EUR/USD Current price: 1.0609

View Live Chart for the EUR/USD

The dollar consolidated its latest gains this Thursday, with the EUR/USD pair confined to a 30 pips range amid a strong lack of volume due to the US Thanksgiving holiday. Nevertheless, the common currency remained under pressure ahead of crucial data to be released next week, including the ECB latest economic policy decision and the US Nonfarm Payroll report. The only piece of data released this Thursday, was the EU money supply figures, showing an increase in circulating in the region during October of 5.3%, the result of the ongoing easing from the Central Bank, but hardly a market mover. European stocks managed to rally, which maintained the EUR subdued, yet there was no action across the board. This Friday, the US will have an early close, and there will be no fundamental data released, although some macro figures will be delivered by the EU, none of them a trend changer.

As for the EUR/USD pair, the 4 hours chart shows that the bearish momentum prevailed for one more day, given that the price was unable to recover above the 20 SMA, whilst the technical indicators present mild bearish slopes below their mid-lines. Given that the month end is around the corner ,little can be expected for this Friday, although market's sentiment continued favoring lower lows towards 1.0460 and selling on spikes.

Support levels: 1.0590 1.0550 1.0520

Resistance levels: 1.0630 1.0660 1.0695

EUR/JPY Current price: 130.04

View Live Chart for the EUR/JPY

The EUR/JPY pair closes in the red for a third day in-a-row-, but within the lower half of its Wednesday range, and a few pips above the 130.00 level. The Japanese yen held strong, despite European stocks edged sharply higher, with the EUR being weighed by rumors that during the next week meeting, the ECB can cut its deposit rate further into negative territory. The 4 hours chart for the EUR/JPY pair maintains the risk towards the downside, as the price is developing well below the 100 and 200 SMA's, while the technical indicators remain below their mid-lines, although lacking directional strength. The weekly low was set at 129.76, which means that a downward acceleration through 129.80 should lead to further declines, with the market pointing then for a test of the 129.00 region.

Support levels: 129.80 129.40 129.00

Resistance levels: 130.55 130.90 131.30

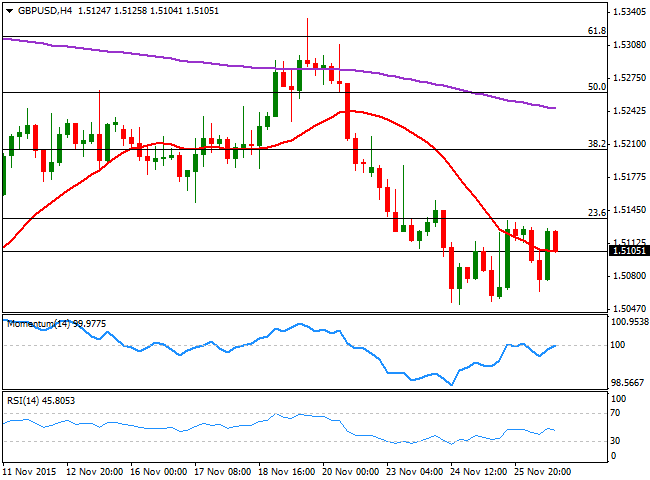

GBP/USD Current price: 1.5103

View Live Chart for the GPB/USD

The GBP/USD pair edged lower in thin trading, having met buying interest on an approach to the weekly low set at 1.5056, but contained below the 23.6% retracement of its latest weekly decline at 1.5135, the main resistance level for the upcoming sessions. There were no macroeconomic releases in the UK, but this Friday, the economy will release a second estimate of the Q3 GDP, expected to remain unchanged at 0.5%. An improved number may help the Pound recover, although at this point, the GBP/USD pair needs to regain the 1.5200 figure to begin looking more constructive. From a technical point of view, the 4 hours chart shows that the price is hovering around a bearish 20 SMA, whilst the Momentum indicator remains below its 100 level, and the RSI indicator retreats from its mid-line and heads lower around 45, all of which maintains the risk towards the downside.

Support levels: 1.5050 1.5010 1.4980

Resistance levels: 1.5135 1.5160 1.5190

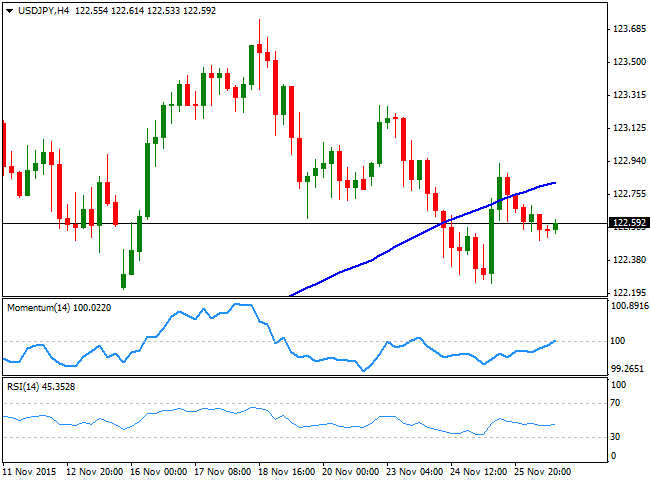

USD/JPY Current price: 122.59

View Live Chart for the USD/JPY

The USD/JPY pair traded in a 20 pips range during the last 24 hours, still holding above the critical 122.20 level, the low of these last three weeks. The pair hovered around the 122.50/60 region for most of the day, still unable to confirm a stepper recovery after having been rejected from the 123.70 region earlier this month. During the upcoming Asian session, Japan will release its inflation data for October, alongside with the latest unemployment rate and some investing and consumption data. Particularly inflation may affect the yen as worse-than-expected readings could send the Japanese currency lower across the board. From a technical point of view, the upside remains limited according to the 4 hours chart, as the price holds below its 100 SMA, while the technical indicators aim slightly higher, but in neutral territory, far from confirming a new leg north. A break below 122.20 would risk a stronger decline, down to 120.50 before buying interest re-surges.

Support levels: 122.20 121.70 121.35

Resistance levels: 123.00 123.40 123.75

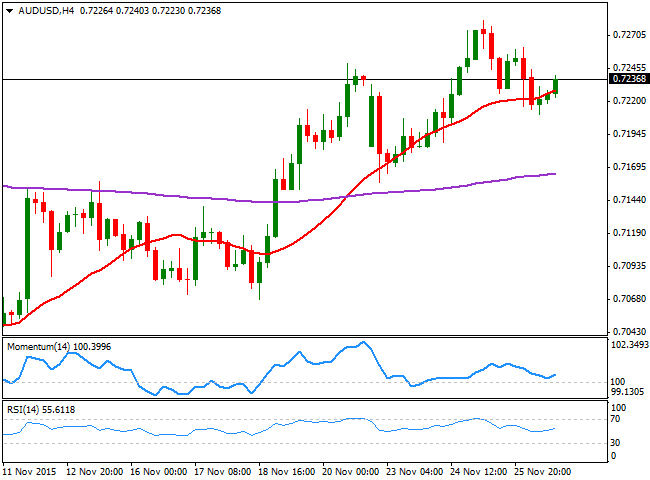

AUD/USD Current price: 0.7236

View Live Chart for the AUD/USD

The AUD/USD pair fell at the beginning of the day, down on disappointing Australian data, as private capital expenditures contracted by another 9.2% in the third quarter, after shrinking 3.3% in the previous one. The decline was led by a contraction in business investments in the mining sector, as commodities prices have been plunging during the past few months on the back of Chinese's economic slowdown. The technical picture is still mild positive, as the pair managed to hold above the 0.7200 level, and the 4 hours chart shows that the price is struggling around a bullish 20 SMA, whilst the technical indicators are bouncing from their mid-lines, in line with an upcoming recovery. Nevertheless, the pair needs to regain the 0.7240 level, the immediate short term resistance, to be able to retest the highs near 0.7300 posted earlier this week.

Support levels: 0.7200 0.7150 0.7110

Resistance levels: 0.7240 0.7285 0.7330

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD struggles to hold above 1.0400 as mood sours

EUR/USD stays on the back foot and trades near 1.0400 following the earlier recovery attempt. In the absence of high-tier data releases, the cautious risk mood helps the US Dollar hold its ground and forces the pair to stretch lower.

GBP/USD declines below 1.2550 on renewed USD strength

GBP/USD loses its traction and trades below 1.2550 in the second half of the day on Monday. The US Dollar (USD) benefits from safe-haven flows and weighs on the pair as trading conditions remain thin heading into the Christmas holiday.

Gold drops to $2,620 area as US bond yields edge higher

Gold struggles to build on Friday's gains and trades modestly lower on the day near $2,620. The benchmark 10-year US Treasury bond yield edges slightly higher above 4.5%, making it difficult for XAU/USD to gather bullish momentum.

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin hovers around $95,000 on Monday after losing the progress made during Friday’s relief rally. The largest cryptocurrency hit a new all-time high at $108,353 on Tuesday but this was followed by a steep correction after the US Fed signaled fewer interest-rate cuts than previously anticipated for 2025.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.