tracked stocks in their way higher, although the rally stalled right at the 38.2% retracement of the decline between 123.54, December 18th high, and the low posted at 115.96 earlier last week. During the weekend, BOJ's Governor Kuroda said that he would analyze various factors, including the effect of global market turbulence on Japan's inflation expectations, in deciding whether additional monetary easing is necessary. Nothing actually new, although enough to fuel speculation of additional stimulus during the upcoming months. The daily chart shows that the technical indicators are pointing to cross their mid-lines towards the upside with a strong upward momentum, although the 100 DMA hovers around 120.70, supporting some further gains, but not yet confirming a long term bullish trend. In the 4 hours chart, the technical indicators retain their upward strength in overbought territory, while the price has extended above the 100 SMA for the first time since mid December, supporting a continued advance on a clear recovery beyond 119.00.

Support levels: 118.40 117.90 117.50

Resistance levels: 119.00 119.35 119.70

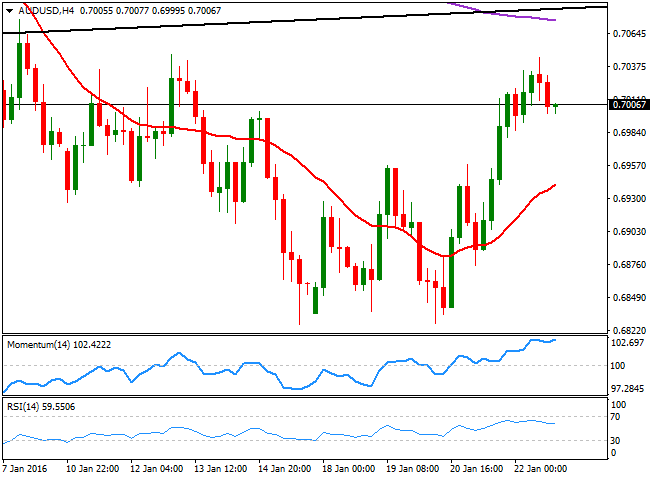

AUD/USD Current price: 0.7006

View Live Chart for the AUD/USD

Commodity-related currencies soared on the back of oil's recovery, with the AUD/USD pair reaching 0.7045 before retreating some, ending the week at 0.7006, a handful of pips down. Following a 5-day in-a-row advance, the daily chart shows that the pair ended the week with a doji, unable to advance beyond a sharply bearish 20 SMA. In the same chart, the Momentum indicator maintains its bullish slope, but below its 100 level, while the RSI lost upward strength and turned flat around 46, suggesting the upward corrective movement is already complete and that the pair may now resume its bearish trend. In the 4 hours chart, the technical indicators consolidate in overbought territory, while the 20 SMA heads strongly higher below the current level. In this last time frame, the 200 EMA heads lower around 0.7085, being the level to beat to confirm a more constructive outlook for this week.

Support levels: 0.6960 0.6920 0.6870

Resistance levels: 0.7040 0.7075 0.7110

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds on to intraday gains after upbeat US data

EUR/USD remains in positive ground on Friday, as profit-taking hit the US Dollar ahead of the weekend. Still, Powell's hawkish shift and upbeat United States data keeps the Greenback on the bullish path.

GBP/USD pressured near weekly lows

GBP/USD failed to retain UK data-inspired gains and trades near its weekly low of 1.2629 heading into the weekend. The US Dollar resumes its advance after correcting extreme overbought conditions against major rivals.

Gold stabilizes after bouncing off 100-day moving average

Gold trades little changed on Friday, holding steady in the $2,560s after making a slight recovery from the two-month lows reached on the previous day. A stronger US Dollar continues to put pressure on Gold since it is mainly priced and traded in the US currency.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.