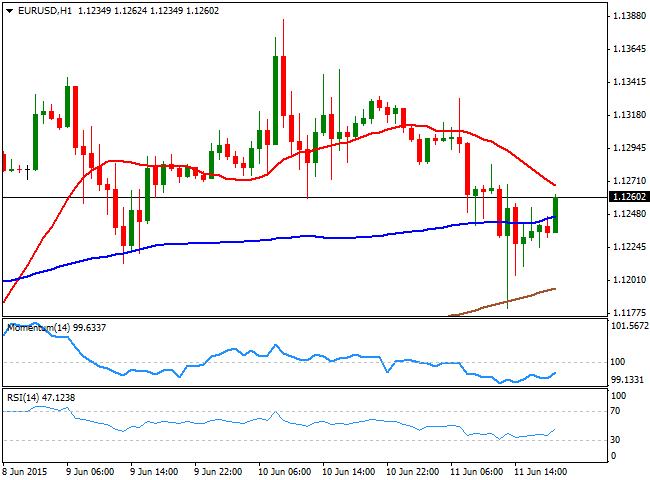

EUR/USD Current price: 1.1260

View Live Chart for the EUR/USD

The American dollar saw some demand this Thursday, advancing against most of its major rivals, albeit far from regaining the green weekly basis. The European session started with a tepid uptick in German Bund yields that traded up to 1.03% intraday, but for once, failed to boost the common currency. The EUR/USD pair was under mild pressure until the release of US data, which showed that Retail Sales in May surged above expected, up 1.2% from an expected recovery of 1.1%, whilst the ex-autos figure came out also above expected, at 1.0% against 0.7%. At the same time, the country released its weekly unemployment claims that resulted slightly below expected for the week ending May 29, up to 279K. The EUR/USD fell down to 1.1181, but quickly reversed north, extending up to 1.1268 before stalling. German bunds turned lower, down to 0.9% weighing on the common currency, whilst the IMF said that its latest negotiations with Greece had failed, and no progress has been made towards a deal.

The EUR/USD pair ended the day above the 1.1200 level, but seems biased lower in the short term, as the 1 hour chart shows that after bouncing from its 200 SMA earlier in the day, the price is now below a bearish 20 SMA, whilst the technical indicators head lower in negative territory. In the 4 hours chart, the price holds below a bullish 20 SMA, whilst the indicators present a neutral stance, lacking direction around their mid-lines. Renewed selling pressure below the 1.1210 level should expose the pair to additional declines intraday, with the next big support at 1.1160 for this Friday.

Support levels: 1.1210 1.1160 1.1120

Resistance levels: 1.1280 1.1320 1.1360

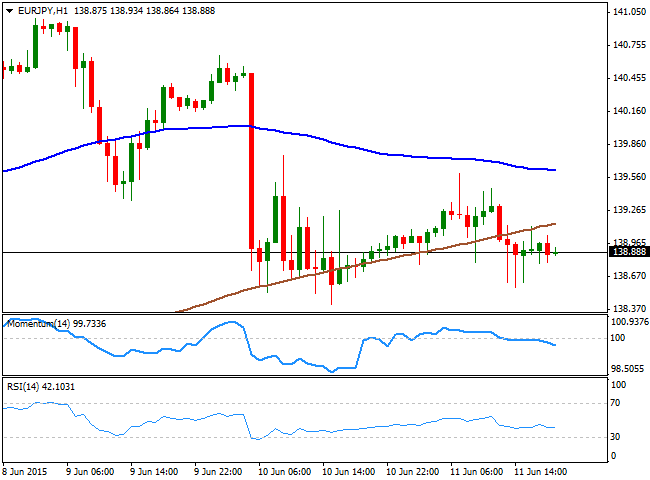

EUR/JPY Current price: 138.88

View Live Chart for the EUR/JPY

The EUR/JPY ended the day slightly lower, as both currencies were equally weak against the greenback on Thursday. There was no relevant data in Japan, although the country will release some manufacturing figures during the upcoming Asian session that may affect briefly JPY crosses. In the meantime, the technical picture presents a mild bearish tone, as the price is developing below its 100 and 200 SMAs, with the shortest around 139.20, acting as key intraday resistance, whilst the technical indicators present tepid bearish slopes below their mid-lines. In the 4 hours chart, the picture is not that clear, as the price remains well above strongly bullish moving averages, whilst the Momentum indicator has turned north, but still below its mid-line, whist the RSI indicator lacks directional strength around 44. A bearish acceleration below 138.45 is required to confirm additional declines, towards the 137.40 region, a strong static support area.

Support levels: 138.45 137.90 137.40

Resistance levels: 139.20 139.65 140.10

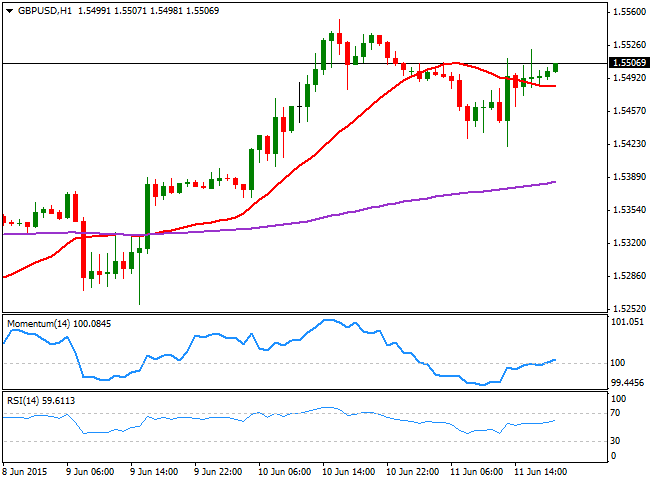

GBP/USD Current price: 1.5506

View Live Chart for the GBP/USD

The GBP/USD pair recovered the 1.5500 level, having bounced sharply from a daily low set at 1.5420 following the release of US data. The Pound has been looking more constructive against its rivals, ever since detaching from the EUR mid last week, with investors regaining confidence in the UK economic recovery. The GBP/USD pair has been slowly grinding higher in the American afternoon, having been as high as 1.5521. Technically, the 1 hour chart shows that the price is holding above a flat 20 SMA, whilst the technical indicators are barely above their mid-lines, with a limited upward strength at the time being. In the 4 hours chart however, the 20 SMA heads higher now around 1.5420, the daily low, whilst the Momentum indicator has turned sharply higher in positive territory, and the RSI also aims north around 64, all of which supports additional gains, particularly on a break above 1.5553, the weekly high posted last Wednesday.

Support levels: 1.5460 1.5420 1.5380

Resistance levels: 1.5525 1.5555 1.5600

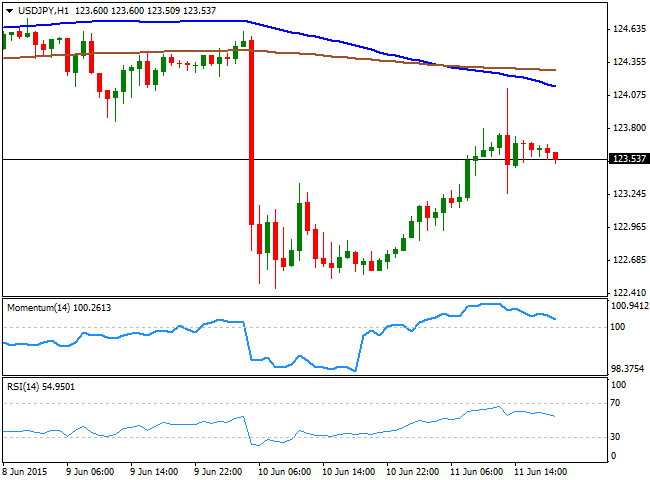

USD/JPY Current price: 123.53

View Live Chart for the USD/JPY

The Japanese yen stalled its recovery from the 13-year low posted last Friday against the greenback, as the USD/JPY pair ended the day up around 123.50. The pair posted a short-lived spike up to 124.13 following the release of US Retail Sales, but quickly turned lower, unable to sustain gains beyond the 124.00 level. The pair seems poised to extend its decline in the short term, as the 1 hour chart shows that the early advance stalled right below its 100 SMA that has crossed below the 200 SMA for the first time since May 20th, now providing an immediate intraday resistance around 124.10. In the same chart, the technical indicators have retreated from overbought levels and continue to head lower towards their mid-lines. In the 4 hours chart, the price is now hovering around its 100 SMA, whilst the technical indicators have corrected extreme oversold readings, but are now losing upward strength below their mid-lines, supporting the shorter term view, particularly on a downward extension below 123.30, the immediate support.

Support levels: 123.30 122.90 122.55

Resistance levels: 124.10 124.45 124.90

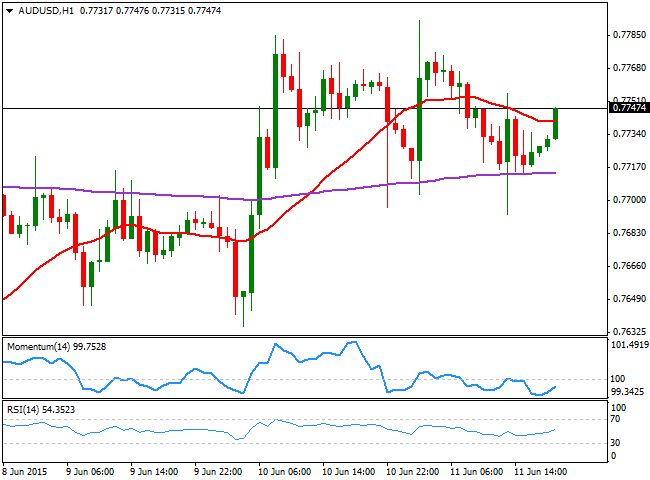

AUD/USD Current price: 0.7747

View Live Chart for the AUD/USD

The Australian dollar gained against all of its rivals during the Asian session, following the release of a stellar job report for May, showing that the economy added 42,000 new jobs, whilst the unemployment rate fell down to 6.0%. The AUD/USD pair recovered up to 0.7792, where it established a fresh weekly high, after flirting with the 0.7700 earlier in the day. The 1 hour chart shows, however, little upward potential as the price is now aiming to extend above its 20 SMA, but the technical indicators remain below their mid-lines. In the 4 hours chart, the technical picture is biased higher, as the price held above a bullish 20 SMA, whilst the technical indicators bounced from their mid-lines and maintain their bullish slopes. Nevertheless, the 200 EMA continues to cap the upside around 0.7780, and it will take a clear break above this level to confirm an upward extension for the upcoming sessions.

Support levels: 0.7720 0.7670 0.7630

Resistance levels: 0.7780 0.7830 0.7880

Recommended Content

Editors’ Picks

AUD/USD turns south toward 0.6500 as US Dollar finds fresh demand

AUD/USD hs turned south toward 0.6500 in Asian trading on Wednesday. The pair lacks bullish conviction after the PBOC left the Lona Prime Rates unchanged. Escalating Russia-Ukraine geopolitical tensions and renewed US Dollar demand keep the Aussie on the edge ahead of Fedspeak.

USD/JPY jumps back above 155.00 as risk sentiment improves

USD/JPY has regained traction, rising back above 155.00 in Wednesday's Asian session. A renewed US Dollar uptick alongside the US Treasury bond yields and an improving risk tone counter Japanese intervention threats and Russia-Ukraine tensions, allowing the pair to rebound.

Gold advances to over one-week high on rising geopolitical risks

Gold price (XAU/USD) attracts some follow-through buying for the third consecutive day on Wednesday and climbs to a one-and-half-week high, around the $2,641-2,642 region during the Asian session.

UK CPI set to rise above BoE target in October, core inflation to remain high

The UK CPI is set to rise at an annual pace of 2.2% in October after increasing by 1.7% in September, moving back above the BoE’s 2.0% target. The core CPI inflation is expected to ease slightly to 3.1% YoY in October, compared with a 3.2% reading reported in September.

How could Trump’s Treasury Secretary selection influence Bitcoin?

Bitcoin remained upbeat above $91,000 on Tuesday, with Trump’s cabinet appointments in focus and after MicroStrategy purchases being more tokens.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.