- US-China close to a trade deal, news expected during the weekend.

- A dovish US Federal Reserve triggered the US dollar’s weakness, no news from the RBA.

- AUD/USD bullish, up for a second consecutive week near 0.6900.

The AUD/USD pair surged for a second consecutive week, rallying to 0.6910 a level last seen in July. The American dollar managed to advance against its Australian rival at the beginning of the week, amid soft China trade data, as the country’s trade surplus in dollar terms shrank to $38.73B in November, with imports down by 1.1% and exports up by 1.3%, both below the market’s expectations. A dismal market’s mood was exacerbated by uncertainty regarding the first-tier events that took place later in the week.

It’s all about the trade war

The pair got its first boost from the US Federal Reserve, as a slightly dovish tone from Chief Powell hurt the greenback. Trade hopes, on reports that the US and China were closer to an agreement, lifted further the market’s mood and the pair alongside.

On Thursday, US President Trump tweeted: “Getting VERY close to a BIG DEAL with China. They want it, and so do we!” Risk appetite took over the financial world, later boosted but different reports indicating that the US was willing to cut tariffs by half on up to $360B worth of Chinese goods, while suspending new levies scheduled for December 15. Other headlines indicated that both economies achieved a trade deal and that it was only waiting for Trump’s signature.

Chinese authorities, however, said early Friday that a trade deal was not yet done, while US President Trump jumped again into Twitter, to deny the story on tariffs, calling it fake news.

Ahead of London’s close, officials from China's State Council Information Office, announced that they agreed with the US on the context of the phase one trade deal. The US will follow up on its promise to cancel tariffs on a phased basis, announced China's Vice Commerce Minister. The mood turned back up, although the story is far from over.

Chinese data and Australian employment figures

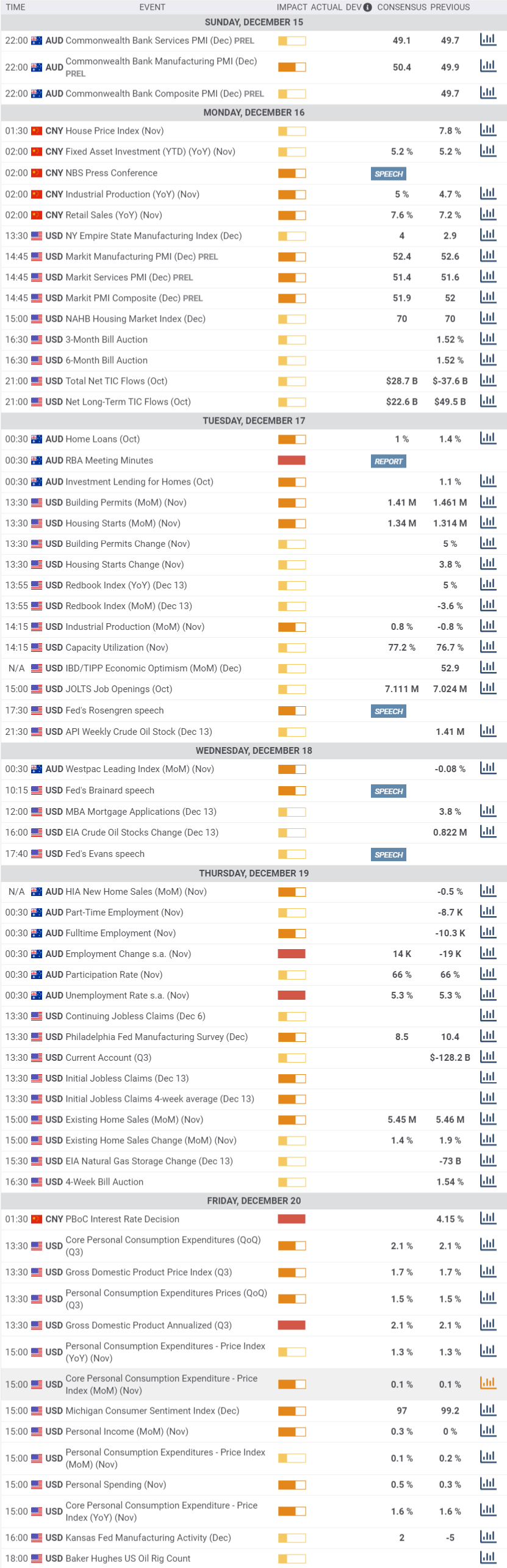

The upcoming week will start on a high note, as early on Monday, Australia will release the Commonwealth Bank preliminary December PMI, while China will publish November Industrial Production and Retail Sales. On Thursday, Australia will release November employment figures, while the PBOC will announce its latest decision on the interest rate on Friday.

Data will remain in the background it US-China trade tensions resume, with risk-aversion taking over and the Aussie probably suffering from it.

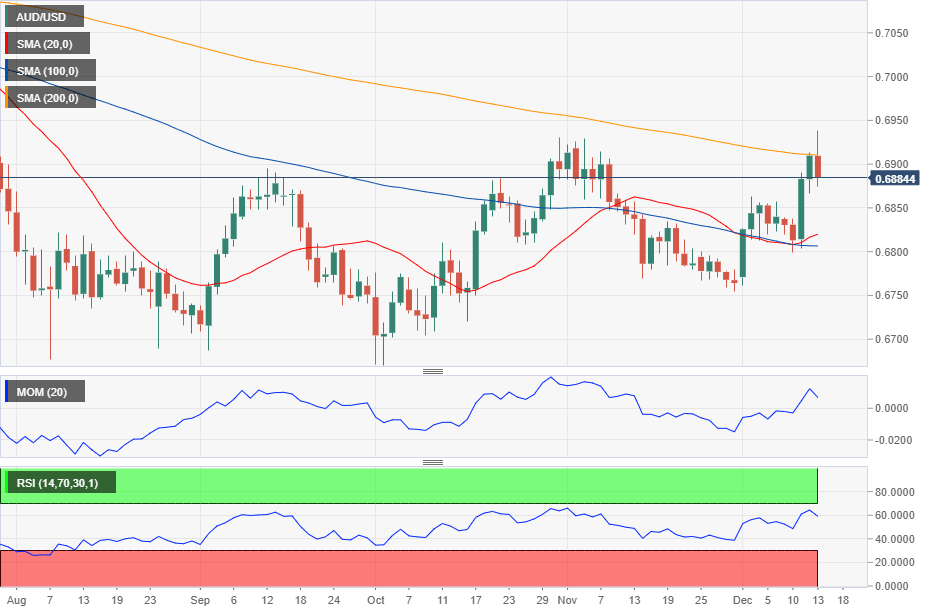

AUD/USD Technical Outlook

The AUD/USD pair retreated below 0.6900 amid mounting concerns related to the US-China trade but holds nearby following a Chinese authorities´ press conference, holding also to its weekly gains, which anyway, fell short of putting it into bullish territory.

The weekly chart shows that the pair is above a bearish 20 SMA, but also that the 100 SMA maintains a strong bearish slope far above the current level and below the 200 SMA. Technical indicators in the mentioned chart have entered positive territory, but lost their bullish strength, offering a neutral stance.

In the daily chart, the pair has pierced but retreated back below the 200 DMA at around 0.6905. The 20 DMA is barely above the 100 DMA both around 0.6800, without strength upward. Technical indicators, in the meantime, retreat from overbought readings, suggesting the pair may have hit an interim top, to be confirmed it the current decline continues sub-0.6865 a former relevant resistance level.

Below the mentioned support, the next ones come at 0.6800 and 0.6770 with bears taking over on a break below this last. The pair would need to accelerate through 0.6940 to extend its rally toward 0.7000, a level that could be breached if the US and China finally solve their trade issues.

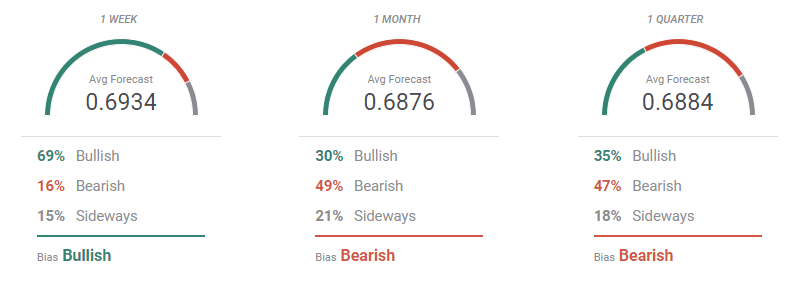

AUD/USD sentiment poll

The FXStreet Forecast Poll shows that bulls dominate the weekly perspective, as the dollar is expected to maintain its negative stance across the board. Bulls stand at 69%, with the pair is seen on average at 0.6934, a strong static resistance area. Bears are a majority in the monthly and quarterly perspectives, but it both cases, falling short of 50% with the pair seen around the current level.

The Overview chart skews the risk toward the upside, although only the shorter moving average reached levels above the current price. In the 3-month perspective, and despite the moving average is bullish, most targets are below the current level, somehow suggesting bulls may soon give up.

Related Forecasts:

EUR/USD Forecast: Uncertainty clearing, volatility returning?

USD/JPY Forecast: US GDP and a rate decision from Japan promise action

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.