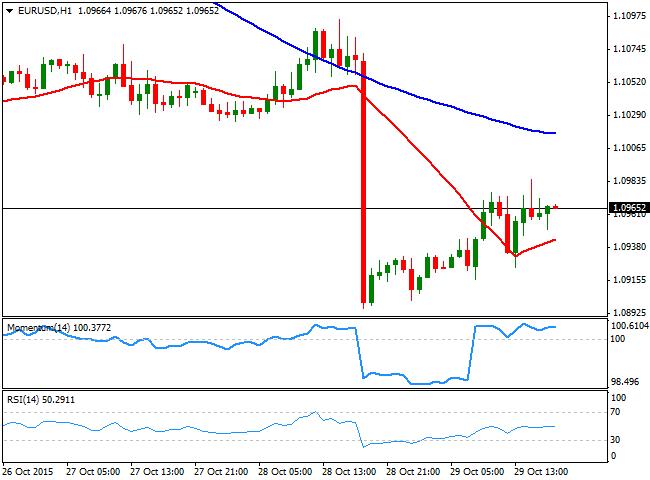

EUR/USD Current price: 1.0965

View Live Chart for the EUR/USD

The American dollar closed mixed this Thursday, having however, held near its recent highs against most of its rivals. The macroeconomic front was pretty busy, but majors saw limited reactions to the news. Starting with Europe, the region released its confidence figures for October, with main reading resulting at -7.7, matching September number. In Germany, unemployment fell in October, by seasonally adjusted 5K to 2.788 million, while inflation in the same month, rose 0.3% compared to a year before. In the US, the advanced GDP reading for the Q3, came out at 1.5% slightly below the 1.6% expected. Weekly unemployment claims, in the week ending October 23rd, resulted at 260K better than the 263K expected. Worse news came from the housing sector, as Pending Home sales in September declined 2.3%.The EUR/USD pair posted a daily high of 1.0985 after in the American afternoon and following soft data, ending the day with some gains around 1.0965. The short term picture however, is far from supporting additional gains, as in the 1 hour chart, the technical indicators have turned flat after recovering above their mid-lines, whilst the price remains well below a bearish 100 SMA. In the 4 hours chart, the technical indicators are heading slightly lower well into negative territory, while the 20 SMA maintains its bearish tone, offering an immediate resistance around 1.1015. Being the last day of the month, investors may take some profits out of the table this Friday although sellers will likely add at higher levels.

Support levels: 1.0920 1.0880 1.0840

Resistance levels: 1.1015 1.1050 1.1090

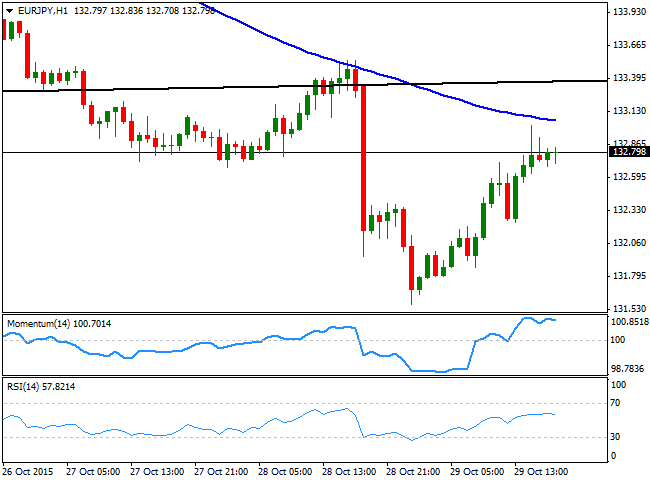

EUR/JPY Current price: 132.79

View Live Chart for the EUR/JPY

The EUR/JPY managed to recover some ground amid a weakening JPY and the EUR upward corrective move, although the pair was unable to regain the 133.00 level. Despite stocks closed generally lower across the world, investors chose to sell the Japanese currency, ahead of the BOJ meeting at the beginning of the Asian session, in which the Central Bank is expected to announce an extension of its ongoing stimulus program. Technically and in the short term, the 1 hour chart shows that the price stalled below a strongly bearish 100 SMA, whilst the Momentum indicator turned flat in overbought territory, and the RSI indicator lacks directional strength around 58. In the 4 hours chart, the technical indicators have managed to correct the extreme oversold readings, but are losing their upward momentum below their mid-lines, whilst the price is far below its moving averages, all of which maintains the risk towards the downside.

Support levels: 132.60 132.30 131.90

Resistance levels: 133.10 133.50 134.00

GBP/USD Current price: 1.5310

View Live Chart for the GPB/USD

The GBP/USD pair recovered some ground after extending its decline to a fresh 2-week low of 1.5241, ending the day a handful of pips above the 1.5300 figure. Soft US readings gave the pair a boost during the American afternoon, despite macroeconomic readings in the UK also were tepid. Money Supply data in the UK, showed that business lending decreased in October, whist mortgage lending came out at 68.874K against previous 71.03K. The recovery was enough to reverse the short term picture, although the dominant trend is still bearish, given that the pair is trading below a daily descendant trend line coming from October 23rd daily high. The 1 hour chart shows that the price is now above a bullish 20 SMA, whilst the technical indicators maintain their sharp bullish slopes near overbought territory. In the 4 hours chart, the technical indicators have advanced below their mid-lines, but remain in negative territory, whilst the price is struggling around a bearish 20 SMA.

Support levels: 1.5280 1.5245 1.5200

Resistance levels: 1.5325 1.5360 1.5400

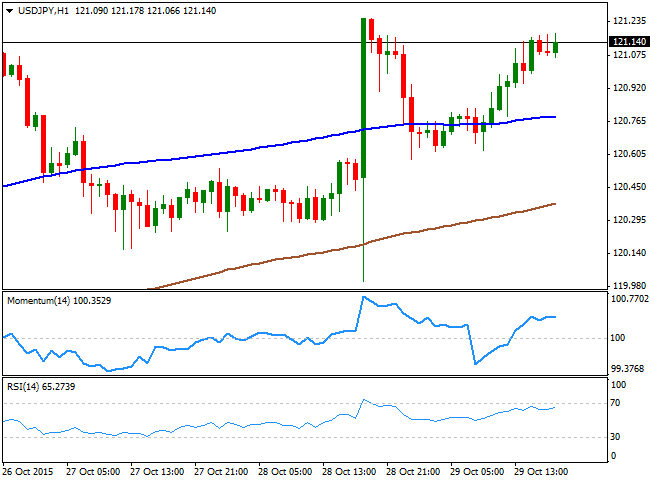

USD/JPY Current price: 121.13

View Live Chart for the USD/JPY

The USD/JPY pair regained the 121.00 level ahead of the Asian opening, as investors are waiting for the upcoming Bank of Japan economic policy decision. The market has been eyeing this particular meeting as the country will also release its half-year forecast, which will give a clearer picture of the economic situation, and therefore if it needs or not, additional QE. Anyway, if the BOJ announces an expansion of its facility program, the pair will likely rally, although notice that the movement has been largely priced in. An on-hold stance on the other hand, may trigger a more interesting bearish move. Technically, the 1 hour chart shows that the price is holding well above its 100 SMA while the technical indicators have lost their upward strength near overbought territory, in line with further gains. In the 4 hours chart, the outlook also favors the upside, with the Momentum indicator still heading higher well above its 100 level and the RSI holding around 59.

Support levels: 121.00 120.70 120.30

Resistance levels: 121.40 121.75 122.10

AUD/USD Current price: 0.7076

View Live Chart for the AUD/USD

The AUD/USD pair extended its decline to a 3-week low of 0.7068 holding nearby by the end of the day, and maintaining the negative tone seen on the previous updates. The Aussie was weighed by a sharp decline in gold prices, but also due to the latest inflation readings, which fueled speculation that the RBA will have to cut rates at least one more time before the year end. Trading below the 0.7200 level, the 1 hour chart shows that the technical readings are biased lower, with the indicators heading south below their mid-lines and the 20 SMA capping the upside around 0.7080. In the 4 hours chart, the 20 SMA has accelerated its decline well above the current level, whilst the technical indicators maintain tepid bearish slopes in oversold territory, all of which points for further declines ahead.

Support levels: 0.7035 0.6990 0.6955

Resistance levels: 0.7125 0.7160 0.7195

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

NZD/USD stays bid toward 0.5900 ahead of RBNZ Orr's presser

NZD/USD has picked up fresh bids, marching toward 0.5900 early Wednesday. The New Zealand Dollar finds fresh buyers after the RBNZ announced 50 bps interest rate cut to 4.25%, as widely expected. Kiwi buyers shrug off dovish guidance by the RBNZ. Orr's presser eyed.

USD/JPY stays pressured below 153.00, US data eyed

USD/JPY slides to over a two-week low below 153.00 early Wednesday as Trump's tariff threats continue to drive haven flows towards the JPY and exert pressure on spot prices. That said, doubts over the BoJ's ability to tighten its monetary policy further should cap gains for the JPY. US data eyed.

Gold price consolidates amid mixed cues; holds comfortably above $2,600

Gold price struggles to capitalize on the overnight bounce from the $2,600 neighborhood or over a one-week low and trades with a mild negative bias on Wednesday. The prevalent risk-on environment, expectations for a less dovish Fed, elevated US bond yields and the underlying bullish sentiment surrounding the USD act as a headwind for the commodity.

Bitcoin remains short of $100K as long-term holders capitalize on recent price rise

Bitcoin (BTC) trades below $95K on Tuesday following increased selling pressure among long-term holders (LTH) after a series of new all-time highs (ATH).

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.