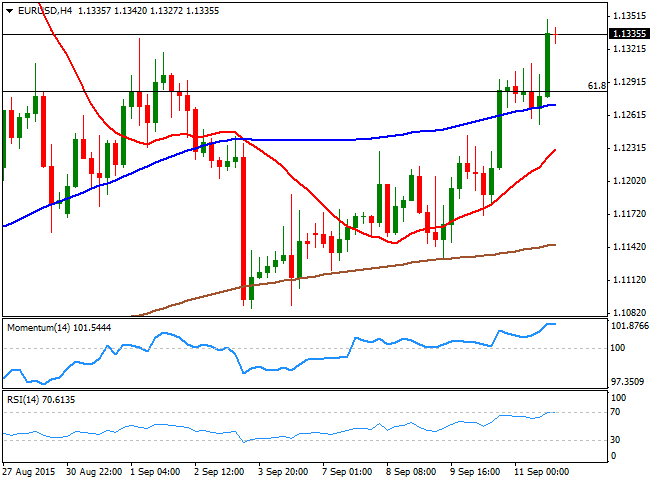

EUR/USD Current price: 1.1335

View Live Chart for the EUR/USD

The common currency closed the week with some solid gains against its American rival, with the EUR/USD pair ending at 1.1335, the highest since August 27th. Investors struggled to find reasons to buy the greenback, as tepid US data left high levels of uncertainty on what the FED may decide this Wednesday. While a rate hike is still possible, most traders are betting on a delay towards next December.

China also had its saying, with fears of an economic slowdown spreading through other major economies, still weighing on sentiment. Over the weekend, news showed that China’s industrial production growth remained weak in August, reaching 6.1% compared to a year before, but marginally higher from the 6.0% printed last month. Also, growth in fixed asset investment slowed to its lowest rate growth in over three years in August, down to 9.2% from 10.3% previous.

Technically, bulls continue dominating the pair, as the daily chart shows that the rally extended well above its 100 DMA in the 1.1100 region, whilst the 20 SMA heads higher around 1.1275, reinforcing the static support placed at 1.1282, the 61.8% retracement of its latest bullish run. In the same chart, the Momentum indicator is around its 100 level with a sharp upward slope, whilst the RSI indicator heads higher around 59. In the 4 hours chart the price is also above a bullish 20 SMA, although the technical indicators have lost upward strength and turned flat, with the RSI at 70. The immediate resistance comes at 1.1365, the 50% retracement of the same rally, with a break above it favoring a steady continuation towards the 1.1440/50 price zone.

Support levels: 1.1315 1.1280 1.1240

Resistance levels: 1.1365 1.1400 1.1445

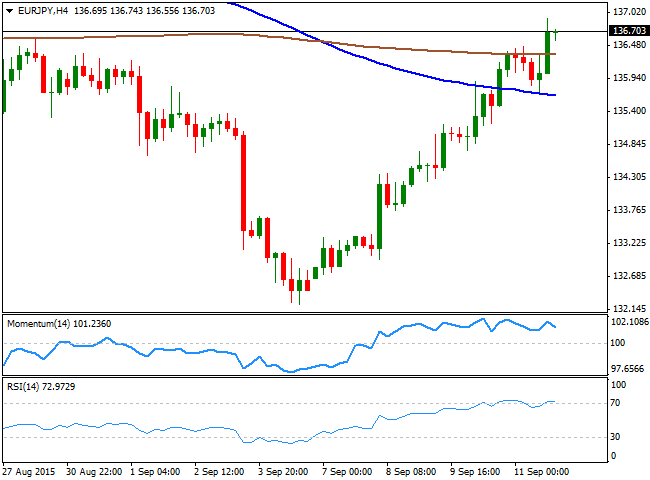

EUR/JPY Current price: 136.70

View Live Chart for the EUR/JPY

The EUR/JPY advanced on the back of EUR's strength, with the JPY slightly weak amid a soft positive close in worldwide stocks. The pair reached advanced up to 136.92 last Friday, and closed the day a few pips below it, and right above its 100 DMA, whilst in the same chart, the technical indicators maintain their bullish slopes after crossing their mid-lines towards the upside, supporting additional gains for this Monday. In the 4 hours chart, however, the technical indicators are giving signs of upward exhaustion in overbought levels, although the price is above its moving averages, not yet confirming a downward corrective move. The immediate support stands at 136.30, and a pullback to the level is possible, yet the price needs to extend below the level to confirm a downward continuation for the upcoming sessions.

Support levels: 136.30 135.80 135.35

Resistance levels: 137.20 137.70 138.20

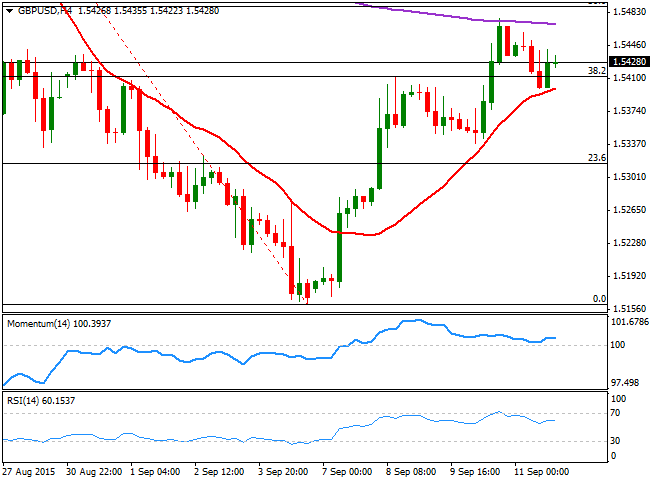

GBP/USD Current price: 1.5428

View Live Chart for the GPB/USD

The British Pound corrected higher against the greenback last week, but the pair failed to retake the 1.5500 level, closing at 1.5428. BOE's inflation report showed that policy makers expect inflation to remain near zero during the upcoming months, although expectations were revised higher from 2.0% to 2.2%. Pound's rally lost steam afterwards, but the GBP/USD pair hold above the 38.2% retracement of its latest daily decline around 1.5410, now the immediate support. Technically, the daily chart shows that the price is actually converging with a still bearish 20 SMA, whilst the RSI indicator lost upward strength around 49 and the Momentum indicator heads higher, but below the 100 level, all of which limits chances of a stronger advance. In the 4 hours chart, the price failed to advance beyond the 200 EMA, currently around 1.5470, whilst the technical indicators are horizontal above their mid-lines, losing the upward strength seem earlier this week. At this point, the price needs to extend beyond 1.5490, the 50% retracement of the mentioned slide, to recover further over the upcoming sessions.

Support levels: 1.5410 1.5365 1.5320

Resistance levels: 1.5450 1.5490 1.5525

USD/JPY Current price: 120.58

View Live Chart for the USD/JPY

The USD/JPY pair managed to close the week with gains, albeit the recovery stalled at 121.35, the 61.8% retracement of its latest bearish run. Both Central Banks, the BOJ and the FED, will have their monthly economic meetings during the upcoming days, and whilst the BOJ is largely expected to remain on hold, the FED can rock the financial world by announcing a rate hike, for the first time in almost a decade. Therefore, the pair will likely trade range bound ahead of the news, in between 120.00 and 121.35. Technically, the daily chart shows that the price has been unable to advance beyond its 200 DMA, a few pips below the mentioned Fibonacci retracement, whilst the Momentum indicator turned south and it's about to signal a bearish breakout, whilst the RSI indicator already heads south around 46, all of which favors the downside. In the 4 hours chart, the pair presents a neutral-to-bearish stance, as the Momentum indicator heads lower below the 100 level, whilst the RSI stands flat around 53.

Support levels: 120.35 120.00 119.60

Resistance levels: 120.90 121.35 121.80

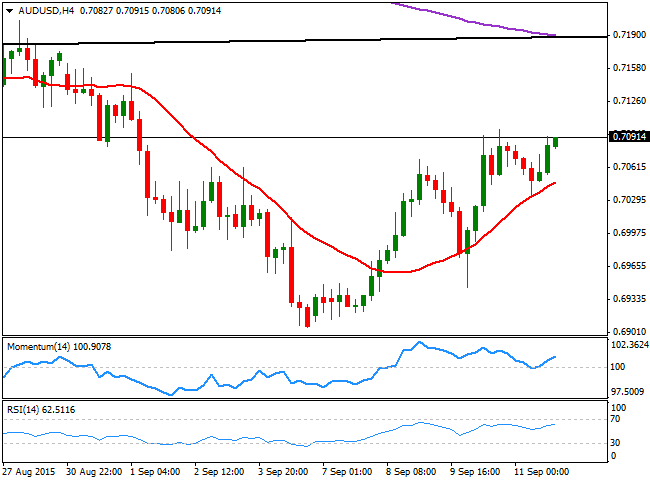

AUD/USD Current price: 0.7091

View Live Chart for the AUD/USD

The AUD/USD pair closed the week with gains at 0.7091, as the Aussie got support from a better-than-expected local jobs report released last Thursday that sent the pair close to the 0.7100 figure, still a major resistance. Australian unemployment rate dropped in August to 6.2% as expected, while the economy managed to create 17.400 new jobs, tripling expectations. The pair also found support from improved inflation readings in China, although giving the fragility of the second world's largest economy, the Aussie is in risk of suffering sudden declines. Technically, the upside is still seen limited as the price has stalled below a bearish 20 SMA, whilst the technical indicators have lost their upward strength below their mid-lines, after correcting extreme oversold readings reached the previous week. Shorter term, the 4 hours chart presents a bullish tone, given that the 20 SMA heads higher below the current price, providing an immediate support around 0.7040, whilst the technical indicators maintain their bullish slope after bouncing from their mid-lines.

Support levels: 0.7040 0.7000 0.6965

Resistance levels: 0.7105 0.7135 0.7170

Recommended Content

Editors’ Picks

EUR/USD treads water just above 1.0400 post-US data

Another sign of the good health of the US economy came in response to firm flash US Manufacturing and Services PMIs, which in turn reinforced further the already strong performance of the US Dollar, relegating EUR/USD to the 1.0400 neighbourhood on Friday.

GBP/USD remains depressed near 1.2520 on stronger Dollar

Poor results from the UK docket kept the British pound on the back foot on Thursday, hovering around the low-1.2500s in a context of generalized weakness in the risk-linked galaxy vs. another outstanding day in the Greenback.

Gold keeps the bid bias unchanged near $2,700

Persistent safe haven demand continues to prop up the march north in Gold prices so far on Friday, hitting new two-week tops past the key $2,700 mark per troy ounce despite extra strength in the Greenback and mixed US yields.

Geopolitics back on the radar

Rising tensions between Russia and Ukraine caused renewed unease in the markets this week. Putin signed an amendment to Russian nuclear doctrine, which allows Russia to use nuclear weapons for retaliating against strikes carried out with conventional weapons.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.