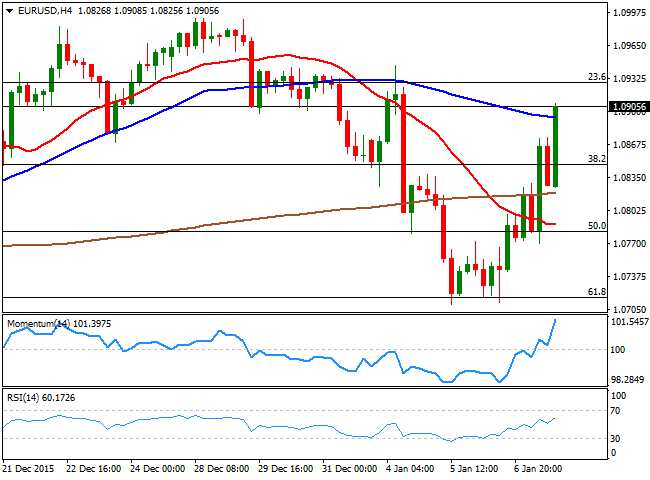

EUR/USD Current price: 1.0899

View Live Chart for the EUR/USD

The EUR/USD pair closed with gains, and near its daily high set above the 1.0900 figure, helped by a run towards safety triggered by China. Chinese stocks led the way, as the Shanghai Composite plummeted over 7% during the first hour of trading, leading to a second early close in the week. The decline dragged worldwide stocks lower, although they recover some ground by the end of London's session after Beijing announced it will suspend the rule that pauses trading after a 5% decline and suspends it after a 7% decline, as its seems it's only good to fuel the sell-off in equities these days. European data was mixed, as the EU´s economic sentiment indicator unexpectedly rose to 106.8 in December from 106.1 in November, significantly better than consensus, but Retail Sales for the same month disappointed, falling for a second month in-a-row. In the US, initial jobless claims dropped to 277K, better than previous, in line with the rising trend born early December, slightly disappointing reading ahead of the US Nonfarm Payroll report to be release early Friday.

The technical picture has turned bullish short term, as in the 1 hour chart, the intraday declines had found buyers around a bullish 20 SMA, while the technical indicators are turning back higher after correcting overbought readings reached earlier in the day. Nevertheless, the pair is still unable to advance beyond the 200 SMA, the immediate resistance around 1.0880. In the 4 hours chart, the technical indicators present a clear upward momentum within positive territory, whilst the price has extended above a bearish 20 SMA. Also, the price is above the 38.2% retracement of the December advance at 1.0845, the level to break to reverse the ongoing upward tone.

Support levels: 1.0845 1.0800 1.0750

Resistance levels: 1.0925 1.0960 1.1000

EUR/JPY Current price: 128.04

View Live Chart for the EUR/JPY

The EUR/JPY pair reversed its early slide and closed in the green above the 128.00 level, after reaching a lower low for the week at 126.77, as the Japanese yen appreciated during the first half of the day, but the EUR stood victorious during the second half of the journey. The pair presents extreme oversold conditions in the daily chart, where the technical indicators seem to be ready to turn higher, supporting at least an upward corrective movement for this Friday. Shorter term, the 1 hour chart shows that the 100 SMA has extended its decline further above the current level, now providing an immediate resistance around 128.65. In the same chart, the Momentum indicator heads higher above the 100 level, while the RSI indicator is now flat around 59, in line with further advances. In the 4 hours chart, the RSI indicator has begun correcting its extreme oversold readings and heads higher around 42 while the Momentum indicator is crossing its mid-line towards the upside, supporting the shorter term perspective.

Support levels: 127.50 127.15 126.60

Resistance levels: 128.20 128.65 129.10

GBP/USD Current price: 1.4606

View Live Chart for the GBP/USD

The British Pound fell to 1.4532, its lowest since June 2010 against the greenback, before finally bouncing some to close the day around the 1.4600 level, erasing most of its intraday gains. Down for a seventh day in a row, data coming from the UK showed that house prices in the three months to December were 1.6% higher than in the previous three months, according to Halifax, well above the 0.3% increase expected. Positive at a first glance, the undertone of the news is negative, as its implies fewer chances of a rate hike over time, as it signals a possible housing bubble. Anyway, in not about housing data, but the Brexit referendum looming the main reason beyond the latest Pound decline. The pair may now advance further on correction, although is not yet confirmed short term, as in the 1 hour chart, the price is struggling around a bearish 20 SMA, while the technical indicators head higher, but are still below their mid-lines. In the 4 hours chart, the technical indicators are heading higher after bouncing in extreme oversold levels, while the price is still below a bearish 20 SMA, now capping the upside around 1.4640, where the pair has also set several intraday highs and lows this week, and therefore the level to break to confirm further gains.

Support levels: 1.4570 1.4535 1.4500

Resistance levels: 1.4640 1.4685 1.4730

USD/JPY Current price: 117.60

View Live Chart for the USD/JPY

The Japanese yen advanced against all of its major rivals, with the USD/JPY pair down to 117.32, favored by safe-haven demand triggered by Chinese stocks' decline. The pair has attempted recovering some ground, but met selling interest around 118.30 and maintains a persistent bearish tone, with the noted exception that the ongoing trend may be interrupted by the release of US Nonfarm Payroll data this Friday. Technically, the 1 hour chart shows that the technical indicators have briefly advanced above their mid-lines before resuming their declines, and now head lower within negative territory, whilst the price remains well below bearish moving averages. In the 4 hours chart, the technical indicators have turned back lower well below their mid-lines after correcting oversold readings, supporting some further declines, but probably limited ones, during the upcoming Asian session.

Support levels: 117.25 116.80 116.50

Resistance levels: 117.90 118.40 118.80

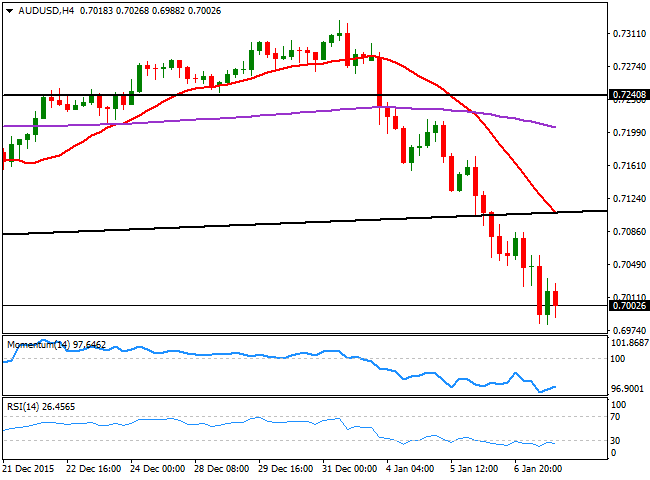

AUD/USD Current price: 0.7000

View Live Chart for the AUD/USD

The AUD/USD pair edged sharply lower, and fell to a daily low of 0.6980 before bouncing some, still unable to settle above the 0.7000 level. Risk sentiment coming from China keeps the Aussie subdued, and the currency is unable to recover ground, even despite a strong advance in gold prices. Down by over 300 pips ever since the week started, the pair risk a test of the multi-year low posted last September at 0.6906, with scope to fall even lower, if the greenback resumes its early year strength. Technically and for the short term, the bias is bearish in the 1 hour chart, as the intraday recoveries were capped by a bearish 20 SMA, now around 0.7020, while the technical indicators have retreated from near their mid-lines and head slightly lower. In the 4 hours chart, the RSI indicator has turned lower within extreme oversold levels, while the Momentum indicator hovers near oversold territory, as the 20 SMA extended its decline above the current level.

Support levels: 0.6980 0.6955 0.6905

Resistance levels: 0.7000 0.7040 0.7075

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD falls to fresh daily lows below 1.0400 after upbeat US data

EUR/USD came under selling pressure early in the American session following the release of United States macroeconomic figures. The December ISM Services PMI unexpectedly surged to 54.1, while November JOLTS Job Openings rose to 8.1 million, also bearing expectations.

GBP/USD extends retracement, struggles to retain 1.2500

GBP/USD lost further traction and battles to retain the 1.2500 mark after hitting an intraday high of 1.2575. Stock markets turned south after the release of upbeat American data, providing fresh legs to the US Dollar rally.

Gold holds on to modest gains amid a souring mood

Spot Gold lost its bullish traction and retreated toward the $2,650 area following the release of encouraging US macroeconomic figures. Jumping US Treasury yields further support the US Dollar in the near term.

Bitcoin Price Forecast: BTC holds above $100K following Fed’s Michael Barr resign

Bitcoin edges slightly down to around $101,300 on Tuesday after rallying almost 4% the previous day. The announcement of Michael S. Barr’s resignation as Federal Reserve Vice Chair for Supervision on Monday has pushed BTC above the $100K mark.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important NFP stand out, but a look at the Federal Reserve and the Chinese economy is also of interest.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.