EUR/USD Current price: 1.0692

View Live Chart for the EUR/USD

Having spent most of the day consolidating in a tight range, the EUR/USD pair resumed its decline ahead of the US opening, falling below the 1.0700 level for the first since late April. There have been no relevant macroeconomic news released in Europe, and there's little ahead in the US, which means market will continue trading on sentiment. European indexes trade in the red, but it hasn't been enough to help the EUR, whilst US stocks are poised to open lower, after yesterdays' decline. Market's are quite mixed, with commodities flat and currencies diverging direction against the dollar, but EUR's weakness is undeniable.Technically, the 1 hour chart shows that the price is moving below a bearish 20 SMA, whilst the technical indicators are barely bouncing from their mid-lines, lacking upward strength. In the 4 hours chart, the price has extended further below its 20 SMA, while the technical indicators have resumed their declines below their mid-lines, in line with a continued decline towards 1.0620.

Support levels: 1.0660 1.0620 1.585

Resistance levels: 1.0750 1.0800 1.0845

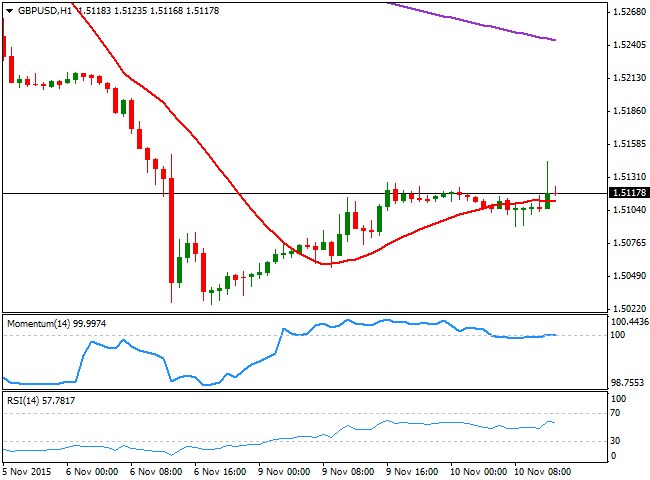

GBP/USD Current price: 1.5117

View Live Chart for the GPB/USD

The GBP/USD saw a limited intraday spike up to 1.5144, but for the most, remains confined to quite a limited range above the 1.5100 figure. The short term picture is neutral, as in the 1 hour chart, the price is hovering around a horizontal 20 SMA whilst the technical indicators remain stuck around their mid-line. In the 4 hours chart, the pair met selling interest around a sharply bearish 20 SMA that continues heading south above the current level, whilst the technical indicators continue correcting higher, but remain in negative territory. Overall, the pair may extend its corrective movement on renewed buying interest above the mentioned daily high, but the bearish background will hardly be affected as long as the price remains below 1.5250.

Support levels: 1.5080 1.5035 1.5000

Resistance levels: 1.5145 1.5190 1.5250

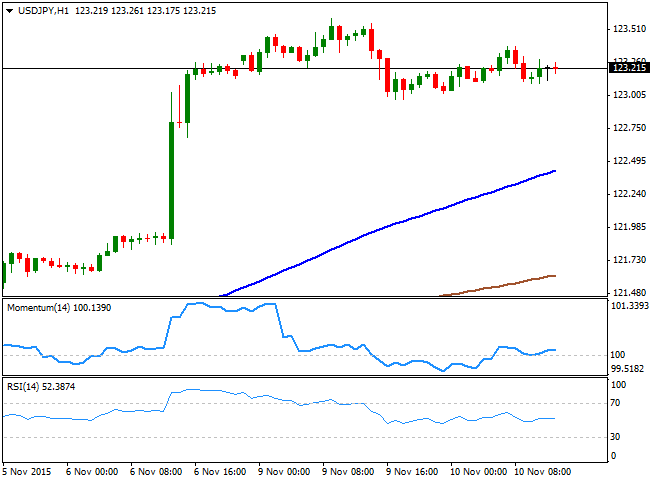

USD/JPY Current price: 123.22

View Live Chart for the USD/JPY

New range, waiting for a catalyst. The USD/JPY pair consolidates above the 123.00 level, this Monday, having little to offer to investors this Tuesday, as it trades in a 40 pips range ever since the day started. The pair has now set a new consolidative range and will need a huge catalyst to break it, which means playing the 122.80/123.60 range could be the way to trade it in the short ter. Technically, the 1 hour chart shows that the moving averages have advanced further below the current level, while the technical indicators are bouncing from their mid-lines, maintaining the downside limited. In the 4 hours chart, the technical indicators have retreated from extreme overbought levels, but lack directional strength well above their mid-lines, whilst the moving averages are slowly advancing below far below the current level. An upward acceleration through 123.80 should favor additional advances, with the market then eyeing a retest of the year high at 125.80.

Support levels: 122.80 122.50 122.20

Resistance levels: 123.80 124.25 125.00

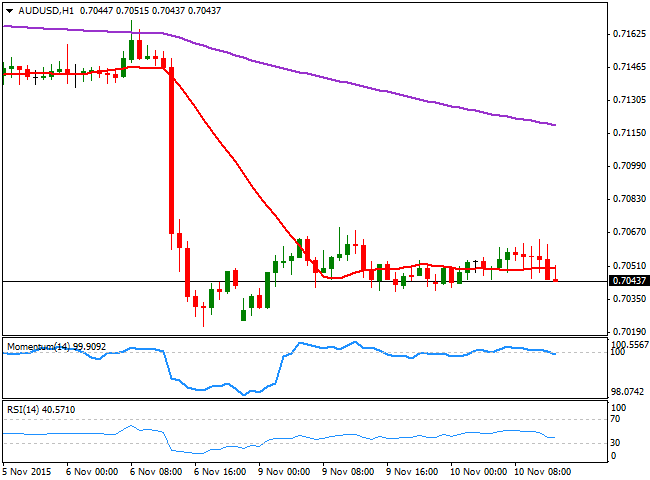

AUD/USD Current price: 0.7043

View Live Chart for the AUD/USD

The AUD/USD pair trades near its daily low, with the bearish potential increasing ahead of the US opening as dollar's demand resurged. The 1 hour chart shows that the price is extending below its 20 SMA, whilst the technical indicators are turning south around their mid-lines, lacking strength at the time being. In the 4 hours chart, the technical indicators have resumed their declines near oversold territory, whilst the 20 SMA maintains a strong bearish slope above the current level, all of which supports a bearish continuation particularly on a break below 0.7030, the immediate support.

Support levels: 0.7030 0.6980 0.6940

Resistance levels: 0.7070 0.7110 0.7150

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY remains below 158.00 after Japanese data

Soft US Dollar demand helps the Japanese Yen to trim part of its recent losses, with USD/JPY changing hands around 157.70. Higher than anticipated Tokyo inflation passed unnoticed.

AUD/USD weakens to near 0.6200 amid thin trading

The AUD/USD pair remains on the defensive around 0.6215 during the early Asian session on Friday. The incoming Donald Trump administration is expected to boost growth and lift inflation, supporting the US Dollar (USD). The markets are likely to be quiet ahead of next week’s New Year holiday.

Gold depreciates amid light trading, downside seems limited due to safe-haven demand

Gold edges lower amid thin trading following the Christmas holiday, trading near $2,630 during the Asian session on Friday. However, the safe-haven asset could find upward support as markets anticipate signals regarding the United States economy under the incoming Trump administration and the Fed’s interest rate outlook for 2025.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.