EUR/USD Current price: 1.1265

View Live Chart for the EUR/USD

Central Banks led the way this Thursday, resulting in a continued decline in the greenback towards fresh weekly lows against most of its rivals. During the European session, the ECB Account of the monetary policy meeting offered a generally dovish tone, with the European Central Bank seeing the downward risk for inflation increasing, and reasserting the full implementation of QE until September 2016 or beyond. Officers were also concerned over the slowdown in emerging markets weighing in global growth, whilst they reckon that the local recovery has been weaker than previously expected. The EUR/USD pair retreated from its session high around 1.1314, and fell down to 1.1237, from where it slowly recovered ahead of the FOMC Minutes. The US Central bank said that many members see that the conditions for a liftoff can be met this year, and pledged for a hike before the year end. They also expressed their concerns about low inflation levels, and the economic slowdown in emerging markets. The meeting was held before the latest awful payroll, and market is understanding that the latest developments will keep the FED on hold.

The EUR/USD pair broke higher and extended up to 1.1326, but failed to sustain gains above the 1.1300 level, and fell back below the 1.1280 level, putting in doubt any additional gains in the common currency. Despite being above the daily descendant trend line coming from 1.1713, the short term picture is far from bullish as the 1 hour chart shows that the technical indicators turned lower in positive territory, whilst the 20 SMA offers an immediate support in the 1.1260 region. In the 4 hours chart, the technical indicators are also turning south above their mid-lines, , whilst the price is now well above its moving averages, that anyway lack directional strength . As long as the price holds above the 1.1250 level, the downside seems limited, yet a break below it should be pretty discouraging for bulls, and anticipate some further intraday declines for this Friday.

Support levels: 1.1260 1.1220 1.1165

Resistance levels: 1.1300 1.1335 1.1370

EUR/JPY Current price: 135.36

View Live Chart for the EUR/JPY

The EUR/JPY pair traded higher in range this Thursday, up to 135.59 in the American afternoon, before easing some amid an overall weak EUR. The Japanese yen had no life of its own for most of this week, and despite the lack of EUR demand, the pair has a mild bullish tone in the short term, as the 1 hour chart shows that it has met buying interest on declines towards the 100 SMA, currently heading higher around 135.00, whilst the technical indicators hold in positive territory, although lacking directional strength. In the 4 hours chart, the price is a handful of pips above its 100 and 200 SMAs that anyway present bearish slopes, whilst the Momentum indicator turned lower above its 100 level and the RSI aims slightly higher around 58, failing to signal a steady continuation for the upcoming session.

Support levels: 135.00 134.60 134.20

Resistance levels: 135.70 136.20 136.60

GBP/USD Current price: 1.5345

View Live Chart for the GPB/USD

The British Pound advanced to a fresh 4-week high against the greenback of 1.5371 during the European morning, retreating from it after the BOE's monthly economic policy meeting. The Bank of England maintained its economic policy unchanged as largely expected, while MPC officers voted again 1-8. Also, officers expressed their concerns over the strength of the currency, and downgraded its inflation expectations, now seen below 1% until 2016 spring. Alongside with the release of US Federal Reserve's Minutes, BOE's Governor Carney hit the wires, saying that there is not a certain timing for a rate hike in the UK, but the decision will come into sharper relief around year end. He added that the timing of a FED move is not decisive for the BOE. The GBP/USD recovered up to the mentioned daily high after being as low as 1.5260 early in the US session, and the 1 hour chart shows that the price is well above its 20 SMA and that the technical indicators head sharply higher above their mid-lines. In the 4 hours chart, the price is still struggling to overcome its 200 EMA, but the technical readings are generally bullish supporting additional gains particularly on a break above 1.5385, the 50% retracement of the latest daily decline.

Support levels: 1.5315 1.5260 1.5220

Resistance levels: 1.5385 1.5430 1.5480

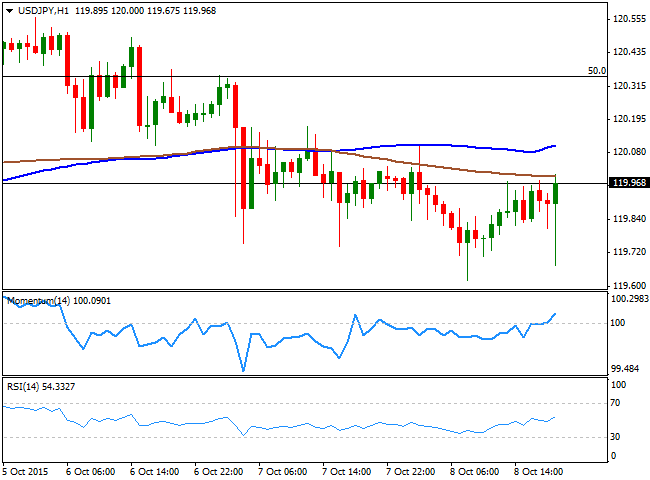

USD/JPY Current price: 119.97

View Live Chart for the USD/JPY

The USD/JPY pair remains glued to the 120.00 region, having been as low as 119.62 earlier in the day. Trading in range, the pair initially fell after the FOMC Minutes' release, but quickly bounced following a strong advance in commodities and stocks. The pair however, was unable to advance beyond the 120.00 level and the 1 hour chart shows that the price is below its 100 and 200 SMAs, whilst the technical indicators are barely aiming higher around their mid-lines. In the 4 hours chart, the downside is favored given that the price is below its moving averages, whilst the technical indicators present slight bearish slopes below their mid-lines. The key support comes at 119.35, the 38.2% retracement of the latest weekly decline, with a break below it required to confirm a steadier decline towards the base of the latest range in the 118.50 region.

Support levels: 119.60 119.35 118.90

Resistance levels: 120.35 120.70 121.00

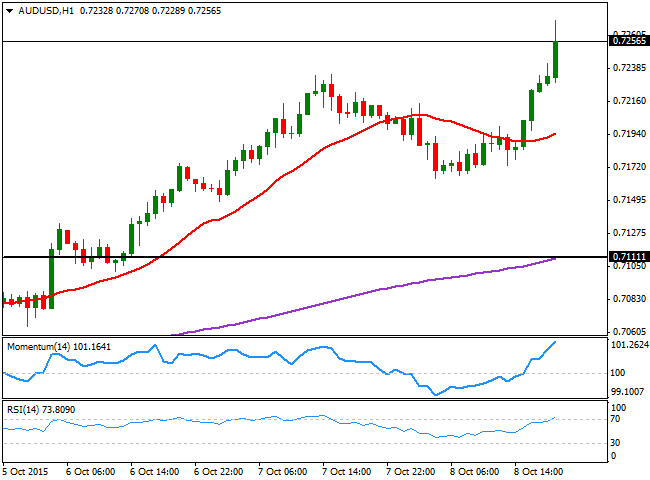

AUD/USD Current price: 0.7257

View Live Chart for the AUD/USD

The AUD/USD rose to its highest level since mid September, reaching 0.7270 in the American afternoon, and holding nearby ahead of the close. Commodities surged following the release of the FED's Minutes, although gold retreated quickly from above $1,150 a troy ounce. As for the AUD/USD pair, the 1 hour chart shows that the technical indicators head higher, despite being in extreme overbought territory, whilst the 20 SMA turned higher around the 0.7200 level. In the 4 hours chart, the pair is clearly bullish, with the technical indicators losing their upward strength, but holding in overbought territory, whilst the 20 SMA maintains a sharp bullish slope well below the current price, and having crossed above the 200 EMA. September high stands at 0.7279, which means that a break above it is required to confirm a new leg higher towards the 0.7400 figure for this Friday.

Support levels: 0.7240 0.7190 0.7150

Resistance levels: 0.7280 0.7320 0.7365

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds on to intraday gains after upbeat US data

EUR/USD remains in positive ground on Friday, as profit-taking hit the US Dollar ahead of the weekend. Still, Powell's hawkish shift and upbeat United States data keeps the Greenback on the bullish path.

GBP/USD pressured near weekly lows

GBP/USD failed to retain UK data-inspired gains and trades near its weekly low of 1.2629 heading into the weekend. The US Dollar resumes its advance after correcting extreme overbought conditions against major rivals.

Gold stabilizes after bouncing off 100-day moving average

Gold trades little changed on Friday, holding steady in the $2,560s after making a slight recovery from the two-month lows reached on the previous day. A stronger US Dollar continues to put pressure on Gold since it is mainly priced and traded in the US currency.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.