EUR/USD Current price: 1.0715

View Live Chart for the EUR/USD

Having been lifeless during the first half of the day, the EUR/USD pair plummeted following the release of the US monthly employment report. According to the US Labor Statistics department the country added 271K new jobs in October, whilst the unemployment rate fell down to 5.0%, the lowest in seven years. Wages, which have been a concern rose by 0.4% against 0.2% expected. The EUR/USD dollar plummeted over 150 in less than a minute after the release, reaching a fresh 7-month low of 1.0703. The pair bounced some after the news, but met selling interest on approaches to the 1.0750/60 region, as the dollar's momentum remained strong.Technically, the pair has reached extreme oversold readings in the short term, as the 1 hour chart shows that the RSI indicator is around 16, but maintains its bearish tone alongside with the Momentum indicator, as the price approaches the mentioned low. In the 4 hours chart, the technical reading also present a strong downward momentum, in line with a continued decline on a break below 1.0700 the immediate support.

Support levels: 1.0700 1.0660 1.0625

Resistance levels: 1.0850 1.0895 1.0930

GBP/USD Current price: 1.5052

View Live Chart for the GPB/USD

The British Pound extended its bleeding ahead of the US data release, with the GBP/USD finally declining to a fresh multi-month low of 1.5028 following much better-than-expected US employment figures. The imbalance between Central Banks has become more notable as these news are supportive of a December rate hike, one day after BOE's Governor Mark Carney offered a gloomy outlook of the UK economic future. The pair is trading at levels not seen since mid April ahead of the US opening, and the 1 hour chart shows that the price accelerated below its 20 SMA, whilst the technical indicators are partially losing their bearish strength in extreme oversold levels. In the 4 hours chart, however, a strong bearish momentum prevails, despite the indicators stand in extreme oversold readings, supporting a test of the 1.5000 level during the upcoming hours.

Support levels: 1.5000 1.4970 1.4930

Resistance levels: 1.5080 1.5130 1.5160

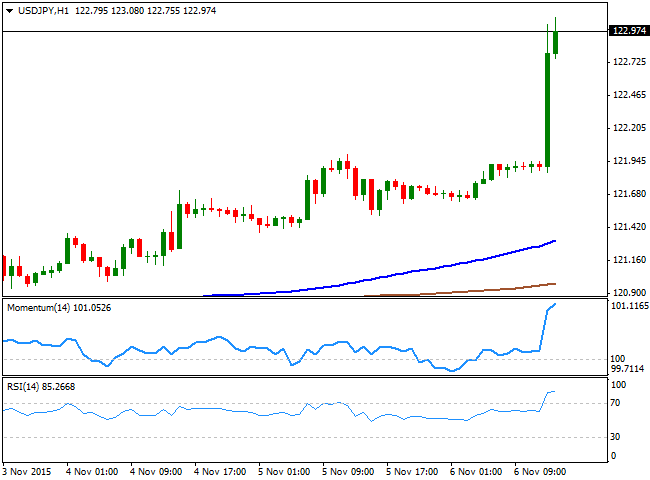

USD/JPY Current price: 122.97

View Live Chart for the USD/JPY

The USD/JPY pair held near the 122.00 level during the first half of the day, as investors waited for the US report which, once again, rocked the financial world. The US economy added 271K last month, and despite some minor downward revisions for August and September headlines, the news have been more than enough to convince investors that the FED will act this December. The USD/JPY pair jumped up o 123.08 after the news, but retreated from the level, as stocks did not like the news: US indexes dipped after the release and are poised to open lower limiting the upside in the pair that anyway holds near the mentioned high. The strong movement has left technical indicators in the 1 hour chart in extreme overbought levels, yet further advances are still likely, particularly of dollar's buying resumes with the US opening. In the 4 hours chart, the technical indicators head sharply lower, also in overbought territory, in line with further advances.

Support levels: 122.80 122.50 122.20

Resistance levels: 123.20 123.60 123.40

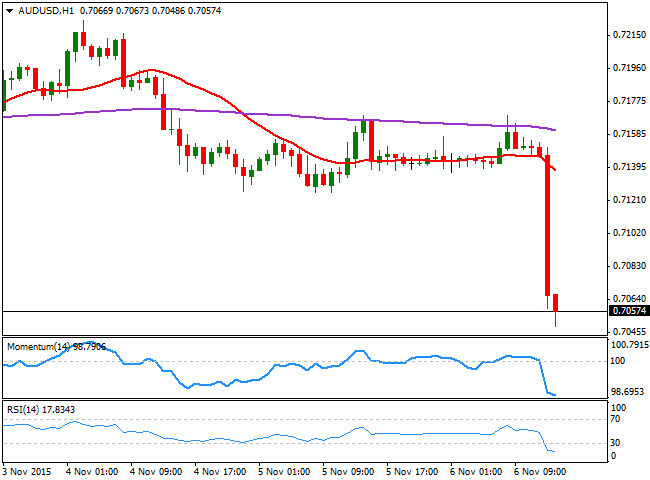

AUD/USD Current price: 0.7058

View Live Chart for the AUD/USD

The Aussie enjoyed some demand during the Asian session, following a mixed RBA Minutes. The spike was short lived, as the Central Bank left doors open to ease the monetary policy further if needed. The AUD/USD pair advanced up to 0.7169, but returned to its comfort zone around 0.7150 to wait for the US employment data release. The positive surprise coming from the US jobs sector resulted in a 100 pips decline in the AUD/USD pair, with the antipodean currency being weighed also by a sharp decline in gold prices, as spot lost over $20 and fell down to 1,087.18 so far, remaining under pressure. The pair is currently trading a few pips above its daily low of 0.7048, and could extend its decline on a break below 0.7030, a strong static support level. The short term picture shows that the technical indicators stand in extreme oversold territory, but market is all about sentiment this Friday, and little about technical readings.

Support levels: 0.7030 0.6980 0.6940

Resistance levels: 0.7070 0.7110 0.7150

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD off lows, stays heavy below 0.6450 amid weak Australian GDP, China's PMI

AUD/USD holds sizeable losses below 0.6450 in Asian trading on Wednesday after testing the 0.6400 level earlier on. The pair bears the brunt of weaker Australian Q3 GDP data, disappointing Chinese Caixin Services PMI and US-Sino trade worries. Focus shifts to more US data and Powell's speech.

USD/JPY rises back above 150.00 on renewed USD buying

USD/JPYhas regained 150.00 in Wednesday's Asian session, looking to extend the latest leg higheer. Increased haven demand for the US Dollar on growing tariff war fears underpins the pair despite bets for a December BoJ rate hike. US ADP data and Powell's speech are eagerly awaited.

Gold awaits Fed Chair Powell’s speech for a fresh directional impetus

Gold price is holding onto minor bids early Wednesday, struggling to build on the previous bounce, anticipating a fresh batch of top-tier US economic data releases and Federal Reserve Chairman Jerome Powell’s speech.

Paul Atkins shows reluctance to replace SEC Chair Gary Gensler

Paul Atkins, regarded as a leading candidate to succeed Gary Gensler as Chairman of the Securities & Exchange Commission, has reportedly expressed a lack of enthusiasm for the position.

The fall of Barnier’s government would be bad news for the French economy

This French political stand-off is just one more negative for the euro. With the eurozone economy facing the threat of tariffs in 2025 and the region lacking any prospect of cohesive fiscal support, the potential fall of the French government merely adds to views that the ECB will have to do the heavy lifting in 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.