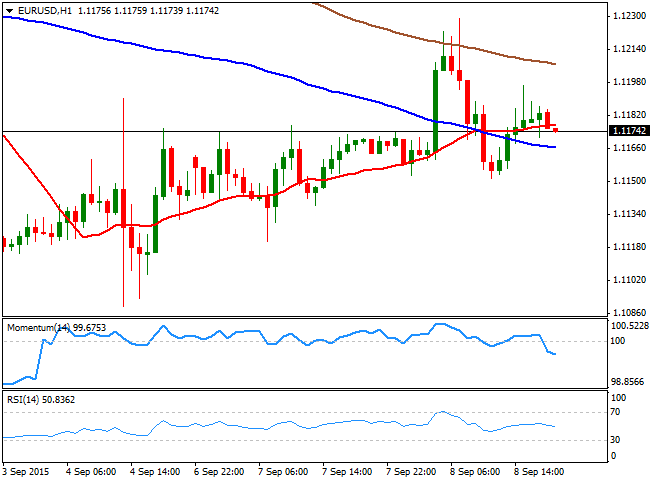

EUR/USD Current price: 1.1174

View Live Chart for the EUR/USD

Investors recovered their optimism this Tuesday, as Chinese shares market advanced 2.92%, despite poor Chinese export and import figures. The dollar and the yen were mostly offered across the board, whilst all of the major indexes closed in the green. The EUR/USD pair advanced up to a daily high of 1.1228, amid a strong European opening, but was unable to sustain gains beyond the 1.1200 figure, spending most of the American session consolidating around the 1.1160 region. The common currency failed to attract buyers as the ECB pledged for most stimulus during its latest meeting, highlighting the fragility of the local economy.

Technically, the short term picture has turned bearish for the pair, as the price stands below its 20 SMA in the 1 hour chart, whilst the technical indicators head slightly lower below their mid-lines. In the 4 hours chart, however, the pair presents a neutral stance, as it holds a few pips above a flat 20 SMA, whilst the technical indicators lack directional strength around their mid-lines. The pair has a strong static support at 1.1120, also the weekly low, and it will take a break below it to confirm additional declines whilst some steady gains beyond 1.1230, should favor a bullish day for this Wednesday.

Support levels: 1.1120 1.1080 1.1050

Resistance levels: 1.1190 1.1230 1.1265

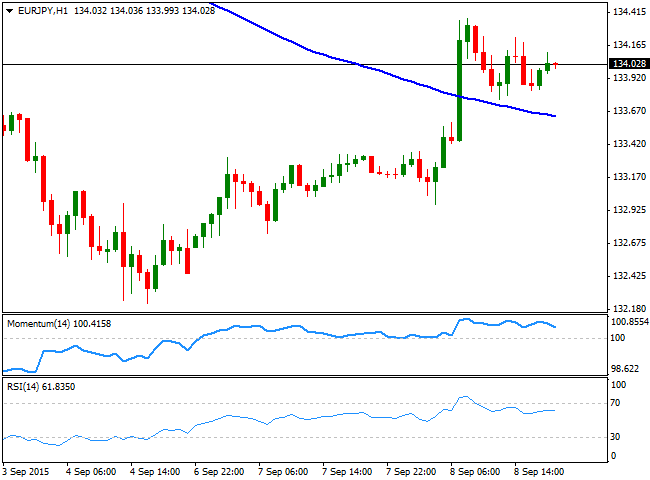

EUR/JPY Current Price: 134.02

View Live Chart for the EUR/JPY

The EUR/JPY advanced on the back of a weaker yen, with the pair surging up to 134.37. A better than expected Japanese GDP in the Q2 was not enough to help the Asian currency that fell purely on risk sentiment. In Japan, the Q2 GDP resulted at -0.3% against previous -0.4% expected, whilst the annualized figure resulted at -1.2%, against expectations of -1.8%. As for the EUR/JPY, the 1 hour chart shows that the price is hovering around the 134.00 figure, above a bearish 100 SMA around 133.60, whilst the technical indicators have lost their upward strength and head lower above their mid-lines, supporting a short term slide ahead. In the 4 hours chart however, the Momentum indicator heads higher well above the 100 level, whilst the RSI bounced from its mid-line and also heads north, currently around 52, suggesting the pair may resume its advance.

Support levels: 133.60 133.25 132.80

Resistance levels: 134.40 134.60 135.00

GBP/USD Current price: 1.5382

View Live Chart for the GPB/USD

The British Pound was among the best performers this Tuesday, extending its upward corrective movement against the greenback to 1.5411, reaching the 38.2% retracement of the 1.5817/1.5161 decline, by the pip. Pound's strength was the result of the announcement of a series of M&A, as Mitsui Sumitomo acquired Amlin for £3.5bln and MBK purchased Tesco’s South Korean business for £ 4.2bln on Monday. The pair retreated from the high, but found intraday buying interest around 1.5350, now the immediate support. Technically, the 1 hour chart shows that 20 SMA heads sharply higher below the current level, whilst the RSI consolidates around 66. The Momentum indicator however, is heading lower from overbought territory, not enough to confirm a bearish breakout, but maintaining the upside limited in the short term. In the 4 hours chart, the technical indicators maintain a strong upward momentum, despite being in overbought territory, whilst the 20 SMA is finally turning north well below the current level, supporting additional gains on a break above the 1.5410 level.

Support levels: 1.5350 1.5315 1.5280

Resistance levels: 1.5410 1.5450 1.5490

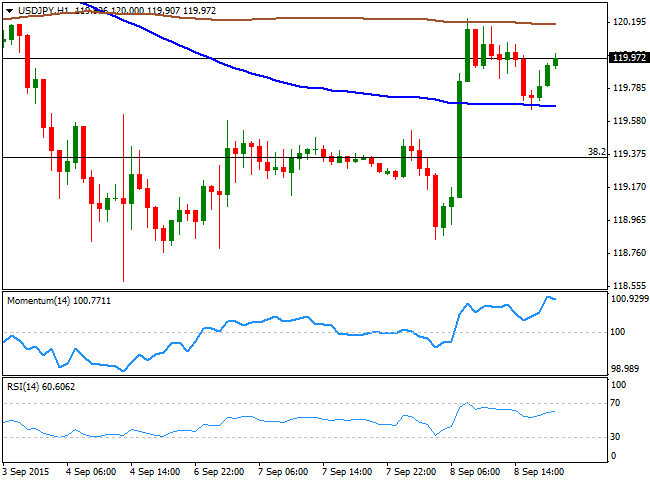

USD/JPY Current price: 119.97

View Live Chart for the USD/JPY

The USD/JPY pair advanced up to 120.22, a fresh 6-day, as risk appetite took over financial markets, following an advance in Chinese stocks. The pair however, was unable to extend its gains beyond the high posted early Europe, and retreated back below the 120.00 figure, where it consolidated for most of the American session. The 1 hour chart shows that the pair found selling interest around a horizontal 200 SMA, although it later held above the 100 SMA, currently around 119.65, the immediate support. In the same chart, the Momentum indicator is turning slightly lower near overbought levels, whilst the RSI indicator holds near 60, lacking upward strength, but far from suggesting a downward movement. In the 4 hours chart the technical indicators maintain their positive tone above their mid-lines, yet the pair needs to extend beyond 120.40, the 50% retracement of the latest weekly slump, to be able to extend its gains towards the 121.00 region.

Support levels: 119.65 119.25 118.90

Resistance levels: 120.10 120.40 120.85

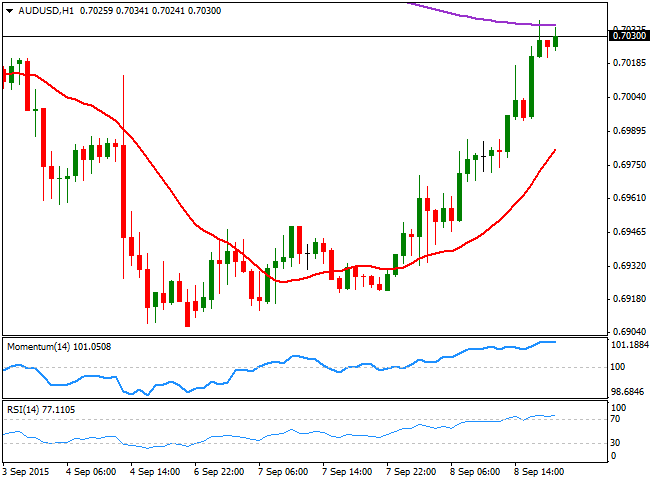

AUD/USD Current price: 0.7030

View Live Chart for the AUD/USD

The Aussie was among the most benefited this Tuesday, supported by a recovery not only in stocks, but also in commodities. Additionally, better-than-expected Australian business confidence in August supported the antipodean currency, ahead of Thursday employment figures. The AUD/USD pair extended up to 0.7037 in the American afternoon, and held above the 0.7000 level by the end of the day, looking slightly overbought in the short term, as the technical indicators are now flat in extreme overbought territory, whilst the 20 SMA heads strongly higher well below the current level. In the 4 hours chart, the Momentum indicator heads sharply higher well above its 100 level, whilst the RSI maintains its upward strength around 60, both supporting further advances for the upcoming sessions. The long term picture however, is still bearish, as it will take a recovery at least above the 0.7200 level to confirm an interim bottom in the pair, with scope then to advance up to the 0.7440/60 price zone.

Support levels: 0.7000 0.6965 0.6930

Resistance levels: 0.7040 0.7090 0.7135

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains near 1.0300 after US PMI data

EUR/USD trades in positive territory at around 1.0300 on Friday. The pair breathes a sigh of relief as the US Dollar rally stalls, even as markets stay cautious amid geopolitical risks and Trump's tariff plans. US ISM PMI improved to 49.3 in December, beating expectations.

GBP/USD holds around 1.2400 as the mood improves

GBP/USD preserves its recovery momentum and trades around 1.2400 in the American session on Friday. A broad pullback in the US Dollar allows the pair to find some respite after losing over 1% on Thursday. A better mood limits US Dollar gains.

Gold retreats below $2,650 in quiet end to the week

Gold shed some ground on Friday after rising more than 1% on Thursday. The benchmark 10-year US Treasury bond yield trimmed pre-opening losses and stands at around 4.57%, undermining demand for the bright metal. Market players await next week's first-tier data.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.