The European Central Bank is heading into the first economic policy meeting of this 2016 and market participants agree that no new measures will be announced this Thursday.

Following a painful battle between doves and hawks, the Governing Council finally decided to extend QE last December, but refrained from expanding it. That means that, while it would be extended in term up to March 2017 or beyond and more assets have entered the buyable range, the ECB kept the pace of QE steady at €60bn a month. Also in December, Mario Draghi and Co. decided to cut further into negative territory the deposit facility rate but by less than what investors were expecting.

Watch: Trade the ECB rate decision & Mario Draghi speech with FXStreet

The market got so disappointed with Draghi that EURUSD rallied 400 pips. And even the Fed delivering their first rate hike in over a decade couldn't affect that surge. Actually, the pair is trading around 1.0910, pretty much where the market closed on December 3rd, just after last ECB press conference.

As said before, and for this upcoming meeting, markets' participants believe that no changes are to be make in the monetary policy stance, as the European Central Bank likes to "wait and see" after an announcement of the magnitude of December one.

Nevertheless, there's also a general consensus that Draghi's words will be dovish this time, as growth has remained weak in the region, not to mention inflation, still near deflationary levels as oil prices plummeted to over 12-year lows.

The more dovish the tone, the higher the chances of further easing in the future, which means that investors can end sending the common currency up with a dovish ECB, once they start pricing in more easing.

In one line, the ECB will likely refrain from adding more easing this week but will leave doors open to do so in the future. And the common currency's reaction will depend on the depth and extension of the possible future easing tip toed tomorrow. However, the China/oil scheme will likely retain its condition of market leader, meaning that the pair's reaction can be neutralized after some wild initial spikes.

EUR/USD technical picture

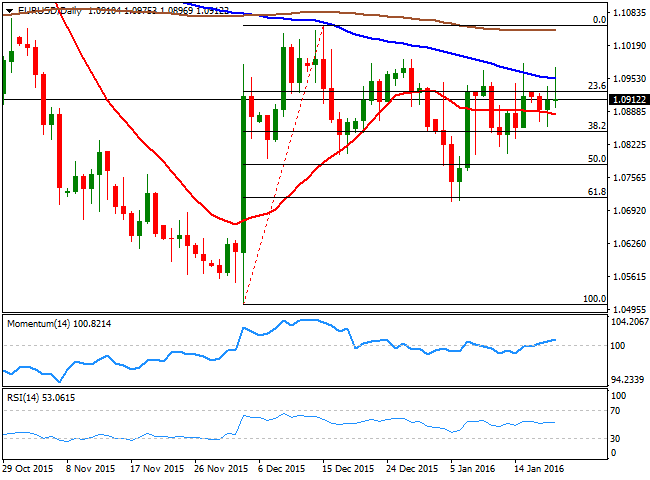

From a technical point of view, the EUR/USD pair has been unable to establish a clear direction, after the long term bearish trend was interrupted by December's ECB announcement. After rallying up to 1.1059, the pair entered in a corrective phase that sent price down to the 61.8% retracement of the latest rally, around 1.0710, from where the pair slowly grinded back higher. The former rallies repeatedly met selling interest around the 23.6% retracement of the same rally around 1.0925, with short lived spikes above it being quickly reverted.

True, Year End holidays did little to help the pair in establishing a certain trend, but January is about to end and the pair still lacks direction. In the daily chart, a slightly positive tone prevails, given that the price is consolidating above a flat 20 SMA and approaches to the 38.2% retracement of the mentioned rally, at 1.0790 that has continuously attracted buying interest. In the same chart the technical indicators aim slightly higher, but within neutral territory, while the 100 SMA caps the upside.

At this point, the pair needs to extend beyond 1.1000 to have a bullish chance following the ECB, and advance up to the 1.1060 high. Should the rally extend beyond this last, the next bullish target comes at 1.1120, a level that will likely be reached before the week is over. A break below the base of the range at 1.0790 on the other hand may see a retest of the mentioned lows in the 1.0710 region, leaving the pair then, poised to resume the long term bearish trend.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stabilizes near 1.0400, volumes remain light on New Year's Eve

EUR/USD stabilizes at around 1.0400 on Tuesday following Monday's choppy action. The cautious market stance helps the US Dollar stay resilient against its rivals and doesn't allow the pair to gain traction as trading conditions remain thin heading into the end of the year.

GBP/USD retreats below 1.2550 after short-lasting recovery attempt

GBP/USD loses its traction and retreats below 1.2550 after climbing above 1.2600 on Monday. Although falling US Treasury bond yields weighed on the USD at the beginning of the week, the risk-averse market atmosphere supported the currency, capping the pair's upside.

Gold rebounds after finding support near $2,600

After posting losses for two consecutive days, Gold found support near $2,600 and staged a rebound early Tuesday. As investors refrain from taking large positions ahead of the New Year Day holiday, XAU/USD clings to daily gains at around $2,620.

These three narratives could fuel crypto in 2025, experts say

Crypto market experienced higher adoption and inflow of institutional capital in 2024. Experts predict the trends to look forward to in 2025, as the market matures and the Bitcoin bull run continues.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.