EUR/USD Current price: 1.1379

View Live Chart for the EUR/USD

The EUR/USD pair advanced partially this Tuesday, but failed to rallied beyond the 1.1400 level, weighed by worse-than-expected local macroeconomic data and a market that tossed and turned between hope and despair. The EUR was on demand early in the data, as poor Chinese trade balance data, kept stocks under pressure and lifted the common currency up to 1.1410 against its American rival. But the beginning of the European session, German was again in the eye of the storm, with its September inflation numbers, unchanged from a year before, recording 0.0%. Monthly basis, the CPI fell 0.2%. The ZEW economic survey released afterwards showed that Economic sentiment has further declines in the country during October, down to 1.9 from previous 12.1, whilst the assessment of the current situation resulted at 55.2 from previous 67.5. The EU economic sentiment, according to the same survey, shrank to 30.1 matching expectations, and sending the EUR/USD pair down to a session low of 1.1364.

The US session saw local stocks firming up after the opening, helping the American dollar to recover some ground, but the indexes later capitulated and so did the greenback. Technically, the short term picture for the pair is neutral-to-bullish, given that the 1 hour chart shows that the price is a few pips above its 20 SMA, whilst the technical indicators lack clear directional strength above their mid-lines. In the 4 hours chart, however, the upside remains favored, as the 20 SMA heads strongly higher around 1.1350, whilst the Momentum indicator is aiming to bounce from its mid-line and the RSI indicator consolidates near overbought levels.

Support levels: 1.1340 1.1290 1.1245

Resistance levels: 1.1400 1.1430 1.1460

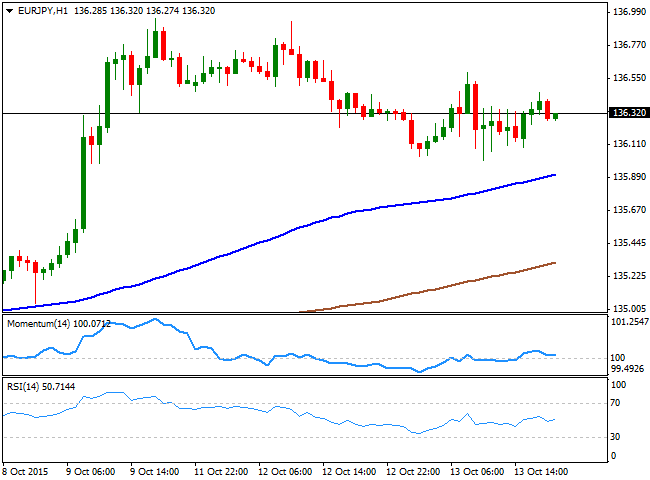

EUR/JPY Current price: 136.32

View Live Chart for the EUR/JPY

The EUR/JPY pair aims to end the day flat a few pips above the 136.00 level, having been rage bound ever since the day started. The Japanese yen strengthened some during the first half of the day, following a sharp decline in Asian stocks, but there was no follow through during the American afternoon, with the JPY giving back its tepid gains. Technically, the 1 hour chart shows that the price holds well above a bullish 100 SMA, currently around 135.90 and the immediate support, whilst the technical indicators have turned flat above their mid-lines, with no clear directional strength. In the 4 hours chart, the price remains well above its moving averages, although the Momentum indicator holds below its 100 SMA while the RSI consolidates around 59, with no clear directional clues for the upcoming hours.

Support levels: 135.90 135.60 135.20

Resistance levels: 136.50 136.95 137.30

GBP/USD Current price: 1.5257

View Live Chart for the GPB/USD

The Pound dive over 180 pips after topping at 1.5387 against its American rival, as the UK inflation unexpectedly dropped below zero. The release of September CPI data showed that inflation fell by 0.1% compared to a year before, being this the second time inflation goes negative in the last 55 years. Producer Price Indexes also fell in September by 1.8% yearly basis, whilst the UK House Price Index for August surged by 5.2%. The GBP/USD pair traded as low as 1.5199 a fresh 5-day low before bouncing some, so far unable to regain the 1.5260 level, a strong static resistance. Short term, the 1 hour chart shows that the technical indicators have bounced strongly from extreme oversold levels, but lost upward strength below their mid-lines, maintaining the risk towards the downside. In the same chart, the 20 SMA heads strongly lower a few pips above the mentioned resistance level. In the 4 hours chart, the technical indicator have also turned north from near oversold levels, but remain well below their mid-lines, whilst the 20 SMA is gaining bearish slope far above the current level. Overall, the downward risk prevails, particularly on renewed selling interest below 1.5230 the 23.6% retracement of the latest weekly decline.

Support levels: 1.5230 1.5190 1.5150

Resistance levels: 1.5260 1.5300 1.5335

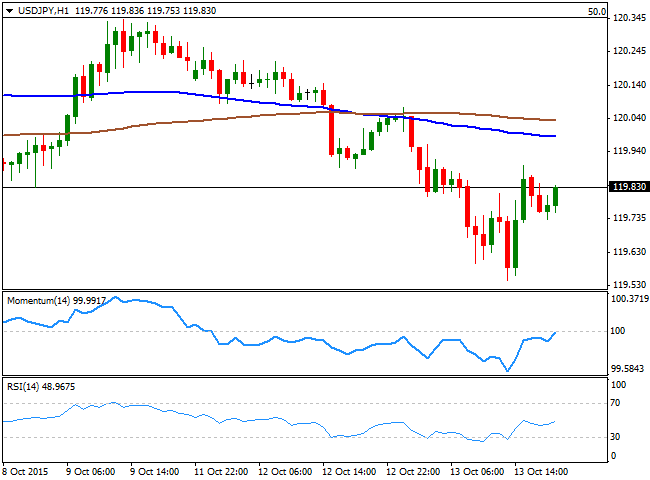

USD/JPY Current price: 119.83

View Live Chart for the USD/JPY

The USD/JPY pair continues going nowhere far, ending the day 20 pips lower after trading as low as 119.54 during the day. The Japanese yen was favored by plummeting stocks in Asia, as the Chinese Trade Balance for September, showed that imports decreased by 17,7% fueling concerns over the global economic slowdown. The pair maintains a limited negative tone, considering that it extended further lower for a second day in-a-row, but the range prevailed for one more day. Technically, the 1 hour chart shows that the price is well below its 100 and 200 SMAs, whilst the technical indicators corrected the oversold readings reached earlier in the day and are now flat below their mid-lines. In the 4 hours chart, the price is now below its 100 and 200 SMAs that continue to lack directional strength, whilst the technical indicators present strong bearish slopes below their mid-lines. The key support for the upcoming hours comes at 119.35, the 38.2% retracement of the pair's latest weekly decline, and a break below it could lead to a continued decline towards the 118.55 level, the base of these last two months' range.

Support levels: 119.35 118.90 118.55

Resistance levels: 120.05 120.35 120.70

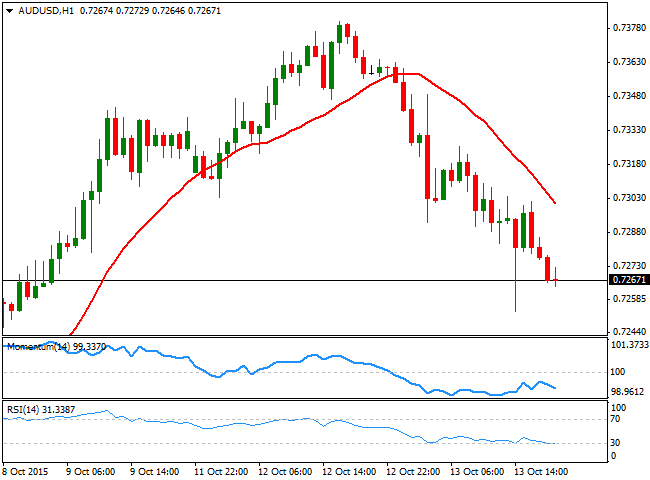

AUD/USD Current price: 0.7267

View Live Chart for the AUD/USD

The Aussie took a hit from Chinese data, ending the day sharply lower against the greenback around 0.7270. Additionally, the pair has corrected the extreme overbought readings achieved after a steady 10-days' advance, and further declines will now depend on markets' mood during the upcoming Asian session, when China will release its September inflation figures. The pair fell down to 0.7253 before bouncing some, but was unable to recover, despite gold prices re-surged during the American session. The short term picture favors another leg lower, as the price is below a strongly bearish 20 SMA, whilst the Momentum indicator heads south below its 100 level, and the RSI indicator consolidates in oversold territory. In the 4 hours chart, a bearish continuation is also likely, as the technical indicators head strongly lower below their mid-lines, whilst the price is well below a still bullish 20 SMA. Only a steady recovery beyond 0.7310, the immediate resistance, can help the pair in recovering its bullish strength and send it back towards the 0.7400 price zone.

Support levels: 0.7250 0.7220 0.7175

Resistance levels: 0.7310 0.7350 0.7390

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains near 1.0300 after US PMI data

EUR/USD trades in positive territory at around 1.0300 on Friday. The pair breathes a sigh of relief as the US Dollar rally stalls, even as markets stay cautious amid geopolitical risks and Trump's tariff plans. US ISM PMI improved to 49.3 in December, beating expectations.

GBP/USD holds around 1.2400 as the mood improves

GBP/USD preserves its recovery momentum and trades around 1.2400 in the American session on Friday. A broad pullback in the US Dollar allows the pair to find some respite after losing over 1% on Thursday. A better mood limits US Dollar gains.

Gold retreats below $2,650 in quiet end to the week

Gold shed some ground on Friday after rising more than 1% on Thursday. The benchmark 10-year US Treasury bond yield trimmed pre-opening losses and stands at around 4.57%, undermining demand for the bright metal. Market players await next week's first-tier data.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.