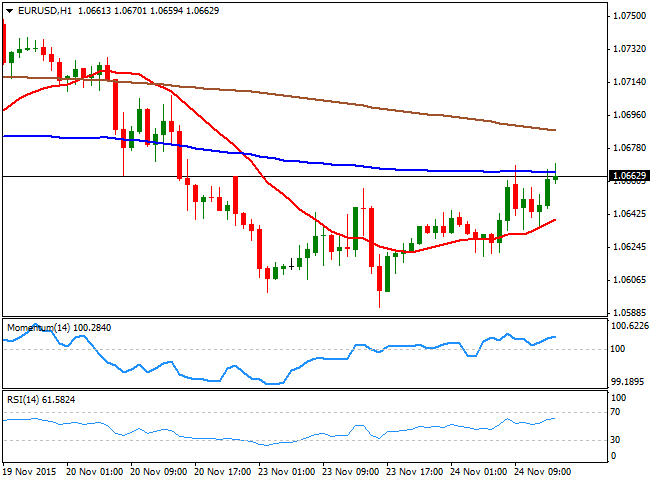

EUR/USD Current price: 1.0665

View Live Chart for the EUR/USD

The EUR/USD pair trades slightly higher this Tuesday, having advanced up to 1.0669 early Europe on the back of positive German data. According to the latest releases, the largest European economy continued growing as the third quarter GDP came as expected at 0.3% whilst the IFO survey showed that the business climate index climbed to 109 in November, the highest level since June 2014, from 108.2 in October. The release of the US Q3 GDP second revision resulted better than expected, up to 2.1% from a previous reading of 1.5% and above the 2.0% expected. Also, the US trade deficit came better-than-expected, down to $-58.41B from a previous $-58.63B. The pair extended its advance by a couple of pips despite the positive readings and ahead of the US opening and the 1 hour chart shows that the price is above a bullish 20 SMA, while the technical indicators aim higher above their mid-lines, but with the price unable to firmly extend above its 100 SMA. In the 4 hours chart, however, the pair maintains a neutral stance, with the price a couple of pips below a mild bearish 20 SMA and the technical indicators heading higher but below their mid-lines.Support levels: 1.0620 1.0590 1.0550

Resistance levels: 1.0690 1.0730 10760

GBP/USD Current price: 1.5078

View Live Chart for the GPB/USD

The GBP/USD pair fell below the 1.5100 level, following some comments from BOE's governor Mark Carnet and chief economist Haldane, the first stating that interest rates are likely to remain low "for some time" and the second stating that downside inflation risk is worse than the one reported in the latest inflation report. The pair trades a few pips above 1.5067, the daily low, and the 1 hour chart shows that the price has accelerated well below a bearish 20 SMA, while the technical indicators have lost their bearish strength but hold in oversold territory. In the 4 hours chart, the technical supports a continued decline, given that the technical indicators head sharply lower well into negative territory, supporting a downward extension towards the 1.5000/10 price zone.

Support levels: 1.5050 1.5010 1.4980

Resistance levels: 1.5110 1.5160 1.5190

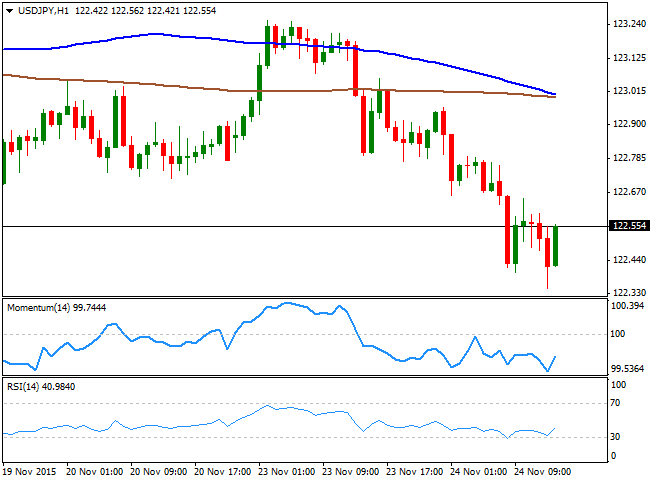

USD/JPY Current price: 122.53

View Live Chart for the USD/JPY

Key support at 122.20. The USD/JPY pair trades near a fresh weekly low set at 122.34 after the release of the US data, from where its currently bouncing, although still in the red daily basis. The 1 hour chart shows that the price has fallen well below its 100 and 200 SMAs, both around 123.00, but that the technical indicators are bouncing from oversold levels, limiting chances of a stronger decline. In the 4 hours chart, the price is stuck around a bullish 100 SMA, whilst the technical indicators aim higher but below their mid-lines. The key support comes at 122.21, past November 15th daily low, with a break below it required to confirm a stronger bearish movement during the upcoming sessions.

Support levels: 122.20 121.70 121.35

Resistance levels: 123.00 123.40 123.75

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD turns lower below 1.0350 after German data

EUR/USD comes under mild selling pressure and eases below 1.0350 in the European session on Wednesday. The pair bears the brunt of an unexpected slowdown in the German manufacturing sector, as the nation's Retail Sales data fail to inspire the Euro. Focus shifts to US ADP data and Fed Minutes.

GBP/USD stays defensive below 1.2500 ahead of key US data, Fed Minutes

GBP/USD stays defensive below 1.2500 in the European trading hours on Wednesday, undermined by a risk-off market sentiment and elevated US Treasury bond yields on increased hawkish Fed bets. Traders look to US data, Fedspeak and FOMC Minutes for fresh trading impulse.

Gold eyes US ADP report and Fed Minutes for next push higher

Gold price is consolidating the previous rebound near $2,650 early Wednesday, awaiting the US ADP jobs report and the Minutes of the US Federal Reserve December meeting for the next leg higher.

DOGE and SHIB traders book profits at the top

Dogecoin and Shiba Inu prices broke below their key support levels on Wednesday after declining more than 9% the previous day. On-chain data provider Santiments Network Realized Profit/Loss indicator shows massive spikes in these dog-theme memecoins, indicating traders realize profits.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important NFP stand out, but a look at the Federal Reserve and the Chinese economy is also of interest.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.