_20151027141420.jpg)

The fact is that, despite the US economy has made significant progress on the employment front, inflation is still a rock in FED's shoe. Inflation, in all of its forms, remains subdued, closer to deflationary levels than to the 2.0% ideal. Anyway, Ms. Yellen is confident that it would return to normal levels, as in its latest congressional hearing she remarked that data fits criteria for increasing rates.

A non-spoken reason on why the Central Bank waited so much was fears of a panic-selling turn-around in stocks, but at this point, a lift-off has been largely priced in. The most likely scenario is a 25bp rate hike, to a range of 0.25% to 0.50%, pretty much what the market is expecting. What may determinate the dollar's tone following the move can be a revision of the inflation and growth outlooks, yet with the winter holidays around the corner, and the year-end seems hard to determinate how the market will react.

Anyway, a rate hike alongside with a hawkish stance should lead to some steady dollar gains into the weekend. Yellen should also offer a discrete outlook of the upcoming pace of rate hikes.

In the unlikely case of an on-hold stance, the Federal Reserve risks more than just a weaker dollar. They risk losing their credibility, which will be much more harmful for the US than a rate hike.

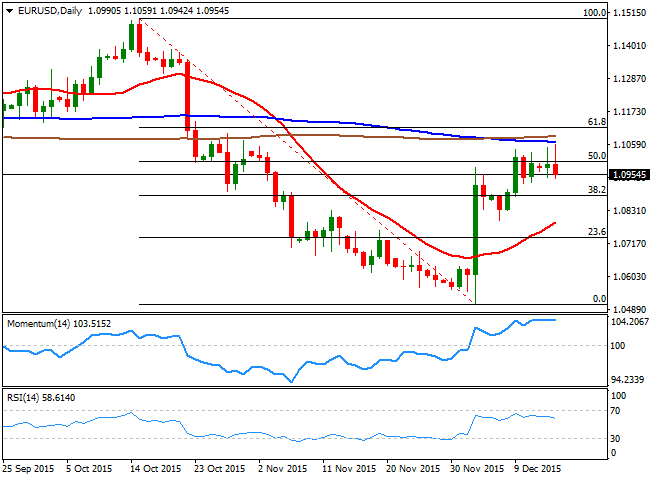

EUR/USD technical outlook

The EUR/USD pair has been clearly bullish ever since the month started, following the ECB's soft announcement on QE, well below markets expectations. The advance was quite convenient ahead of a US rate hike, as the dollar is around 500 pips away from its year high against the common currency, and therefore the risk of an excessive strength has been diminished. Anyway, a 0.25% rate hike won't be surprise enough to send the greenback soaring, but indeed should be supportive of the American currency.

Technically speaking, the pair has failed to sustain gains beyond the critical 1.1000 figure after recovering from the monthly low at 1.0505, having met selling interest around its 100 DMA. Also this latest recovery represents an upward corrective movement of the 50% of the October high/December low decline, and if the price is unable to recoup the 1.1000 level, and extend beyond it, the risk is towards a new bearish trend in the mid-term.

The initial bearish target, in the case of dollar's demand comes at 1.0880, the 38.2% retracement of the same decline, whilst additional slides can extend down to 1.0795, December 12th daily low. Towards the upside on the other hand, the level to watch is 1.1045, as a steady advance beyond it should lead to a continued advance up to 1.1120, while further gains above it will only confirm a bullish continuation into 2016.

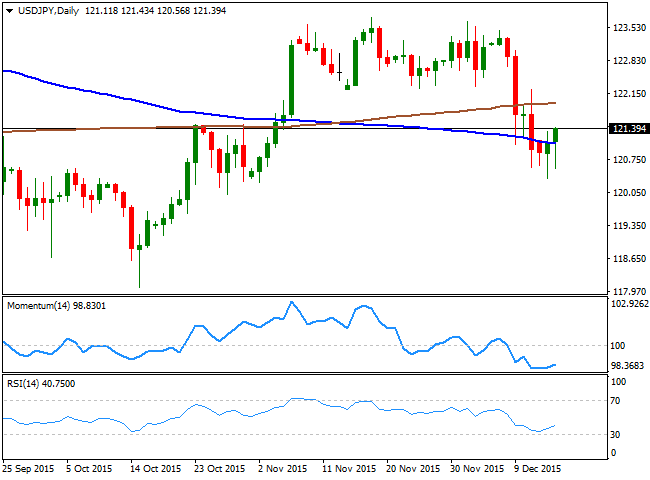

USD/JPY technical outlook

The USD/JPY has entered in bearish mode last week, after breaking below the 122.20 level, the base of the previous two-month range. The pair will be among the most interesting this Wednesday, as its usually extremely sensitive to first line US data, which means it could react sharply, even despite if the FED fails to surprise. The pair seems to be recovering some ground, advancing above its 100 DMA for the first time in three days, but still around 100 pips below the mentioned breakout point.

Daily basis, the technical picture is still favoring the downside, as the technical indicators have barely corrected extreme oversold readings, and remain well below their midlines. For this Wednesday, an advance beyond 121.60 should lead to an advance up to 122.20, while a stronger recovery above this last, exposes the 123.00 level. Below 121.00 on the other hand, and with a dovish tone from the US Federal reserve, the pair can slide down to 119.80, with a weekly close below this level opening doors for another 100 pips decline.

-------

What will 2016 bring to the Forex traders? Attend our event, Forex Forecast 2016 - The Panel with Ashraf Laidi, Valeria Bednarik, Boris Schlossberg, Adam Button, Ivan Delgado and Dale Pinkert. Register for the live event on Dec. 18th and get the recording too.

-------

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.