BEST BROKERS IN YOUR LOCATION

China’s economic data are often treated with a degree of caution by global investors. The challenge is not necessarily that the numbers are incorrect, but that they can describe very different parts of a vast and complex economy. Nowhere is that more evident than in China’s PMIs.

More News

In-Depth Analysis

Despite panic taking over financial markets, the usual safe-haven metals are getting ignored. The US Dollar, on the other hand, became the shining star of the board, recovering its refuge status after long missing it. What happened?

Gold's price has declined as the US-Iran war unfolds with little sign of ending soon. In perhaps the most uncertain times in recent years, Gold isn’t moving the way it is supposed to. What is going on?

Broker Reviews

Find independent, trusted reviews and choose your perfect broker.

Cryptocurrencies

Ripple (XRP) continues to demonstrate notable resilience as the cryptocurrency market navigates the persistent war in the Middle East after the United States (US) and Israel attacked Iran on Saturday.

Bitcoin hovers around $73,000 on Thursday, driven by the US Stock market recovery, boosting risk-on sentiment. Data shows analysts are mostly bullish on Bitcoin, citing renewed demand from institutional investors, on-chain holders, and the derivatives market.

The cryptocurrency market is gaining strength on Thursday, building on Wednesday's upswing, which saw Bitcoin reach a weekly high above $74,000. Ethereum and Ripple are moderating their recent gains amid uncertainty stemming from the escalating war in the Middle East.

Smart insights by real people. Every day.

Stay ahead with key market trends from Orange Juice Newsletter.

Stocks

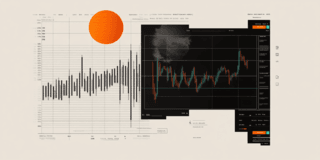

The index hit a low on February 5, peaked on February 11, and reached its bottom on February 17. So far, so good. However, it then made a secondary high on February 25, and yesterday it dropped to its lowest level since the November 2025 low in response to the joint military operations in Iran.

Weekly Forecast

EUR/USD is still struggling to find real traction. The pair has tried to stabilise, but momentum keeps fading, leaving the door open to further weakness.

The Pound Sterling (GBP) entered a bearish consolidation phase against the US Dollar (USD), after having tested critical support near the 1.3450 level on several occasions.

Gold is set for a huge bullish opening gap in Asian trading on Monday, with a flight to safety rush likely to sponsor the upsurge after the US and Israel struck Iran with heavy bombings over the weekend. More geopolitical headlines surrounding the Middle East conflict and Oil price movement remain in focus.

Bitcoin (BTC) price is stabilizing around $68,000 at the time of writing on Friday, but the Crypto King is poised to close February on a fragile footing, marking its fifth consecutive month of losses since October and a rare start to the year with back-to-back monthly corrections.