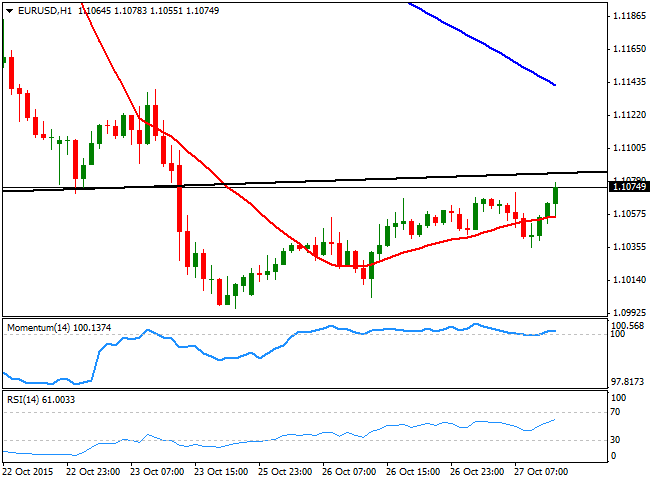

EUR/USD Current price: 1.1056

View Live Chart for the EUR/USD

The dollar is under pressure this Tuesday, extending its early decline after the release of US Durable Goods Orders that unexpectedly fell in September, by 1.2%, beyond the 1.1% decline expected. The core reading also missed expectations falling by 0.4%. Nevertheless, the movements across the board are for the most shallow, ahead of the FOMC meeting on Wednesday, and the EUR/USD trades a few pips above the 1.1050 level, where it has been consolidating ever since the week started, having been as high as 1.1078 following the news. With the Markit Services PMI and Consumer Confidence ahead, the EUR/USD pair continues lacking directional strength, as the 1 hour chart shows that the price is barely above a horizontal 20 SMA, whilst the technical indicators hover above their mid-lines. In the 4 hours chart, the technical indicators continued correcting higher but remain below their mid-lines, whilst the 20 SMA has extended further its decline and the price hovers around it ahead of the US opening. Additional gains above 1.1080 should lead to further advances up to the 1.1120 region, whilst further gains beyond this last exposed the 1.1160 price zone.

Support levels: 1.1000 1.0960 1.0920

Resistance levels: 1.1080 1.1120 1.1160

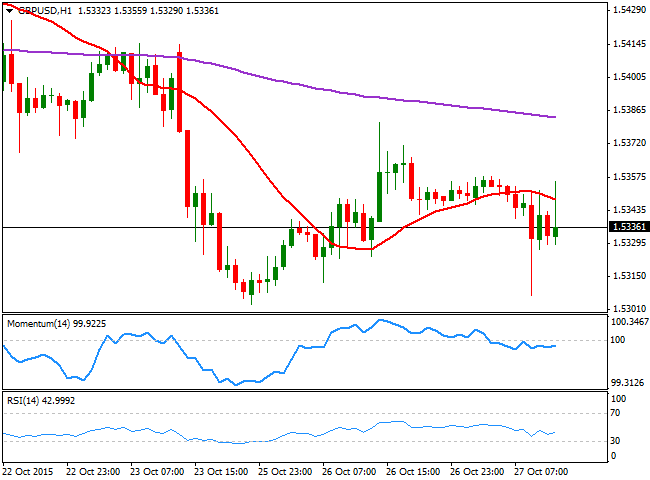

GBP/USD Current price: 1.5336

View Live Chart for the GPB/USD

UK growth slowed during the third quarter of this 2015, sending the GBP/USD down to 1.5307, where buyers quickly surged to defend the figure. The pair trades in a tight range near its lows and the short term picture is bearish, as in the 1 hour chart, the price is below a bearish2 0 SMA, whilst the technical indicators remain below their mid-lines, albeit showing no directional strength. In the 4 hours chart, the early spike was rejected from a strongly bearish 20 SMA, whilst the technical indicators also stand directionless below their mid-lines. Should the pair accelerate below the 1.5300 figure, the decline may extend down to 1.5250, whilst in the short term, spikes are seen as selling opportunities.

Support levels: 1.5295 1.5250 1.5210

Resistance levels: 1.5370 1.5415 1.5450

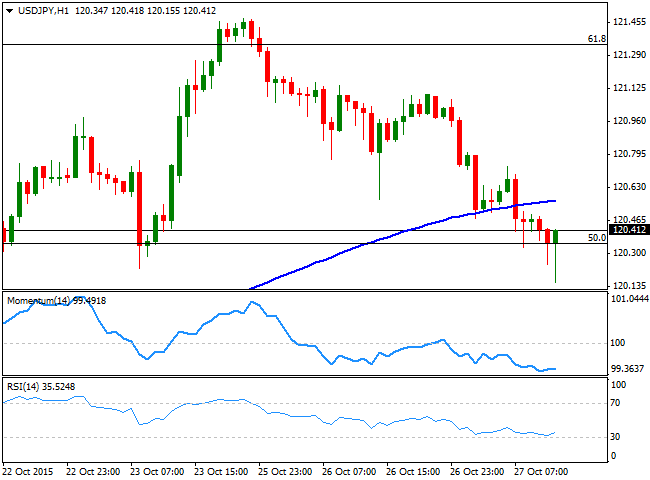

USD/JPY Current price: 120.42

View Live Chart for the USD/JPY

Bouncing from the lows. The USD/JPY pair plunged during the Asian session, following a sharp decline in local share markets, as risk sentiment led the session. The decline extended down to 120.15 after the release of poor US Durable Goods Orders readings, but quickly bounced back above the 120.35 level, a strong Fibonacci support, and the 1 hour chart shows that the technical indicators are bouncing from oversold readings, suggesting the pair may extend its upward corrective move, particularly if the upcoming US data beats expectations. In the same chart, the 100 SMA provides an immediate resistance around 12.0.65, while the 4 hours chart shows that the technical indicators are also heading higher, but still not confirming a continued advance, given that they remain below their mid-lines.

Support levels: 120.35 120.00 119.70

Resistance levels: 120.65 121.00 121.45

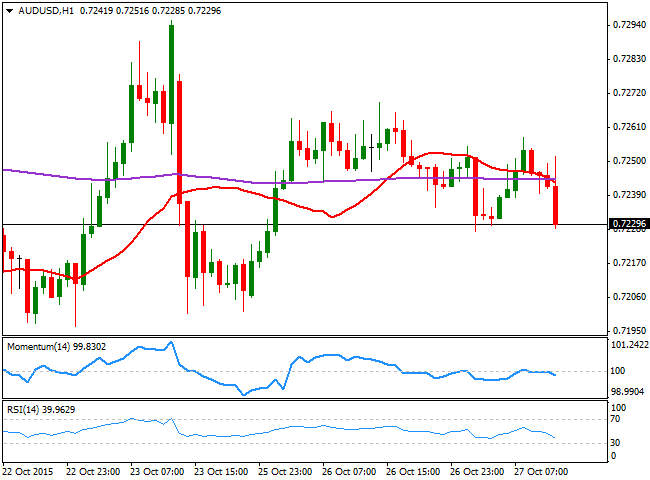

AUD/USD Current price: 0.7230

View Live Chart for the AUD/USD

The AUD/USD pair trades near its daily around 0.7227, weighed by the negative tone in commodities, and accelerating its decline after failing to recover firmly above 0.7240 after US data release. The pair turned short term bearish this Tuesday, as the 1 hour chart shows that the price is now below a bearish 20 SMA, whilst the technical indicators have turned lower below their mid-lines, pointing for a test of the 0.7200 figure. In the 4 hours chart, the price is right below a directionless 20 SMA, whilst the technical indicators present tepid bearish slopes below their mid-lines, in line with further declines.

Support levels: 0.7195 0.7150 0.7110

Resistance levels: 0.7245 0.7290 0.7335

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD resumes slide below 1.0500

EUR/USD gained modest upward traction ahead of Wall Street's opening but resumed its slide afterwards. The pair is under pressure in the American session and poised to close the week with losses near its weekly low at 1.0452.

GBP/USD nears 1.2600 as the US Dollar regains its poise

Disappointing macroeconomic data releases from the UK put pressure on the British Pound, yet financial markets are all about the US Dollar ahead of the weekly close. Demand for the Greenback increased in the American session, pushing GBP/USD towards 1.2600.

Gold pierces $2,660, upside remains capped

Gold (XAU/USD) puts pressure on daily lows and trades below $2,660 on Friday’s early American session. The US Dollar (USD) reclaims its leadership ahead of the weekly close, helped by rising US Treasury yields.

Broadcom is the newest trillion-dollar company Premium

Broadcom (AVGO) stock surged more than 21% on Friday morning after management estimated on Thursday’s earnings call that the market for customized AI accelerators might reach $90 billion in fiscal year 2027.

Can markets keep conquering record highs?

Equity markets are charging to new record highs, with the S&P 500 up 28% year-to-date and the NASDAQ Composite crossing the key 20,000 mark, up 34% this year. The rally is underpinned by a potent mix of drivers.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.