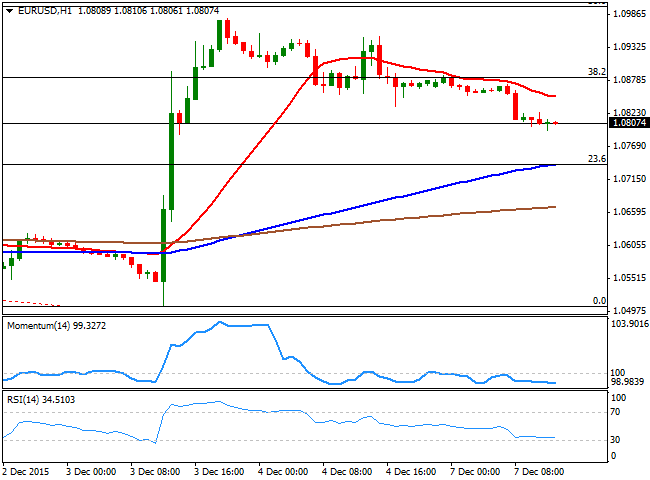

EUR/USD Current price: 1.0806

View Live Chart for the EUR/USD

The EUR/USD pair fell down to 1.0795 in the European session, but holds above the 1.0800 level ahead of the US opening. The pair fell with the European opening, as stocks opened sharply higher, whilst German Industrial Production missed expectations, rising by 0.2% in October, against a 0.7% advance. The lack of volume however is quite strong across the board, and the pair trades in a tight range, with a mild negative tone in the short term, as the in the 1 hour chart, the price is well below a bearish 20 SMA, whilst the technical indicators head south below their mid-lines. In the 4 hours chart, the decline has stalled a couple of pips above a still bullish 20 SMA, while the technical indicators have corrected their extreme overbought readings, and are currently turning higher well above their mid-lines, limiting chances of a stronger decline as long as 1.0790 holds. A recovery above 1.0835 is now required to see the pair maintaining its bullish tone and attempting a retest of the 1.0900 region.

Support levels: 1.0790 1.0740 1.0700

Resistance levels: 1.0835 1.0880 1.0910

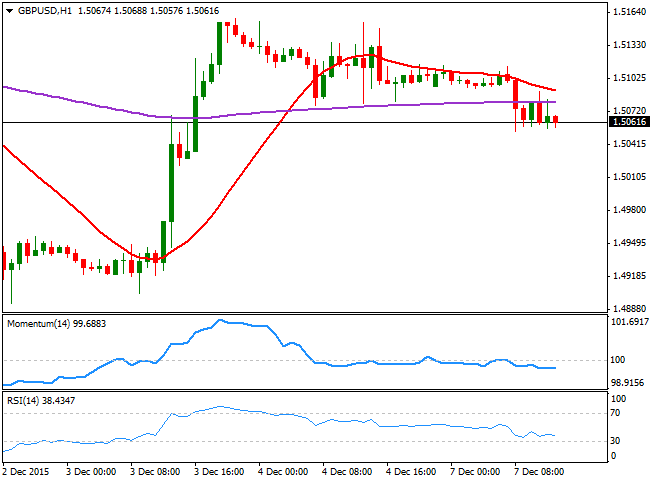

GBP/USD Current price: 1.5061

View Live Chart for the GPB/USD

The GBP/USD pair trades near a daily low set at 1.5053, with the European opening, having then met selling interest on attempts to advance beyond the 1.5100 level. There were no macroeconomic news in the UK, but will release some manufacturing and industrial data this Tuesday, expected to have advanced some during October. In the meantime, the short term technical picture is bearish, as in the 1 hour chart, the price is below a bearish 20 SMA, whilst the technical indicators head slightly lower below their mid-lines. In the 4 hours chart, the price holds a few pips above its 20 SMA, while the technical indicators have turned flat well above their mid-lines, limiting the downside.

Support levels: 1.5050 1.5020 1.4980

Resistance levels: 1.5125 1.5160 1.5190

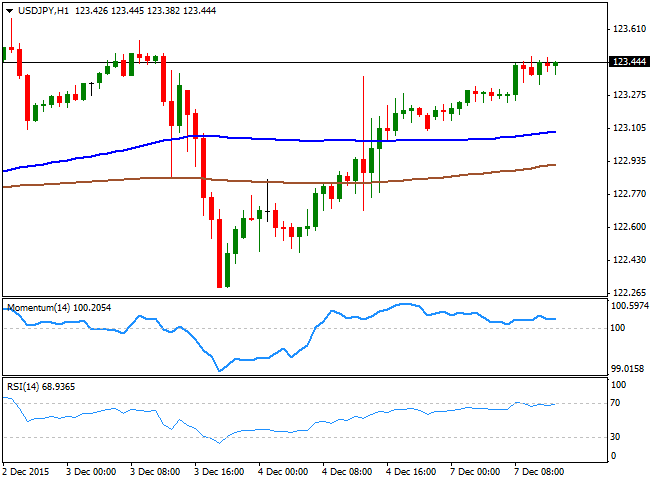

USD/JPY Current price: 123.44

View Live Chart for the USD/JPY

Upside limited. The USD/JPY pair has gathered some momentum at the beginning of the day, extending up to 123.47 with dollar's strength. The pair has been trading between 122.20 and 123.75 since early September, and seems the range will remain in place for one more day, given the thin market conditions of this Monday. The short term picture is, however, mild bullish as in the 1 hour chart, as the price is holding well above its 100 and 200 SMAs, while the technical indicators are consolidating in positive territory, closed to overbought levels. In the 4 hours chart, however, the technical outlook is neutral, with the Momentum indicator stuck around its 100 level and the RSI also flat around 59.

Support levels: 123.00 122.60 122.20

Resistance levels: 123.75 124.10 124.50

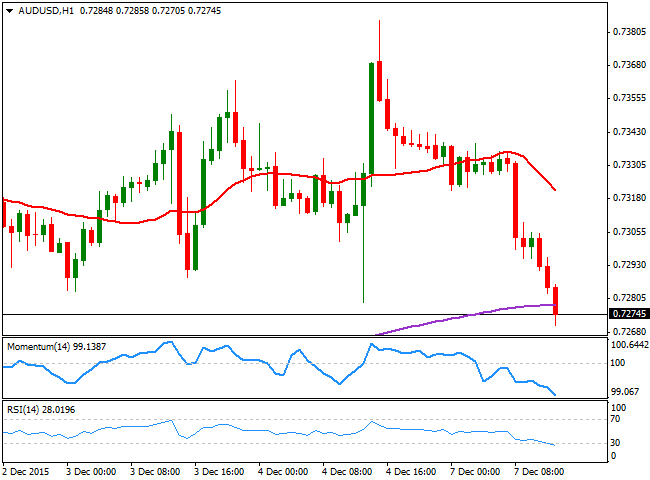

AUD/USD Current price: 0.7274

View Live Chart for the AUD/USD

The AUD/USD pair accelerates its decline after triggering stops below the 0.7300 level, probably the most clearly bearish pair ahead of the US opening. Commodity currencies are under strong selling pressure, and the AUD/USD pair will face a critical support at 0.7240, as far declines below it could lead to a stronger decline during this Tuesday. Technically, the 1 hour chart shows that the price has accelerated below a bearish 20 SMA, whilst the technical indicators maintain their bearish slopes, despite being near oversold levels. In the 4 hours chart, the technical picture is also bearish, as the technical indicators head sharply lower below their mid-lines, whilst the price accelerated below its 20 SMA.

Support levels: 0.7240 0.7200 0.7165

Resistance levels: 0.7290 0.7335 0.7370

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD recovers above 1.0300, markets await comments from Fed officials

EUR/USD gains traction and trades above 1.0300 on Thursday despite mixed German Industrial Production and Eurozone Retail Sales data. Retreating US bond yields limits the USD's gains and allows the pair to hold its ground as market focus shifts to Fedspeak.

GBP/USD rebounds from multi-month lows, trades above 1.2300

GBP/USD erases a portion of its daily gains and trades above 1.2300 after setting a 14-month-low below 1.2250. The pair recovers as the UK gilt yields correct lower after surging to multi-year highs on a two-day gilt selloff. Markets keep a close eye on comments from central bank officials.

Gold climbs to new multi-week high above $2,670

Gold extends its weekly recovery and trades at its highest level since mid-December above $2,670. The benchmark 10-year US Treasury bond yield corrects lower from the multi-month high it touched above 4.7% on Wednesday, helping XAU/USD stretch higher.

Bitcoin falls below $94,000 as over $568 million outflows from ETFs

Bitcoin continues to edge down, trading below the $94,000 level on Thursday after falling more than 5% this week. Bitcoin US spot Exchange Traded Funds recorded an outflow of over $568 million on Wednesday, showing signs of decreasing demand.

Recent developments in the global economy

United States: Recent business surveys suggest that the clean election outcome has led companies that delayed investment and hiring due to election/regulatory uncertainty to start putting money to work.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.